Question: Can someone help me with this problem? Attached is an example to help Question 2 1 pts 2. Consider a 6-year loan. The lender requires

Can someone help me with this problem? Attached is an example to help

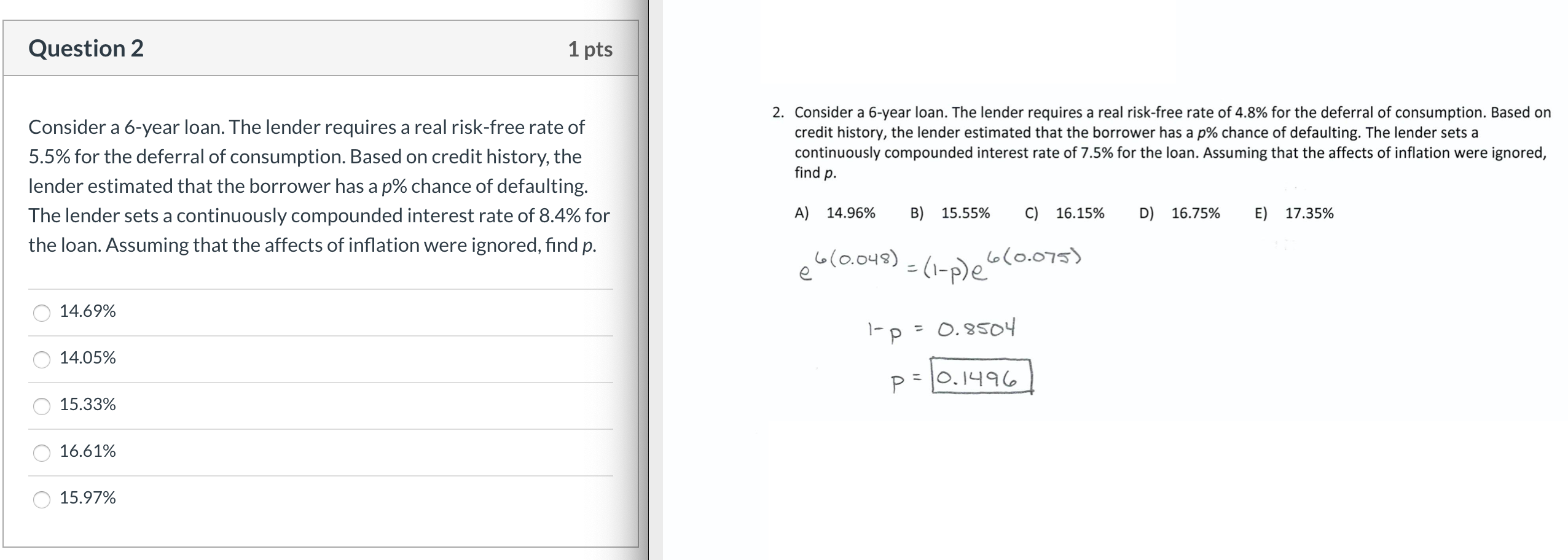

Question 2 1 pts 2. Consider a 6-year loan. The lender requires a real risk-free rate of 4.8% for the deferral of consumption. Based on credit history, the lender estimated that the borrower has a p% chance of defaulting. The lender sets a continuously compounded interest rate of 7.5% for the loan. Assuming that the affects of inflation were ignored, find p. Consider a 6-year loan. The lender requires a real risk-free rate of 5.5% for the deferral of consumption. Based on credit history, the lender estimated that the borrower has a p% chance of defaulting. The lender sets a continuously compounded interest rate of 8.4% for the loan. Assuming that the affects of inflation were ignored, find p. A) 14.96% B) 15.55% C) 16.15% D) 16.75% E) 17.35% 6(0.048) = (1-P)26/0.075) 14.69% 14.05% 1-= 0.8504 p=10.1496] 15.33% O 16.61% 15.97%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts