Question: Can someone help with this? I am having trouble calculating the numbers. The code is supposed to be written is c++ CMSY 141 Lab 1

Can someone help with this? I am having trouble calculating the numbers. The code is supposed to be written is c++

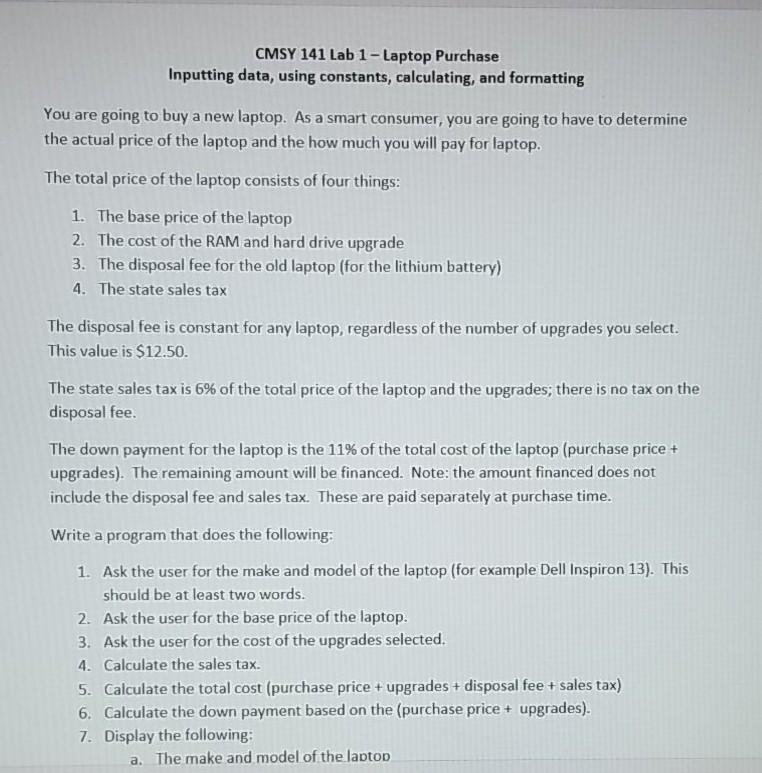

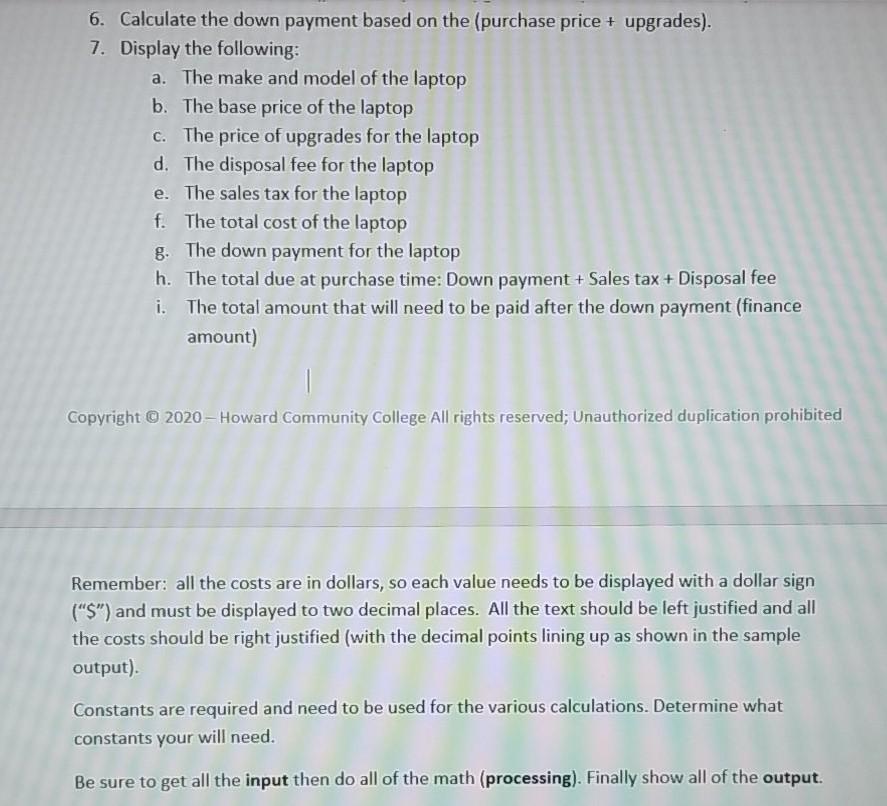

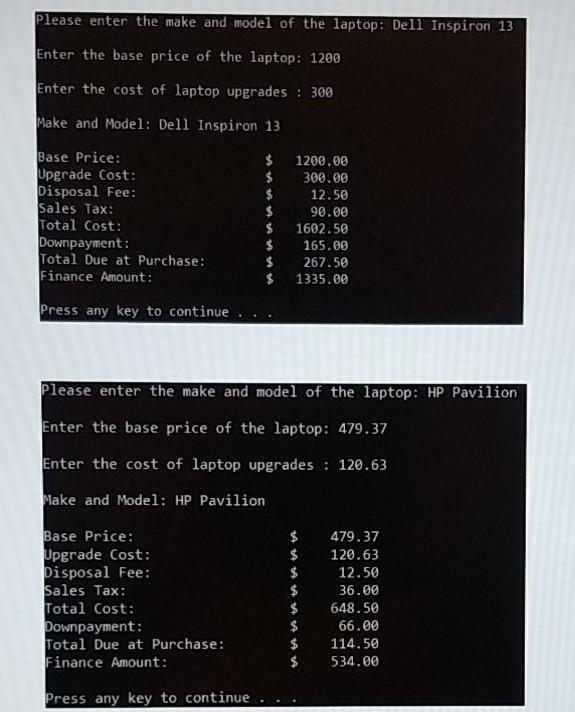

CMSY 141 Lab 1 - Laptop Purchase Inputting data, using constants, calculating, and formatting You are going to buy a new laptop. As a smart consumer, you are going to have to determine the actual price of the laptop and the how much you will pay for laptop. The total price of the laptop consists of four things: 1. The base price of the laptop 2. The cost of the RAM and hard drive upgrade 3. The disposal fee for the old laptop (for the lithium battery) 4. The state sales tax The disposal fee is constant for any laptop, regardless of the number of upgrades you select. This value is $12.50. The state sales tax is 6% of the total price of the laptop and the upgrades; there is no tax on the disposal fee. The down payment for the laptop is the 11% of the total cost of the laptop (purchase price + upgrades). The remaining amount will be financed. Note: the amount financed does not include the disposal fee and sales tax. These are paid separately at purchase time. Write a program that does the following: 1. Ask the user for the make and model of the laptop (for example Dell Inspiron 13). This should be at least two words. 2. Ask the user for the base price of the laptop. 3. Ask the user for the cost of the upgrades selected. 4. Calculate the sales tax. 5. Calculate the total cost (purchase price + upgrades + disposal fee + sales tax) 6. Calculate the down payment based on the (purchase price + upgrades). 7. Display the following: a. The make and model of the laptop 6. Calculate the down payment based on the (purchase price + upgrades). 7. Display the following: The make and model of the laptop b. The base price of the laptop C. The price of upgrades for the laptop d. The disposal fee for the laptop e. The sales tax for the laptop f. The total cost of the laptop g. The down payment for the laptop h. The total due at purchase time: Down payment + Sales tax + Disposal fee i. The total amount that will need to be paid after the down payment (finance amount) Copyright 2020 - Howard Community College All rights reserved; Unauthorized duplication prohibited Remember: all the costs are in dollars, so each value needs to be displayed with a dollar sign ("S") and must be displayed to two decimal places. All the text should be left justified and all the costs should be right justified (with the decimal points lining up as shown in the sample output) Constants are required and need to be used for the various calculations. Determine what constants your will need. Be sure to get all the input then do all of the math (processing). Finally show all of the output. Please enter the make and model of the laptop: Dell Inspiron 13 Enter the base price of the laptop: 1200 Enter the cost of laptop upgrades : 300 Make and Model: Dell Inspiron 13 $ Base Price: Upgrade Cost: Disposal Fee: Sales Tax: Total Cost: Downpayment: Total Due at Purchase: Finance Amount: $ $ 1200.00 300.00 12.50 90.00 1602.50 165.00 267.50 1335.00 $ Press any key to continue Please enter the make and model of the laptop: HP Pavilion Enter the base price of the laptop: 479.37 Enter the cost of laptop upgrades : 120.63 Make and Model: HP Pavilion $ Base Price: Upgrade Cost: Disposal Fee: Sales Tax: Total Cost: Downpayment: Total Due at Purchase: Finance Amount: 479.37 120.63 12.50 36.00 648.50 66.00 114.50 534.00 $ Press any key to continue

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts