Question: can anyone know how to do this question?? its mangerial accounting and itd all one question its just the tables. thank uuuu these are the

![PVA. ofS1, and FVA of Si]) (Use appropriate factor(s) from the tables](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/09/66e3e78150f5e_96866e3e780e28ed.jpg)

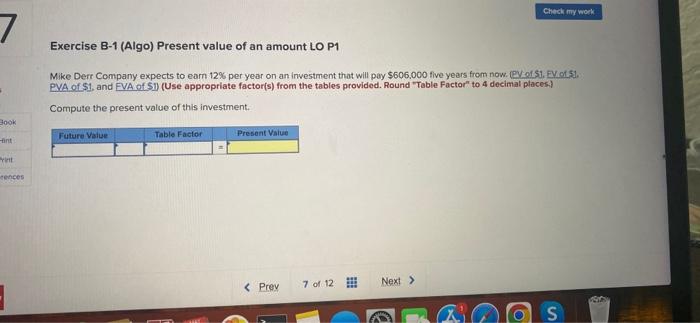

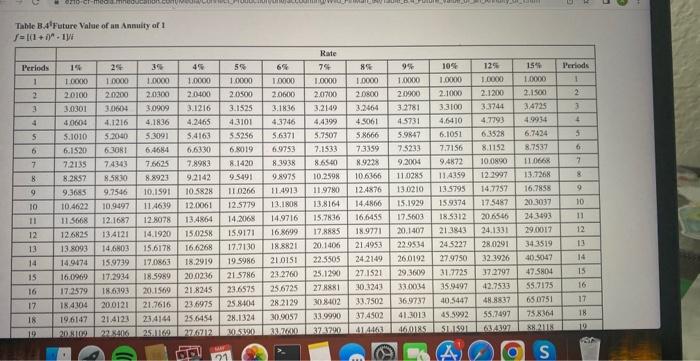

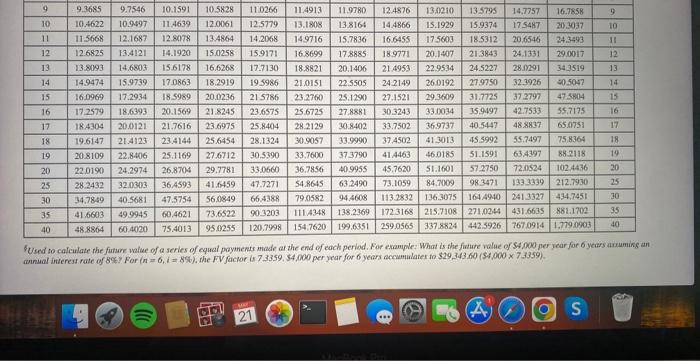

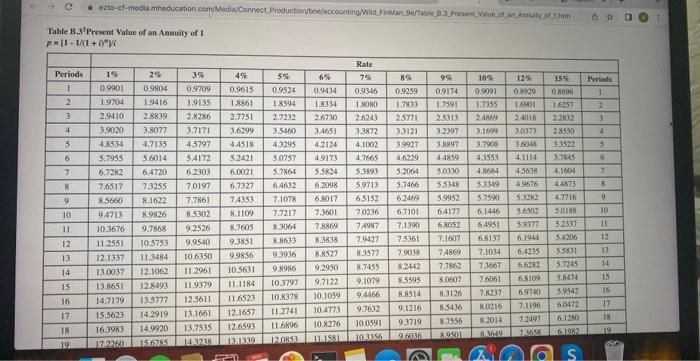

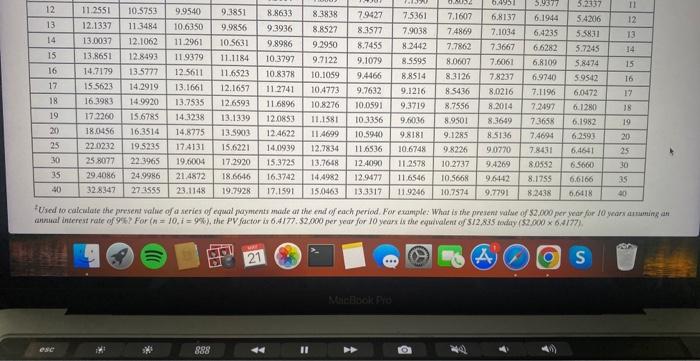

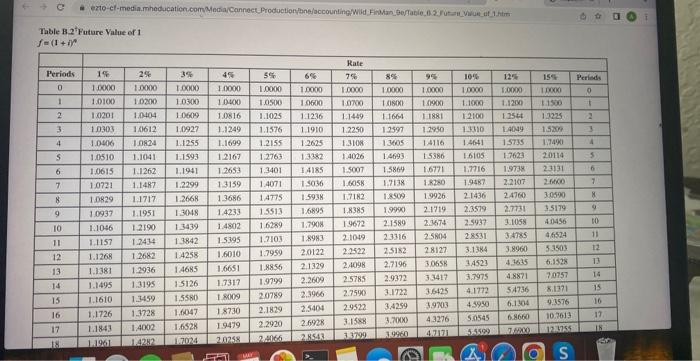

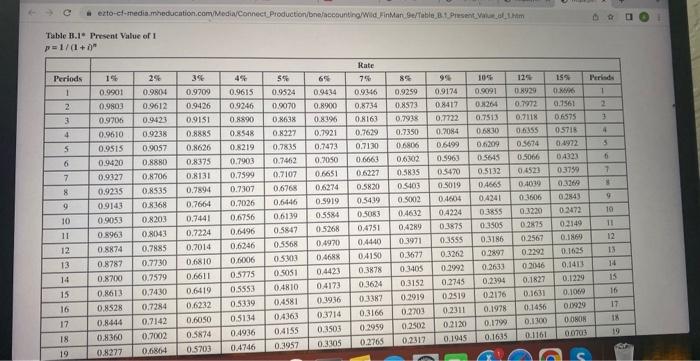

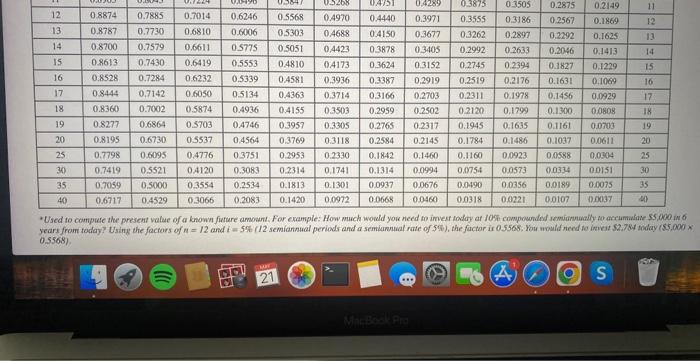

Exercise B-1 (Algo) Present value of an amount LO P1 Mike Derr Company expects to earn 12% per year on an investment that will pay $606.000 five years from now. (py. of 51 , EV of 51 . PVA. ofS1, and FVA of Si]) (Use appropriate factor(s) from the tables provided. Round "Table Factor" to 4 decimal placesh) Compute the present value of this investment. Table B. 4FretureValueofanAnsuityof1 f=1(1+i)n+1yf Uerd to calculate the furure walue of a series of equal poyments made at the end of each period. For example: What is the future nolue of S4.900 jer jear for 6 years arruming an manal interess rate of 8% For (n=6,d=8% ), the FV fachor is 7,3359,54,000 per year for 6 years accumulater ta $29,343.60 ( $4,0007.3359). Table B. 3 Present Value of an Asmuity of 1 p=[11/(1+i)Vi "Used to culculate the present walive of a series of equal paymients made at the end of each period. For exantide: What is the present value of 52.000 per vear for 10 years aunuming Table B2'Future Value of 1 f=(1+i)n Table B.1* Present Value of 1 p=1/(1+i)n years from today? Using the factars of n=12 and i=5% (12 semiannual periods and a semiunnual rate of 5% 0.5568)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts