Question: Can anyone explain the solution to the question step by step? I tried answering them and I got B, but I am not sure if

Can anyone explain the solution to the question step by step? I tried answering them and I got B, but I am not sure if it's the right answer because some other solutions got A.

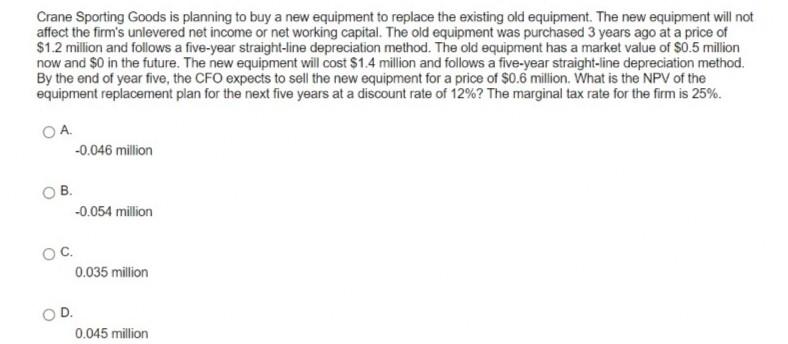

Crane Sporting Goods is planning to buy a new equipment to replace the existing old equipment. The new equipment will not affect the firm's unlevered net income or net working capital. The old equipment was purchased 3 years ago at a price of $1.2 million and follows a five-year straight-line depreciation method. The old equipment has a market value of $0.5 milion now and $0 in the future. The new equipment will cost $1.4 million and follows a five-year straight-line depreciation method. By the end of year five, the CFO expects to sell the new equipment for a price of $0.6 million. What is the NPV of the equipment replacement plan for the next five years at a discount rate of 12%? The marginal tax rate for the firm is 25%. OA. -0.046 million B. -0.054 million 0.035 million D. 0.045 million

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts