Question: Calculation steps must be shown in the answer!!! Awani Integrated System (AIS) Bhd is a Malaysian exporter of computer chips. AIS has agreed to deliver

Calculation steps must be shown in the answer!!!

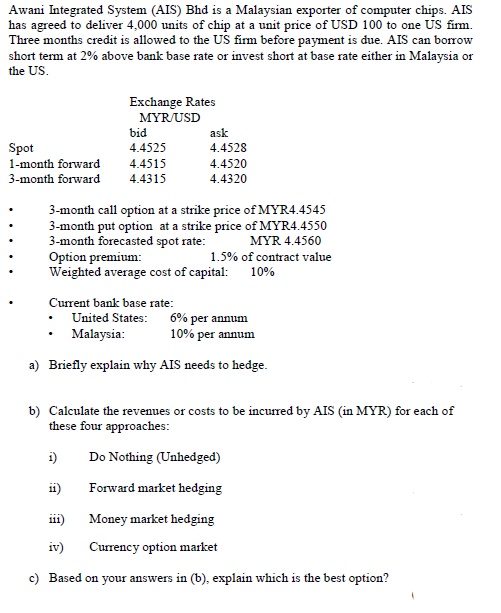

Awani Integrated System (AIS) Bhd is a Malaysian exporter of computer chips. AIS has agreed to deliver 4,000 units of chip at a unit price of USD 100 to one US firm. Three months credit is allowed to the US firm before payment is due. AIS can borrow short term at 2% above bank base rate or invest short at base rate either in Malaysia or the US. bid Spot 1-month forward 3-month forward Exchange Rates MYR/USD ask 4.4525 4.4528 4.4515 4.4520 4.4315 4.4320 3-month call option at a strike price of MYR4.4545 3-month put option at a strike price of MYR4.4550 3-month forecasted spot rate: MYR 4.4560 Option premium: 1.5% of contract value Weighted average cost of capital: 10% Current bank base rate: United States: 6% per annum Malaysia: 10% per annum a) Briefly explain why AIS needs to hedge. b) Calculate the revenues or costs to be incurred by AIS (in MYR) for each of these four approaches: 1) Do Nothing (Unhedged) ii) Forward market hedging 111) Money market hedging iv) Currency option market c) Based on your answers in (b), explain which is the best option

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts