Question: Can anyone solve this problem with excel? Please show the formulas too so that I can see how you did it. Excel Problem 2: Consider

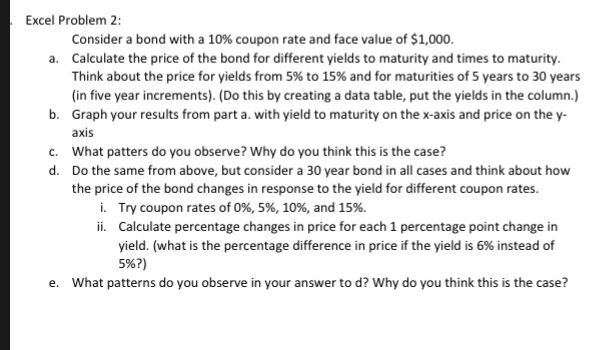

Excel Problem 2: Consider a bond with a 10% coupon rate and face value of $1,000 Calculate the price of the bond for different yields to maturity and times to maturity Think about the price for yields from 5% to 15% and for maturities of 5 years to 30 years (in five year increments). (Do this by creating a data table, put the yields in the column.) Graph your results from part a. with yield to maturity on the x-axis and price on the y- axis What patters do you observe? Why do you think this is the case? Do the same from above, but consider a 30 year bond in all cases and think about how the price of the bond changes in response to the yield for different coupon rates. a. b. c. d. i. ii. Try coupon rates of 096, 596, 10%, and 15%. Calculate percentage changes in price for each 1 percentage point change in yield. (what is the percentage difference in price if the yield is 6% instead of 5%?) e. What patterns do you observe in your answer to d? Why do you think this is the case

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts