Question: I need help ASAP! please Question 3. Simple Bootstrapping You have fives bonds as shown in the below. Three are zero coupon bonds and the

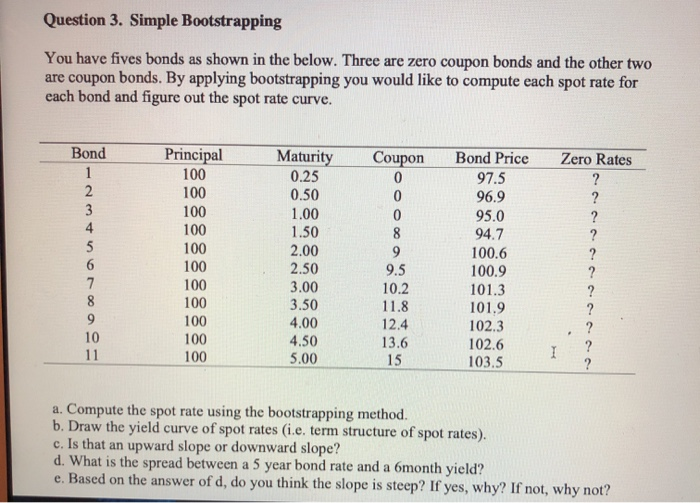

Question 3. Simple Bootstrapping You have fives bonds as shown in the below. Three are zero coupon bonds and the other two are coupon bonds. By applying bootstrapping you would like to compute each spot rate for each bond and figure out the spot rate curve. Bond Coupon Zero Rates Principal 100 100 100 Maturity 0.25 0.50 1.00 1.50 2.00 Bond Price 97.5 96.9 95.0 94.7 100.6 100.9 101.3 101.9 102.3 102.6 103.5 2.50 10.2 100 100 100 100 3.00 3.50 4.00 4.50 5.00 11.8 12.4 13.6 15 a. Compute the spot rate using the bootstrapping method b. Draw the yield curve of spot rates (ie, term structure of spot rates). c. Is that an upward slope or downward slope? d. What is the spread between a 5 year bond rate and a 6month yield? e. Based on the answer of d, do you think the slope is steep? If yes, why? If not, why not

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts