Question: Can someone do this properly, if you don't know how to do it, please dont do it. if you have any questions, please free to

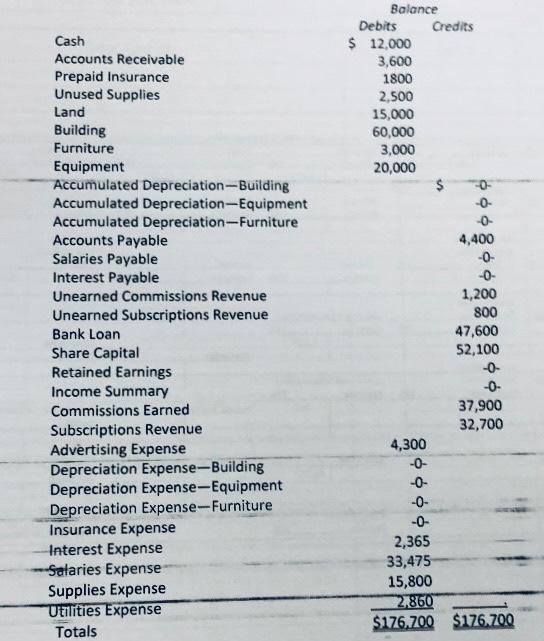

The unadjusted trial balance of nike store showed the following balances

at the end of its first 12 month fiscal year ended August 31, 2019:

here u go, if u cant do the whole thing , dont do it let someone else do it please dont ruin this question for me.

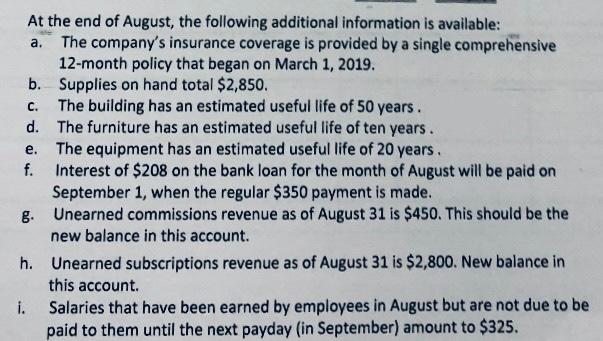

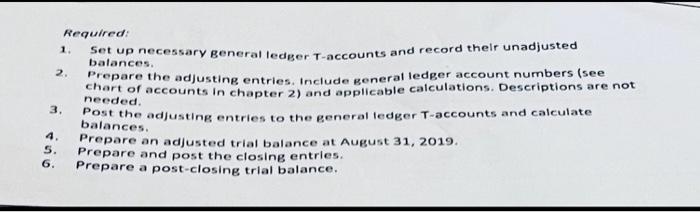

Balance Debits Credits $ 12,000 3,600 1800 2,500 15,000 60,000 3,000 20,000 $ 4,400 -0- Cash Accounts Receivable Prepaid Insurance Unused Supplies Land Building Furniture Equipment Accumulated Depreciation-Building Accumulated Depreciation-Equipment Accumulated Depreciation --Furniture Accounts Payable Salaries Payable Interest Payable Unearned Commissions Revenue Unearned Subscriptions Revenue Bank Loan Share Capital Retained Earnings Income Summary Commissions Earned Subscriptions Revenue Advertising Expense Depreciation Expense-Building Depreciation Expense-Equipment Depreciation Expense-Furniture Insurance Expense Interest Expense Salaries Expense Supplies Expense Utilities Expense Totals 1,200 800 47,600 52,100 -0- 37,900 32,700 4,300 -O- -0- -0- 2,365 33,475 15,800 2,860 $176.700 $176.700 C. e. At the end of August, the following additional information is available: a. The company's insurance coverage is provided by a single comprehensive 12-month policy that began on March 1, 2019. b. Supplies on hand total $2,850. The building has an estimated useful life of 50 years. d. The furniture has an estimated useful life of ten years. The equipment has an estimated useful life of 20 years. f. Interest of $208 on the bank loan for the month of August will be paid on September 1, when the regular $350 payment is made. g. Unearned commissions revenue as of August 31 is $450. This should be the new balance in this account. h. Unearned subscriptions revenue as of August 31 is $2,800. New balance in this account. i. Salaries that have been earned by employees in August but are not due to be paid to them until the next payday (in September) amount to $325. Required: 1. Set up necessary general ledger T-accounts and record their unadjusted balances 2. needed 3. Prepare the adjusting entries. Include general ledger account numbers (see Sbart of accounts in Chapter 2) and applicable calculations. Descriptions are not Post the adjusting entries to the general ledger T-accounts and calculate Prepare an adjusted trial balance at August 31, 2019. Prepare and post the closing entries. Prepare a post-closing trial balance. balances. 4 5. 6

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts