Question: Can someone help me on this problem it is page 286 and 287 from the text book an introduction to programming using Visual Basic and

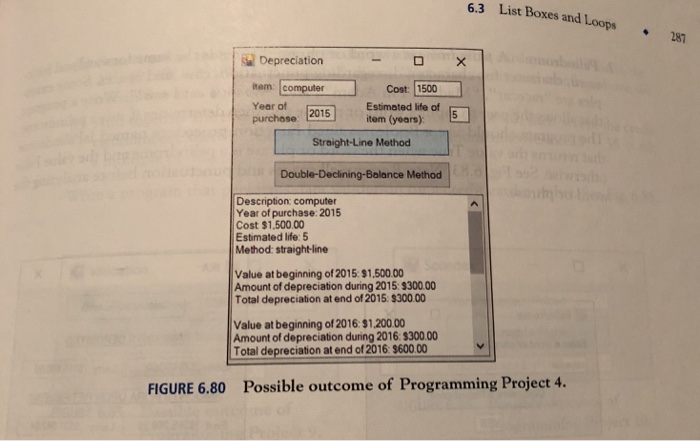

4. Depreciation For tax purposes an item may be depreciated over a period of several years n. With the straight-line method of depreciation, each year the item depreciates by (Iith of its original value. With the double-declining-balance method of depreciation each year the item depreciates by (2/m)ths of its value at the beginning of that year. (In the final year it is depreciated by its value at the beginning of the year.) Write a program that performs the following tasks: (a) Request a description of the item, the year of purchase, the cost of the item, the of depreciation number of years to be depreciated (estimated life), and the method The method of depreciation should be chosen by clicking on one of two buttons (b) Display a year-by-year description of the depreciation. See Fig. 6.80

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts