Question: Can someone help me solve this question 3. Consider two stocks A and B. These stocks have returns that are driven by the state of

Can someone help me solve this question

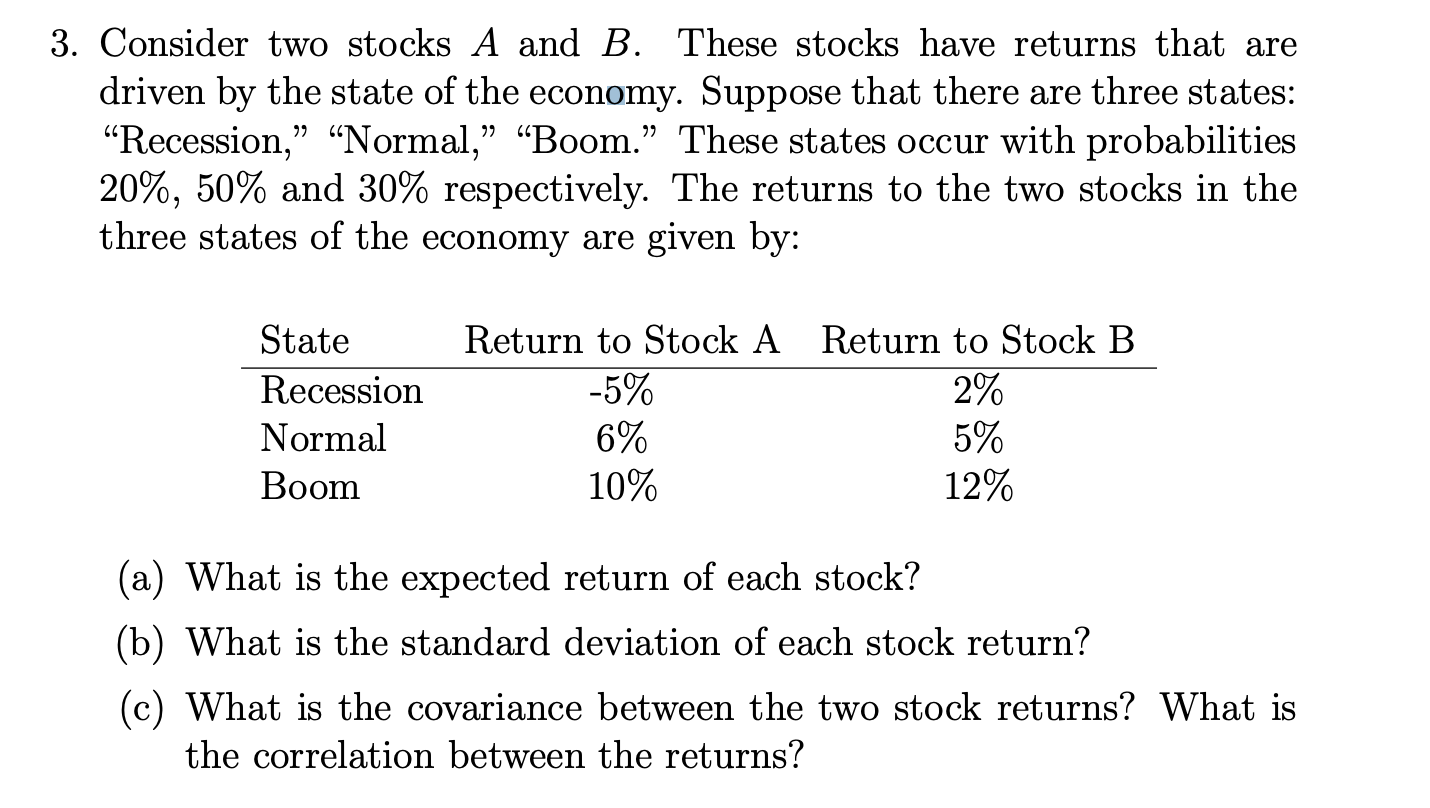

3. Consider two stocks A and B. These stocks have returns that are driven by the state of the economy. Suppose that there are three states: "Recession," "Normal," "Boom." These states occur with probabilities 20%, 50% and 30% respectively. The returns to the two stocks in the three states of the economy are given by: State Recession Normal Boom Return to Stock A Return to Stock B -5% 2% 6% 5% 10% 12% (a) What is the expected return of each stock? (b) What is the standard deviation of each stock return? (c) What is the covariance between the two stock returns? What is the correlation between the returns

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts