Question: can anyone know how to do this question?? its mangerial accounting and itd all one question its just the tables. thank uuuu these were the

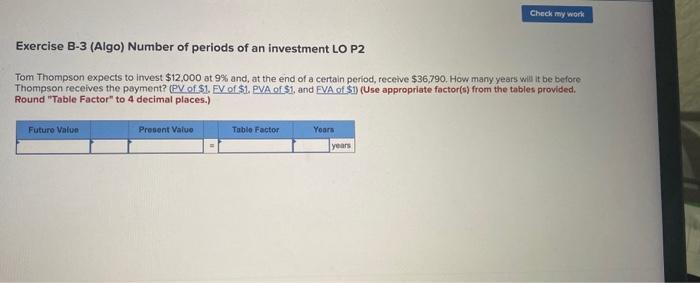

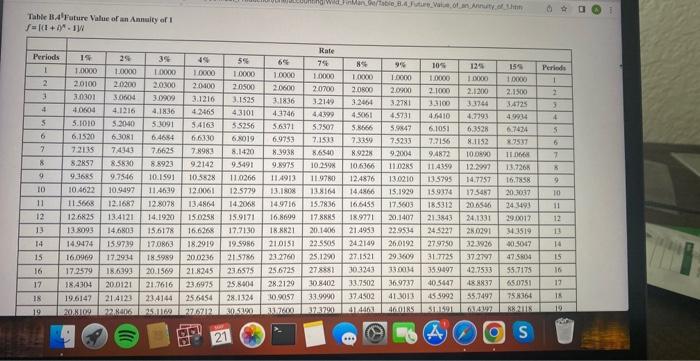

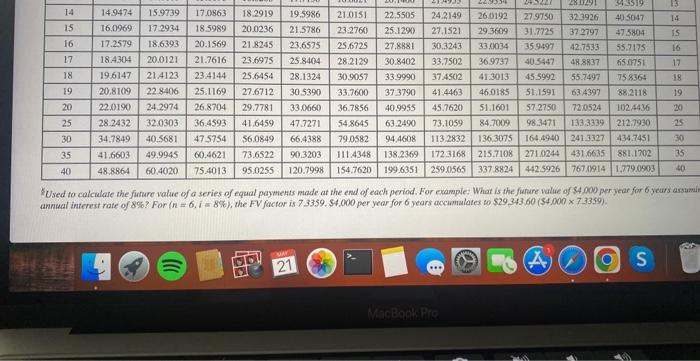

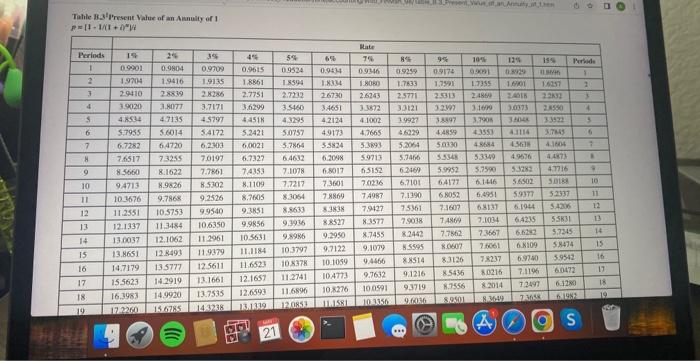

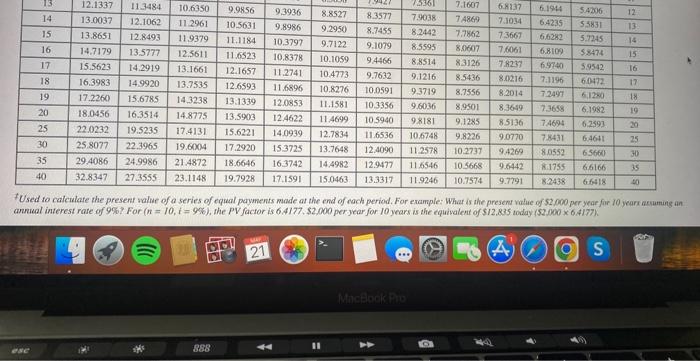

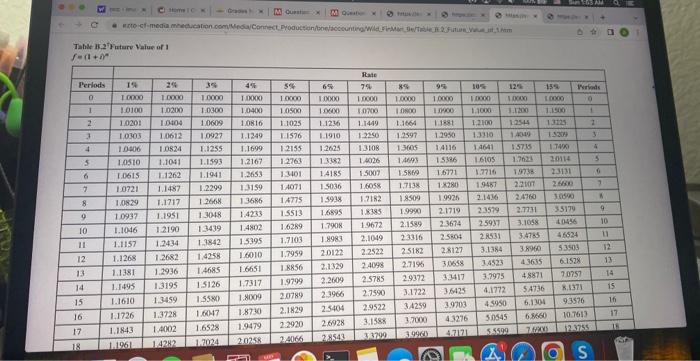

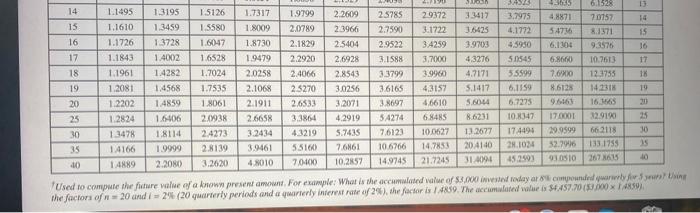

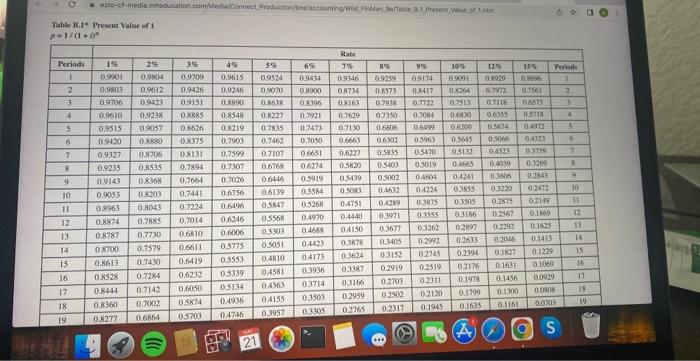

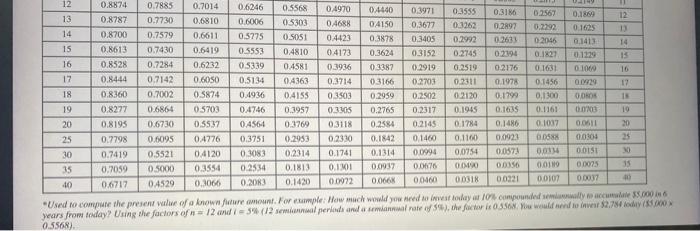

Exercise B-3 (Algo) Number of periods of an investment LO P2 Tom Thompson expects to invest $12,000 at 9% and, at the end of a certain period, receive $36,790. How many years will it be before Thompson receives the payment? (PV of S1. PV of \$1, PVA of S1, and EVA of \$1) (Use appropriate factor(s) from the tables provided. Round "Table Factor" to 4 decimal places.) Table B1.Al' Future Value of an Annuity of I f=[(1+)1W YUsed to calculare the furture value of a series of equal payments made at ihe end of each period. For example: What is the finare value of $4.000 per year for 6 yeurs assum annaal interest rate of 8% ? For (n=6,i=8%), the FV factor is 7.3359.$4,000 per year for 6 years accumalates 50$29,343,60 ( $4.0007.3359). Thhle Baskl'resent Vaue of an Amnuily of I A =[1+1/(1+i)2/i FUsed to caleulate the present walue of a series of equal payments made at the end of each period. For example: What is the present nalue of 52 goo per year for 10 yearr aknuming an anneal interest rate of 9% F For (n=10,i=9%), the PV factor is 6.4177,$2.000 peryear for 10 years is the equivalent of $12,835 today i $2.000 * 6.4177 . Tahle if.27f neterv beiue of I f=r+in^n Table B,1. Present Valoe of 1 p=1/(1+i 0.55681

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts