Question: Can somebody please explain an answer for me. Why is the ask price used to calculate the 6 month rate? 2. MARCUS plc is a

Can somebody please explain an answer for me.

Why is the ask price used to calculate the 6 month rate?

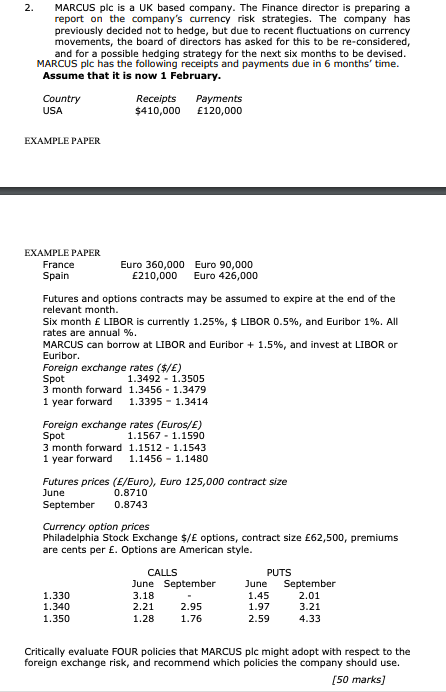

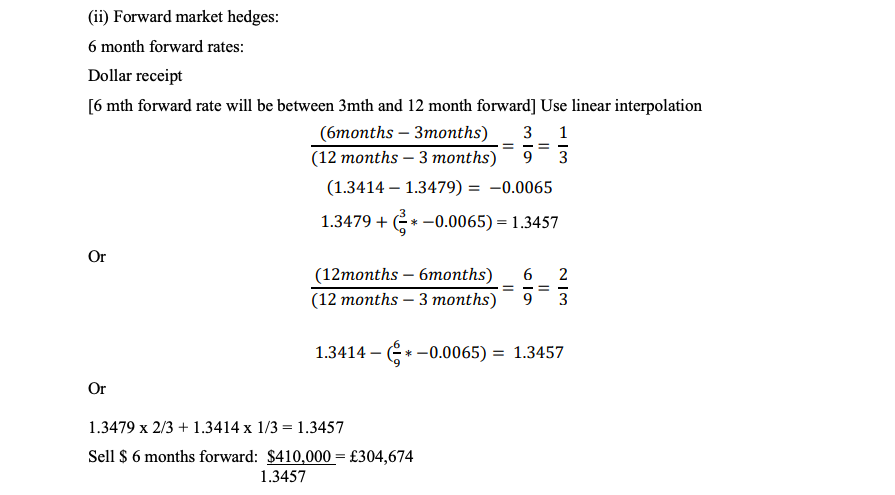

2. MARCUS plc is a UK based company. The Finance director is preparing a report on the company's currency risk strategies. The company has previously decided not to hedge, but due to recent fluctuations on currency movements, the board of directors has asked for this to be re-considered, and for a possible hedging strategy for the next six months to be devised. MARCUS plc has the following receipts and payments due in 6 months' time. Assume that it is now 1 February. Country Receipts Payments USA $410,000 120,000 EXAMPLE PAPER EXAMPLE PAPER France Euro 360,000 Euro 90,000 Spain 210,000 Euro 426,000 Futures and options contracts may be assumed to expire at the end of the relevant month. Six month LIBOR is currently 1.25%, $ LIBOR 0.5%, and Euribor 1%. All rates are annual %. MARCUS can borrow at LIBOR and Euribor + 1.5%, and invest at LIBOR or Euribor. Foreign exchange rates ($/E) Spot 1.3492 - 1.3505 3 month forward 1.3456 - 1.3479 1 year forward 1.3395 - 1.3414 Foreign exchange rates (Euros/E) Spot 1.1567 - 1.1590 3 month forward 1.1512 - 1.1543 1 year forward 1.1456 - 1.1480 Futures prices (E/Euro), Euro 125,000 contract size June 0.8710 September 0.8743 Currency option prices Philadelphia Stock Exchange $/ options, contract size 62,500, premiums are cents per . Options are American style. CALLS PUTS June September September 1.330 3.18 1.45 2.01 1.340 2.21 2.95 1.97 3.21 1.350 1.28 1.76 2.59 4.33 June Critically evaluate FOUR policies that MARCUS plc might adopt with respect to the foreign exchange risk, and recommend which policies the company should use. [50 marks) (ii) Forward market hedges: 6 month forward rates: Dollar receipt [6 mth forward rate will be between 3mth and 12 month forward] Use linear interpolation (6months - 3months) 3 1 (12 months - 3 months) 9 3 (1.3414 - 1.3479) = -0.0065 = == 1.3479+ * -0.0065) = 1.3457 Or 2 (12months - 6months) (12 months - 3 months) = 6 9 = 1.3414 6*-0.0065) = 1.3457 Or 1.3479 x 2/3 + 1.3414 x 1/3 = 1.3457 Sell $ 6 months forward: $410,000 = 304,674 1.3457

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts