Question: Calculator Solution: Enter each value then the appropriate key (N, 1/4, FV) then press PV. Problem #4: Calculating Present Values A., Inc. has an unfunded

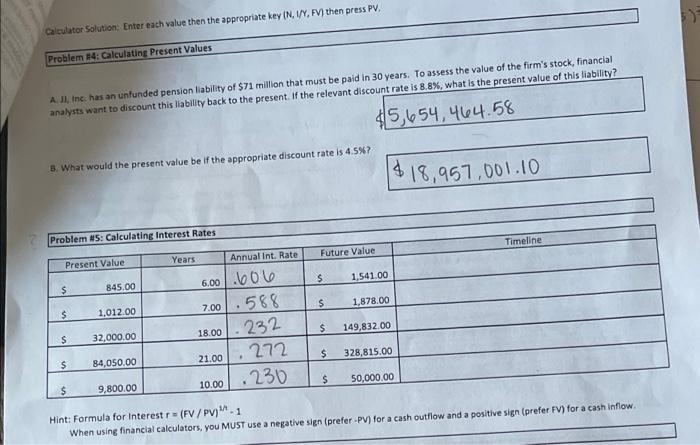

Calculator Solution: Enter each value then the appropriate key (N, 1/4, FV) then press PV. Problem #4: Calculating Present Values A., Inc. has an unfunded pension liability of $71 million that must be paid in 30 years. To assess the value of the firm's stock, financial analysts want to discount this liability back to the present. If the relevant discount rate is 8.8%, what is the present value of this liability? 45,654,464.58 8. What would the present value be if the appropriate discount rate is 4.5%? $18,957,001.10 Problem #5: Calculating Interest Rates Timeline Years Annual Int. Rate Future Value Present Value $ 1,541.00 $ 845.00 S 1,878.00 $ 1,012.00 6.00.606 7.00.588 .232 272 18.00 $ 149.832.00 $ 32,000.00 $ 328,815.00 21.00 . $ 84,050.00 .230 $ 50,000.00 $ 9,800.00 10.00 Hint: Formula for interest r = (FV/PV}""1 When using financial calculators, you MUST use a negative sign (prefer PV) for a cash outflow and a positive sign (prefer FV) for a cash inflow

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts