Question: Can someone help with a? Question 3. Simple Bootstrapping You have fives bonds as shown in the below. Three are zero coupon bonds and the

Can someone help with a?

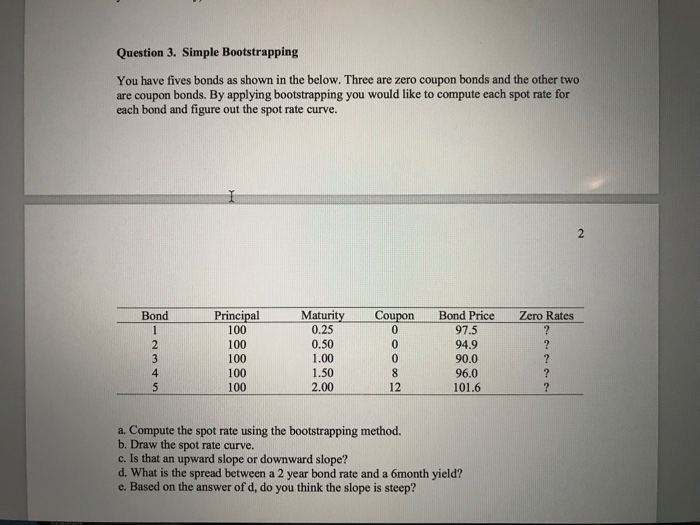

Question 3. Simple Bootstrapping You have fives bonds as shown in the below. Three are zero coupon bonds and the other two are coupon bonds. By applying bootstrapping you would like to compute each spot rate for each bond and figure out the spot rate curve. a. Compute the spot rate using the bootstrapping method. b. Draw the spot rate curve. c. Is that an upward slope or downward slope? d. What is the spread between a 2 year bond rate and a 6 month yield? e. Based on the answer of d, do you think the slope is steep

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts