Question: Can someone look at this and help explain how to get the answers please? John Wiggins is considering the purchase of a small restaurant. The

Can someone look at this and help explain how to get the answers please?

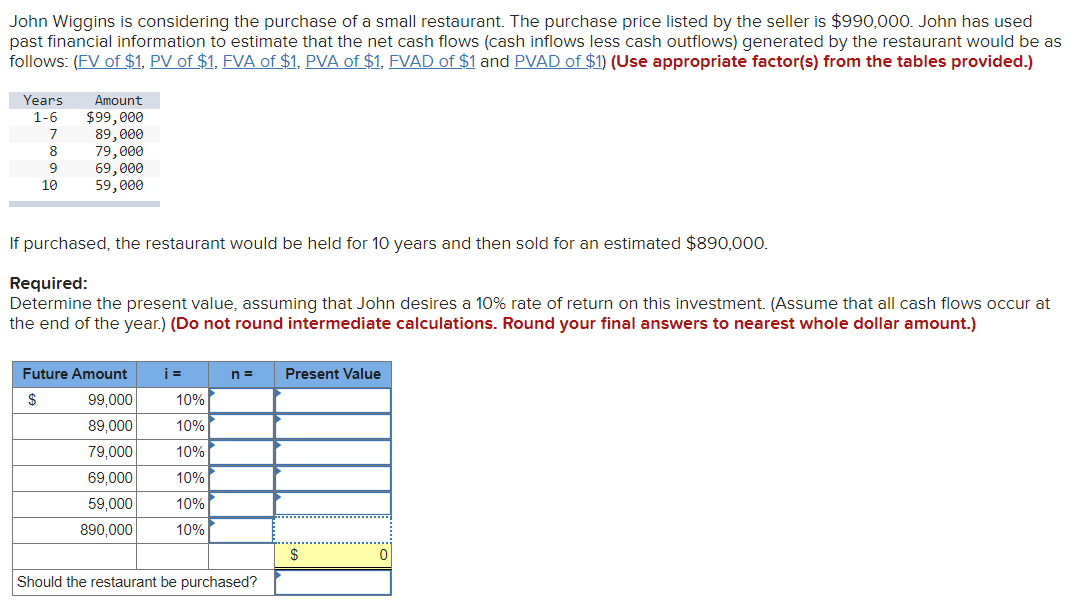

John Wiggins is considering the purchase of a small restaurant. The purchase price listed by the seller is $990,000. John has used past financial information to estimate that the net cash flows (cash inflows less cash outflows) generated by the restaurant would be as follows: (FV of $1, PV of $1, FVA of $1. PVA of $1, FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.) Years 1-6 7 8 9 10 Amount $99,000 89,000 79,000 69,000 59,000 If purchased, the restaurant would be held for 10 years and then sold for an estimated $890,000. Required: Determine the present value, assuming that John desires a 10% rate of return on this investment. (Assume that all cash flows occur at the end of the year.) (Do not round intermediate calculations. Round your final answers to nearest whole dollar amount.) Future Amount i = n = Present Value $ 10% 10% 10% 99,000 89,000 79,000 69,000 59,000 890,000 10% 10% 10% $ 0 Should the restaurant be purchased

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts