Question: can someone help me with this practice problem. there are 6 parts so the same thing has to be done for each year Under the

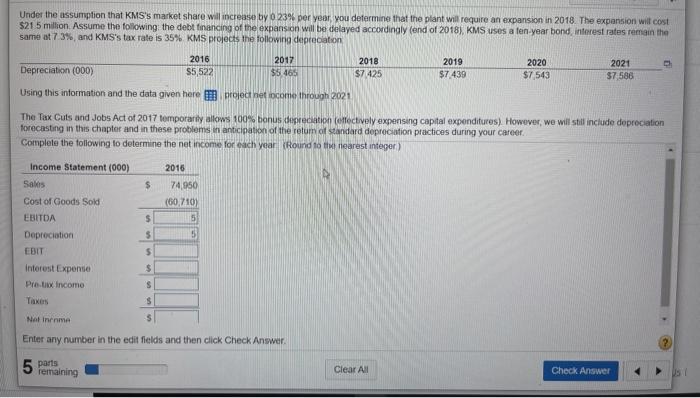

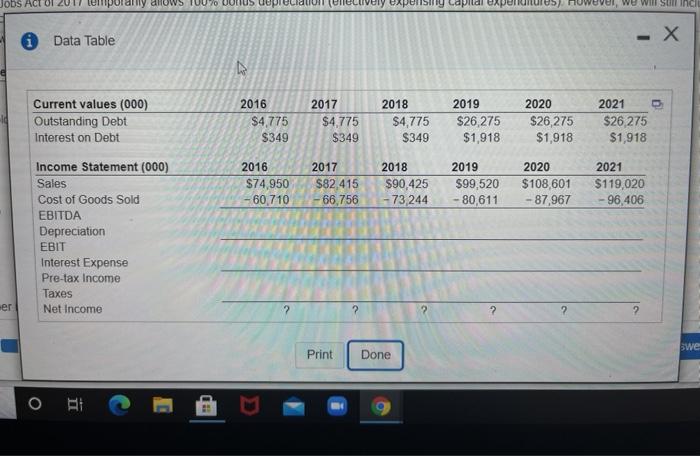

Under the assumption that KMS's market share will increase by o 23% per year you determine that the plant will require an expansion in 2018. The expansion will cost $215 million. Assume the following the debt financing of the expansion will be delayed accordingly (end of 2018). KMS uses a fen-year bond interest rates remain the same at 73%, and KMS's tax rate is 35% KMS projects the following depreciation 2016 2017 2018 2019 2020 2021 Depreciation (000) S5,522 $5465 $7425 $7439 $7543 57 586 Using this information and the data given here project netcome through 2021 The Tax Cuts and Jobs Act of 2017 temporarily allows 100% bonus depreciation effectively expensing capital expenditures) However, we will still include depreciation forecasting in this chapter and in these problems in anticipation of the return of standard depreciation practices during your career. Complete the following to determine the net income for each year Round to nearest integer) $ 2016 74,950 (60,710) 5 $ Income Statement (000) Sals Cost of Goods Sold EBITDA Depreciation EBIT interest Expense Proti incomo $ 5 $ $ $ Taxes $ Nainenme $ Enter any number in the edit fields and then click Check Answer 5 panta remaining Clear All Check Answer Jobs Act Ol 2017 mporary allows Toyo Ootus topicciato hectively expensil Owever, we will Sol Inch 1 Data Table - X D Current values (000) Outstanding Debt Interest on Debt 2016 $4,775 $349 2017 $4.775 $349 2018 $4,775 $349 2019 $26 275 $1,918 2020 $26,275 $1,918 2021 $26 275 $1,918 2016 $74,950 60,710 2017 $82,415 66,756 2018 $90,425 -73 244 2019 $99,520 -80,611 2020 $108,601 - 87,967 2021 $119,020 - 96,406 Income Statement (000) Sales Cost of Goods Sold EBITDA Depreciation EBIT Interest Expense Pre-tax Income Taxes Net Income -er 2 ? swe Print Done

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts