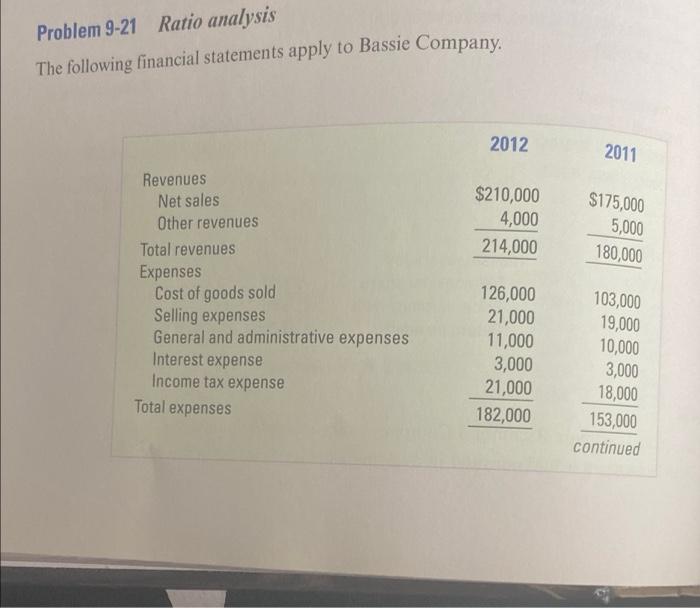

Question: Can someone help with these? Problem 9-21 Ratio analysis The following financial statements apply to Bassie Company. 2012 2011 $210,000 4,000 214,000 Revenues Net sales

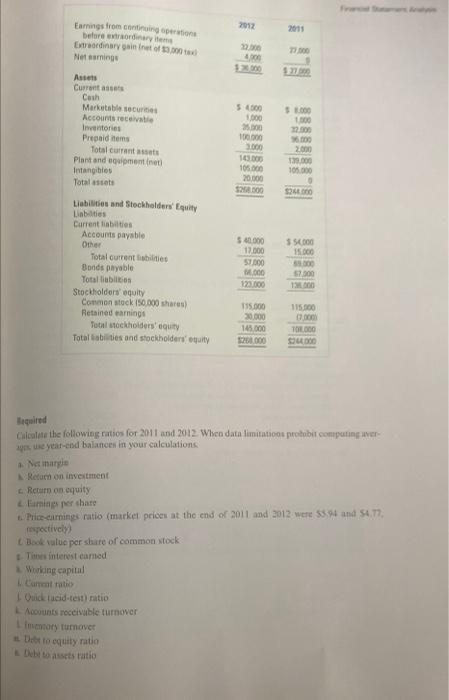

Problem 9-21 Ratio analysis The following financial statements apply to Bassie Company. 2012 2011 $210,000 4,000 214,000 Revenues Net sales Other revenues Total revenues Expenses Cost of goods sold Selling expenses General and administrative expenses $175,000 5,000 180,000 Interest expense Income tax expense Total expenses 126,000 21,000 11,000 3,000 21,000 182,000 103,000 19,000 10,000 3,000 18,000 153,000 continued 2012 2015 Earnings from continger before theme wiarygint of Net naming 22 17.000 Assets Current assets Cash Marketable sec Accounts receivable Inventories Prepaid items Total currants Plant and equipmentineti Intangibles Total asset 54500 1000 25.000 100.000 3000 100 105.000 20.000 525000 5.000 1500 72.000 5 2.000 199.000 105.500 . S2000 $ 40.000 17.000 57.000 Liabilities and Stockholders' Equity Liabilities Current bites Accounts payable Other Total current abilities Bonds payable Total bilion Stockholders' equity Common stock 150.000 shares) Retained earnings Total stockholders equity Total abilities and stockholders equity 35.000 . 500 57300 1.000 1234000 115.500 195.000 3000 145.000 000 TESCO SL Required Calculate the following ratios for 2011 and 2012. When data limitations protobit computing over es une year-end balances in your calculations Ne marge Recurn on investment Return on equity Llarninps per share t. Price-camnings ratio (market prices at the end of 2011 and 2012 were 53 and 54.77 respectively Book value por share of common stock The interest comed Working capital Carrito Ouid acid-test ratio Accounts receivable turnover memory turnover Detto equity ratio Debit assets ratio

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts