Question: Can someone help me with this problem? Attached is an example to help Question 2 1 pts The yield rate on a one year zero-coupon

Can someone help me with this problem? Attached is an example to help

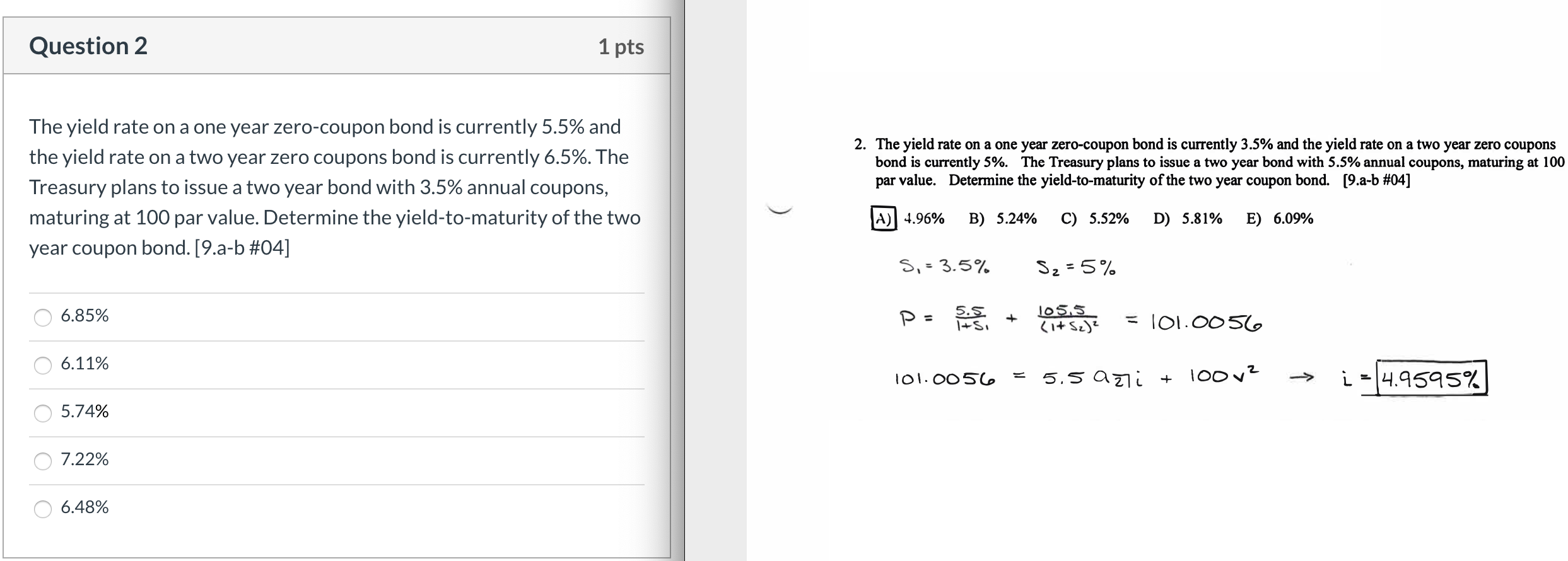

Question 2 1 pts The yield rate on a one year zero-coupon bond is currently 5.5% and the yield rate on a two year zero coupons bond is currently 6.5%. The Treasury plans to issue a two year bond with 3.5% annual coupons, maturing at 100 par value. Determine the yield-to-maturity of the two year coupon bond. [9.a-b #04] 2. The yield rate on a one year zero-coupon bond is currently 3.5% and the yield rate on a two year zero coupons bond is currently 5%. The Treasury plans to issue a two year bond with 5.5% annual coupons, maturing at 100 par value. Determine the yield-to-maturity of the two year coupon bond. [9.a-b #04] A) 4.96% B) 5.24% C) 5.52% D) 5.81% E) 6.09% 0 6.85% 5,= 3.5% 52-5% De + = 101.0056 101.0056 = 5.5 aizi + 100v2 06.11% 1-4.9595%] 0 5.74% 0 7.22% 06.48%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts