Question: Can someone explain to me why we are square rooting step 2 by 13?? Please explain step 2 in full detail why we are doing

Can someone explain to me why we are square rooting step 2 by 13?? Please explain step 2 in full detail why we are doing that step and why we are doing it that way. Thank you

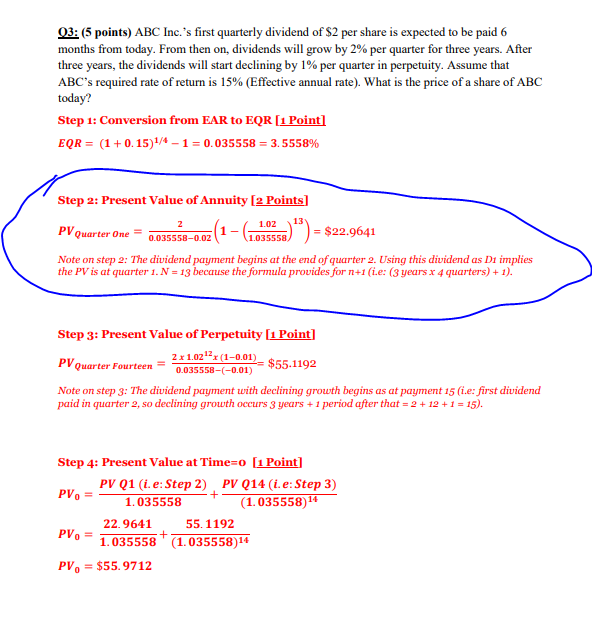

Q3: (5 points) ABC Inc.'s first quarterly dividend of $2 per share is expected to be paid 6 months from today. From then on, dividends will grow by 2% per quarter for three years. After three years, the dividends will start declining by 1% per quarter in perpetuity. Assume that ABC 's required rate of return is 15% (Effective annual rate). What is the price of a share of ABC today? Step 1: Conversion from EAR to EQR [1 Point] EQR=(1+0.15)1/41=0.035558=3.5558% Step 2: Present Value of Annuity [2 Points] PVQuarterone=0.0355580.022(1(1.0355581.02)13)=$22.9641 Note on step 2: The dividend payment begins at the end of quarter 2. Using this dividend as D1 implies the PV is at quarter 1.N=13 because the formula provides for n+1 (i.e: ( 3 years x4 quarters) +1 ). Step 3: Present Value of Perpetuity [1 Point] PVVQuarterFourteen=0.035558(0.01)21.0212x(10.01)=$55.1192 Note on step 3: The dividend payment with declining growth begins as at payment 15 (i.e: first dividend paid in quarter 2 , so declining growth occurs 3 years +1 period after that =2+12+1=15 ). Step 4: Present Value at Time=o [1 Point] PV0=1.035558PVQ1(i.e:Step2)+(1.035558)14PVQ14(i.e:Step3)PV0=1.03555822.9641+(1.035558)1455.1192PV0=$55.9712

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts