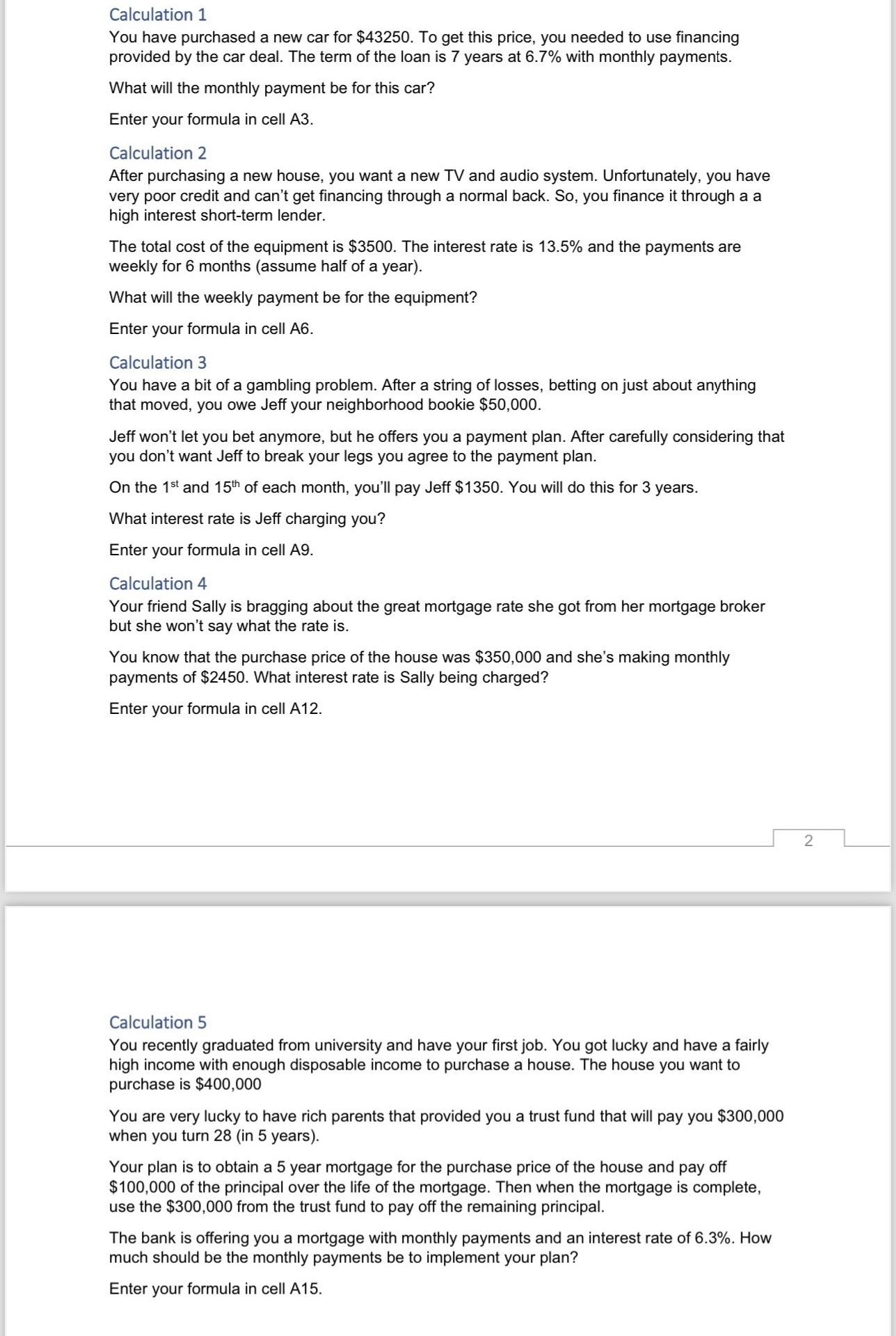

Question: Calculation 1 Please show all workings. This is excel based assignment so please use excel calculation formula. Thank you. You have purchased a new car

Calculation

Please show all workings. This is excel based assignment so please use excel calculation formula. Thank you.

You have purchased a new car for $ To get this price, you needed to use financing

provided by the car deal. The term of the loan is years at with monthly payments.

What will the monthly payment be for this car?

Enter your formula in cell A

Calculation

After purchasing a new house, you want a new TV and audio system. Unfortunately, you have

very poor credit and can't get financing through a normal back. So you finance it through a a

high interest shortterm lender.

The total cost of the equipment is $ The interest rate is and the payments are

weekly for months assume half of a year

What will the weekly payment be for the equipment?

Enter your formula in cell A

Calculation

You have a bit of a gambling problem. After a string of losses, betting on just about anything

that moved, you owe Jeff your neighborhood bookie $

Jeff won't let you bet anymore, but he offers you a payment plan. After carefully considering that

you don't want Jeff to break your legs you agree to the payment plan.

On the and of each month, you'll pay Jeff $ You will do this for years.

What interest rate is Jeff charging you?

Enter your formula in cell A

Calculation

Your friend Sally is bragging about the great mortgage rate she got from her mortgage broker

but she won't say what the rate is

You know that the purchase price of the house was $ and she's making monthly

payments of $ What interest rate is Sally being charged?

Enter your formula in cell A

Calculation

You recently graduated from university and have your first job. You got lucky and have a fairly

high income with enough disposable income to purchase a house. The house you want to

purchase is $

You are very lucky to have rich parents that provided you a trust fund that will pay you $

when you turn in years

Your plan is to obtain a year mortgage for the purchase price of the house and pay off

$ of the principal over the life of the mortgage. Then when the mortgage is complete,

use the $ from the trust fund to pay off the remaining principal.

The bank is offering you a mortgage with monthly payments and an interest rate of How

much should be the monthly payments be to implement your plan?

Enter your formula in cell A

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock