Question: Can someone help me with this problem? Attached is an example to help Question 5 1 pts 5. You are given the following information about

Can someone help me with this problem? Attached is an example to help

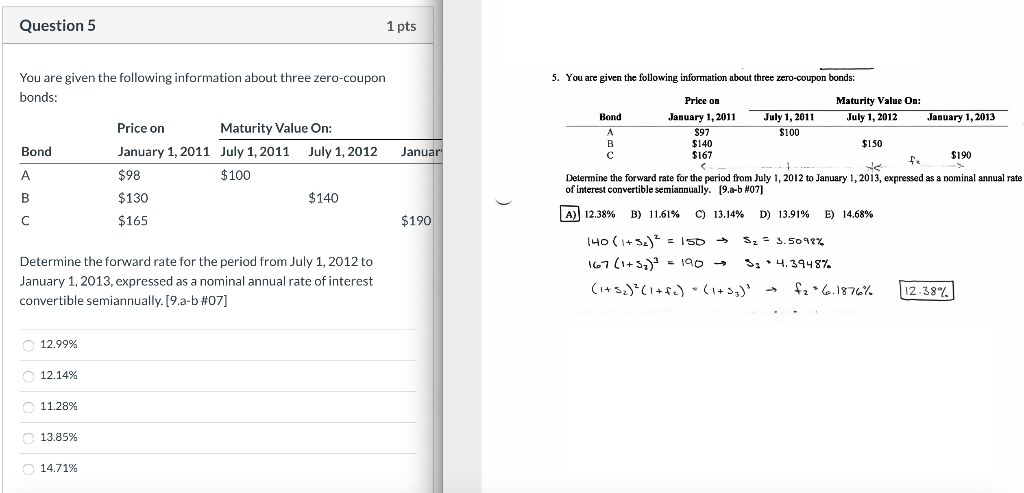

Question 5 1 pts 5. You are given the following information about three zero-coupon bonds: You are given the following information about three zero-coupon bonds: Maturity Value On: July 1, 2012 Bond January 1, 2013 Price on January 1, 2011 $97 $140 $167 July 1, 2011 $100 Price on Maturity Value On: January 1, 2011 July 1, 2011 July 1, 2012 $150 Bond Januar $190 Naf $100 $98 $130 $140 $165 $190 Determine the forward rate for the period from July 1, 2012 to January 1, 2013, expressed as a nominal annual rate of interest convertible semiannually. (9.a-b 07] A) 12.38% B) 11.61% C) 13.14% D) 13.91% E) 14.68% 140 (1+52) = 150 S, = 3.5098% 167 (1+3) = 190 3: 4.3948%. (1+3,)*(1+fe) (1+) - $26.1876% 12.38% Determine the forward rate for the period from July 1, 2012 to January 1, 2013, expressed as a nominal annual rate of interest convertible semiannually. [9.a-b#07] 12.99% 12.14% 11.28% 13.85% 14.71%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts