Question: Calculate the net present value (NVP) for both project A and project B. 2, Determine the profitability index (PI) for both project. 3, Evaluate the

Calculate the net present value (NVP) for both project A and project B.

2, Determine the profitability index (PI) for both project.

3, Evaluate the internal rate of return (IRR) for both project.

4, Based on your analysis, provide a recommendation to the management regarding which project to pursue and justify your decision.

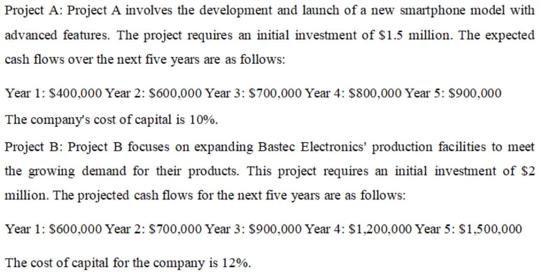

Project A: Project A involves the development and launch of a new smartphone model with advanced features. The project requires an initial investment of $1.5 million. The expected cash flows over the next five years are as follows: Year 1: $400,000 Year 2: $600,000 Year 3: $700,000 Year 4: $800,000 Year 5: $900,000 The company's cost of capital is 10%. Project B: Project B focuses on expanding Bastec Electronics' production facilities to meet the growing demand for their products. This project requires an initial investment of $2 million. The projected cash flows for the next five years are as follows: Year 1: $600,000 Year 2: $700,000 Year 3: $900,000 Year 4: $1,200,000 Year 5: $1.500,000 The cost of capital for the company is 12%.

Step by Step Solution

3.50 Rating (157 Votes )

There are 3 Steps involved in it

To calculate the Net Present Value NPV Profitability Index PI and Internal Rate of Return IRR for bo... View full answer

Get step-by-step solutions from verified subject matter experts