Question: can anyone please help me with the question 2, with explanation please. Thank you! B 9 1 Question 1: 2 1. Present the sources of

can anyone please help me with the question 2, with explanation please. Thank you!

can anyone please help me with the question 2, with explanation please. Thank you!

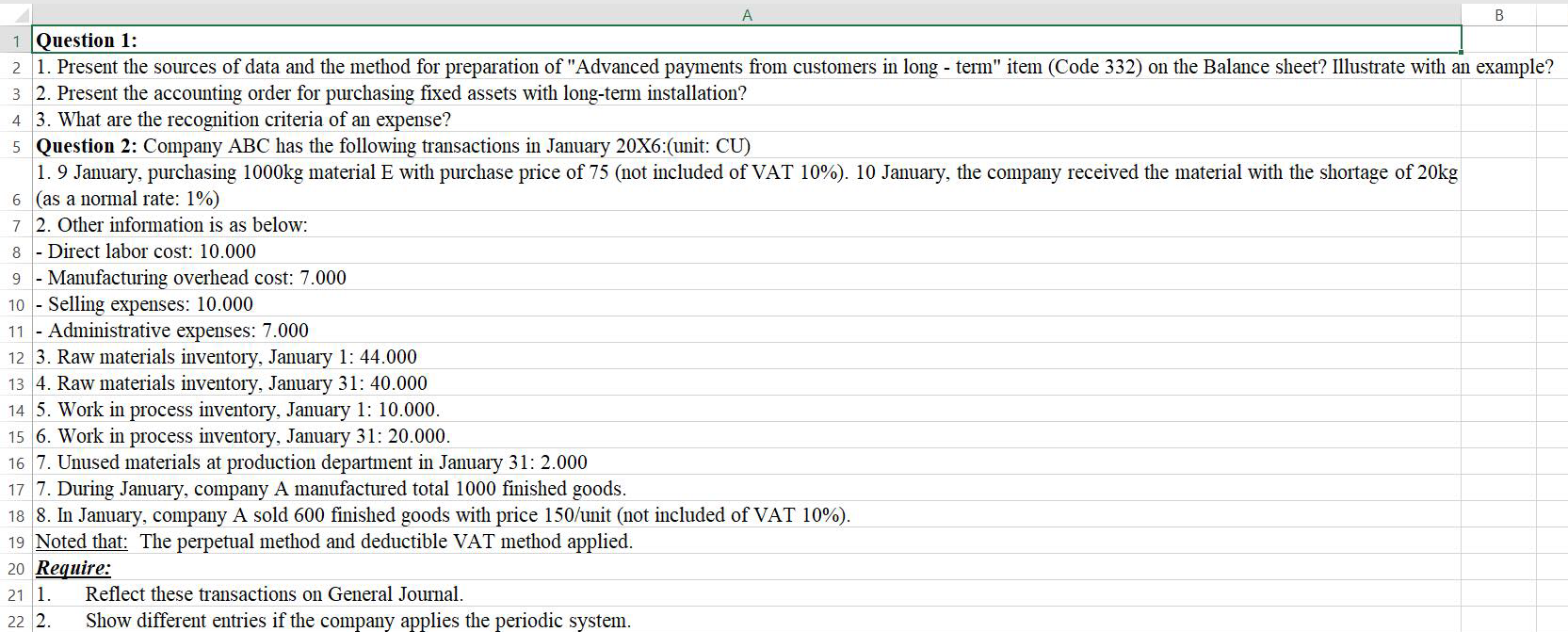

B 9 1 Question 1: 2 1. Present the sources of data and the method for preparation of "Advanced payments from customers in long - term" item (Code 332) on the Balance sheet? Illustrate with an example? 3 2. Present the accounting order for purchasing fixed assets with long-term installation? 4 3. What are the recognition criteria of an expense? 5 Question 2: Company ABC has the following transactions in January 20X6:(unit: CU) 1. 9 January, purchasing 1000kg material E with purchase price of 75 (not included of VAT 10%). 10 January, the company received the material with the shortage of 20kg 6 (as a normal rate: 1%) 7 2. Other information is as below: 8 - Direct labor cost: 10.000 Manufacturing overhead cost: 7.000 10 - Selling expenses: 10.000 11 - Administrative expenses: 7.000 12 3. Raw materials inventory, January 1: 44.000 13 4. Raw materials inventory, January 31: 40.000 14 5. Work in process inventory, January 1: 10.000. 15 6. Work process inventory, January 31: 20.000. 16 7. Unused materials at production department in January 31: 2.000 17 7. During January, company A manufactured total 1000 finished goods. 18 8. In January, company A sold 600 finished goods with price 150/unit (not included of VAT 10%). 19 Noted that: The perpetual method and deductible VAT method applied. 20 Require: 21 1. Reflect these transactions on General Journal. 22 2. Show different entries if the company applies the periodic system. B 9 1 Question 1: 2 1. Present the sources of data and the method for preparation of "Advanced payments from customers in long - term" item (Code 332) on the Balance sheet? Illustrate with an example? 3 2. Present the accounting order for purchasing fixed assets with long-term installation? 4 3. What are the recognition criteria of an expense? 5 Question 2: Company ABC has the following transactions in January 20X6:(unit: CU) 1. 9 January, purchasing 1000kg material E with purchase price of 75 (not included of VAT 10%). 10 January, the company received the material with the shortage of 20kg 6 (as a normal rate: 1%) 7 2. Other information is as below: 8 - Direct labor cost: 10.000 Manufacturing overhead cost: 7.000 10 - Selling expenses: 10.000 11 - Administrative expenses: 7.000 12 3. Raw materials inventory, January 1: 44.000 13 4. Raw materials inventory, January 31: 40.000 14 5. Work in process inventory, January 1: 10.000. 15 6. Work process inventory, January 31: 20.000. 16 7. Unused materials at production department in January 31: 2.000 17 7. During January, company A manufactured total 1000 finished goods. 18 8. In January, company A sold 600 finished goods with price 150/unit (not included of VAT 10%). 19 Noted that: The perpetual method and deductible VAT method applied. 20 Require: 21 1. Reflect these transactions on General Journal. 22 2. Show different entries if the company applies the periodic system

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts