Question: Can any body answer the question 9) Unlike forward contracts, the size of currency futures contracts are A) a standardized amount that differs for each

Can any body answer the question

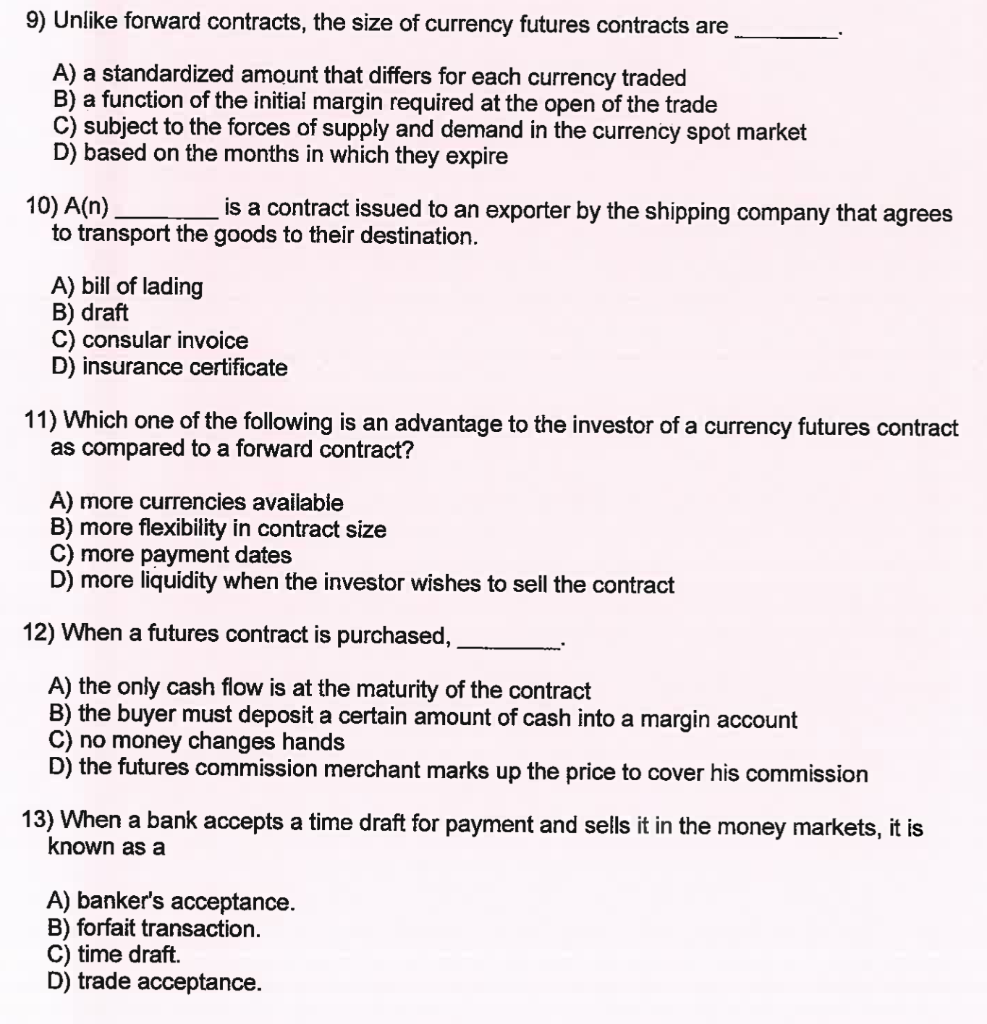

9) Unlike forward contracts, the size of currency futures contracts are A) a standardized amount that differs for each currency traded B) a function of the initial margin required at the open of the trade C) subject to the forces of supply and demand in the currency spot market D) based on the months in which they expire 10) A(n), to transport the goods to their destination. is a contract issued to an exporter by the shipping company that agrees A) bill of lading B) draft C) consular invoice D) insurance certificate 11) Which one of the following is an advantage to the investor of a currency futures contract as compared to a forward contract? A) more currencies availabie B) more flexibility in contract size C) more payment dates D) more liquidity when the investor wishes to sell the contract 12) When a futures contract is purchased, A) the only cash flow is at the maturity of the contract B) the buyer must deposit a certain amount of cash into a margin account C) no money changes hands D) the futures commission merchant marks up the price to cover his commission 13) When a bank accepts a time draft for payment and sells it in the money markets, it is known as a A) banker's acceptance. B) forfait transaction. C) time draft. D) trade acceptance

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts