Question: can i get help with this question i have two total 2 out of 2. in ten minutes its due for both Panda Industries Inc.

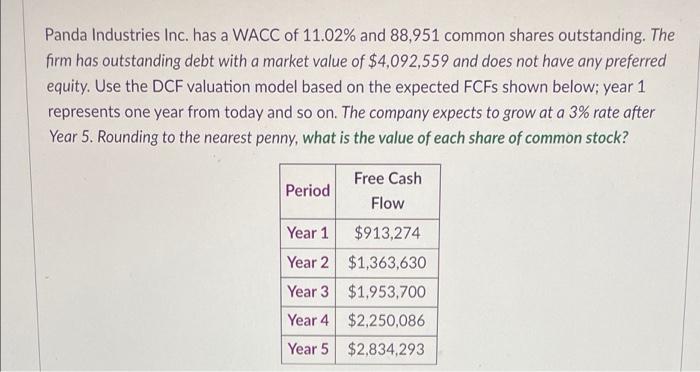

Panda Industries Inc. has a WACC of 11.02% and 88,951 common shares outstanding. The firm has outstanding debt with a market value of $4,092,559 and does not have any preferred equity. Use the DCF valuation model based on the expected FCFs shown below; year 1 represents one year from today and so on. The company expects to grow at a 3% rate after Year 5. Rounding to the nearest penny, what is the value of each share of common stock? Free Cash Flow Year 1 $913,274 Year 2 $1,363,630 Year 3 $1,953,700 Year 4 $2,250,086 Year 5 $2,834,293 Period

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts