Question: Can someone please answer number 4 and 5? On number 4, why? What about the transparency index and barriers? On number 5, what is some

Can someone please answer number 4 and 5? On number 4, why? What about the transparency index and barriers? On number 5, what is some data that the Nigerian market is established? what about barriers, competition, and readiness?

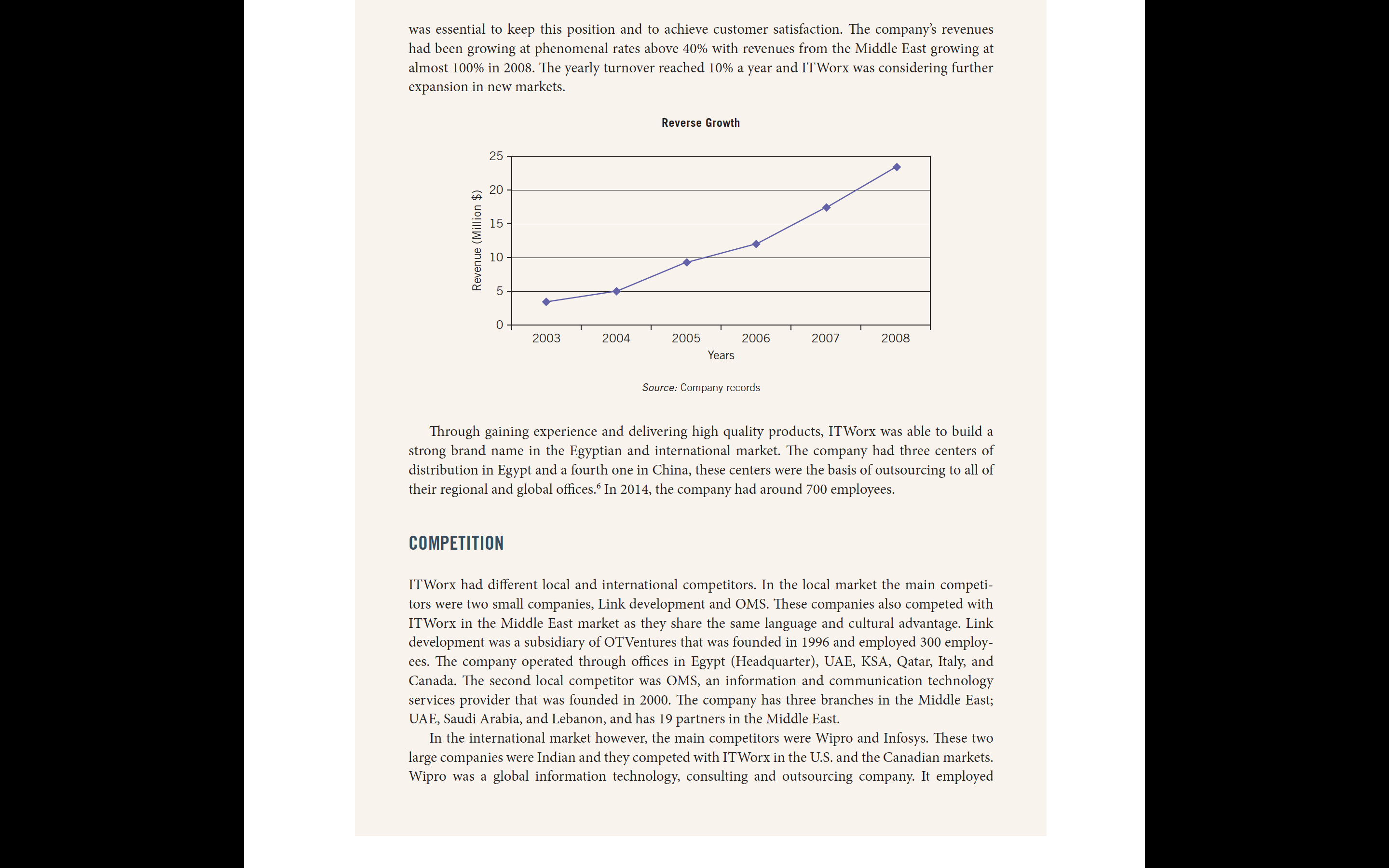

Case III.4 Egypt's ITWorx plans African Expansion ON A SUNNY DAY, ON MARCH 2015, Ahmed Badr, the vice president of ITWorx, was sitting in his office recalling a lecture he attended in his MBA class, back in 2010. The lecture was on "How to enter a new market" which caused his thoughts to drift away. He started thinking of his own global software services company, ITWorx which he and his other two partners, Wael Amin and Youssri Helmy, established in 1994. Then the idea hit him, isn't it the time to expand and enter a new market? The steady pace of development of ITWorx made the thought even more desirable and attractive, especially that they started with one customer, "Corel Corporation", in Canada, and reached out to be one of the fastest growing market leader companies. Although his expansion plans were put on hold due to the political unrest that took place in Egypt between 2011 and 2014, Badr believed that the economy now was starting to move again and it was time to reconsider his plans. Headquartered in Cairo, the company offered portals, business intelligence, enterprise applica- tion integration, and application development outsourcing services to Global 2000 companies. Cairo, Egypt-the old and the new worlds meet ji Baloncici/bigstock.com This case was prepared by (Dr) Marina Apaydin and Hend Mostafa based on materials from Ahmed Badr, MahaIT Worx already covered a wide range of customers including governments, financial services firms, educational institutions, and telecommunication operators and media companies in North America, Europe, and the Middle East. ITWorx was able to customize software applications to satisfy customers' needs. All of this made Ahmed Badr see growing opportunities in different new market that the com- pany could penetrate especially after having offices in KSA, USA and UAE. After their successful expansion in the Middle East, he thought that it was time for the next step of expansion but this time to Africa, to diversify and to take advantage of being the market leader, which would enable the company to have first mover advantage as many countries in Africa are still entering the phase of technological advances. ITWorx's current financial position helped trigger the idea of expansion, especially after being privately held in 2008, with financial backing from the Euro Mena Fund, Venture Capital Bank and Proparco and fortunate to have industry leading customers United Technologies, Vodafone, and Mellon Bank. The lecturer interrupted his thoughts by asking "how should we choose this new market?" This question trigged a serious of questions in Badr's mind: what countries in Africa should we choose? What method of expansion was most suitable? POLITICAL OVERVIEW During former president Gamal Abdel Nasser, Egypt's economy was highly centralized, which changed later during the 70s by former president Sadat to an open door policy. Between 2004 and 2008, former president Mubarak pursued economic reforms to attract foreign investment and increase GDP. However, the economic growth in recent years was not reflected on living conditions. Accordingly on 25th of Jan 2011, the Egyptian revolution took place were citizens demanded political and economic reforms. On the 11th Feb 2011, Mubarak resigned and the Egyptian military assumed leadership. By June 2012, Mohamed Morsi was elected as president however massive anti-government demonstrations took place against his government and the Egyptian Armed Forces intervened, removed Morsi, and replaced him by an interim president, Adly Mansour, in July 2013. During June 2014, presidential elections took place, and Abdel Fattah al Sisi became the president. ECONOMY After the Egyptian revolution took place in January 2011, the Egyptian economy was deeply affected. The sectors that were affected most in the economy were tourism, manufacturing, and construct tion. Moreover, the political instability decreased economic growth, increased unemployment, and reduced government's revenues. In 2011, the GDP growth rate dropped to 1.8% and the GDP per capita was $6,600. There was a minor increase in the GDP growth rate in 2012, reaching 2.2%however it dropped again in 2013 to 1.8%. In 2012 the public debt reached 88% of the GDP and it increased to 92.2% of GDP in 2013. Moreover the external debt accounted for $38.69 billion in 2012 and increased to $48.76 billion in 2013. The government spending has also increased to address the dissatisfied public, and accordingly Egypt had been using its foreign exchange reserves and was now depending on foreign assistance especially from the gulf countries.' SOCIAL Population Over the last thirty years, The Egyptian population has almost doubled from forty four million in 1980 to over eighty four million persons today, making Egypt one of the most populous Arab countries. According to central Intelligence Agency, the annual population growth rate is almost two percent. Religion Islam was the main religion of Egypt; nearly ninety percent of the population were Muslims. The ma- jority of the Muslim Egyptians were Sunni. The Mufti and Sheikh Al Azhar University were the two religious leaders in Egypt and they were elected by the government. Family traditions and structures were influenced by the Islamic concepts. Nevertheless, the Coptic community was an important group in the Egyptian society despite the fact that it accounted for only ten percent of the population. Muslims and Copts lived together peacefully as there was no discrimination. Language Arabic was the official language of Egypt. The Colloquial Egyptian Arabic known as Amayia, had been spread throughout of the Arab countries which revealed the impact of the Egyptian's strong cultural influence. Amayia adopted terms from other language such as French, English, Persia and Turkish over the last hundred years. Education Almost 71.4% of Egyptians over the age of fifteen were literate but there was a wide gap in literacy between males (83%) and females (59.4%) due to the Egyptian rural customs which restricted the education of females. One biggest challenge resulted from the poor educational system was matching the labors' skills with the skills needed by employers.EEYPT'S ICT Back in 1980, the elite Egyptian had only a transistor radio as source of communication, however, nowadays due to the globalization inuence in spreading the improvement of technology, more than half of the Egyptian population has cell phone while the telephone main line users are 10313 million. Furthermore, the number of internet users reached 11.414 million. The information and communications technology (ICT) had become one of main drivers of the economy In the rst quarter of 2010, the IT sector had witnessed a growth of 11,3percent, contribute ing to a substantial increase of 5.8 percent in the total GDR Egypt had become one of the world growing outsourcing destinations due to reforms which included local employment subsidies, lower corporate taxes, deductions for training costs, the increased availability of attractive business properties like Smart Village and exible income tax regulations, Furthermore, the government was encouraging the expansion in ICT Sector by investing in infrastructure and by supporting SME IT start ups. The underutilization of the extensive Egyptian workforces who had computer and linguistic skills represented competitive advantages for multina- tional companies. Although the IT market in Egypt was expected to grow, the political unrest since 2011 highly impacted the IT market, The revolution that took place in 2011 followed by many political instability forced many retail outlets and distributors to suspend their operations Moreover, the spending on consumer electronics dropped causing temporary closure of country's bank and the drop off in con- sumer condence. The mobile operators had a large drop in revenues and a number of multinational vendors suspended local sales and marketing activities. However sales were expected to recover, but the uncertainty about the future direction of economic policies limited business investment, These uncertainties in the Egyptian market hindered the country to develop its IT market and become a hub between Middle East and Africa. Despite the period of uncertainty that Egypt witnessed, the IT market was expected to improve in the coming years. The large population of Egypt and the strong government support for the IT industry was expected to boost the IT market in Egypt The emergence of a more aluent middle class in Egypt, urbanization, and the growing acceptance of modern retail concepts would allow the consumer electronics market to grow steadily over the next ve years. The growing internet usage during the political uncertainty in Egypt, the large growth of DSL, mobile broadband, and the economic recovery in 2015, would also contribute to the growth of the IT market in Egypt,2 The government initiatives such as 'PC for Every Home' would also support growth in the in- dustry. The computer hardware sales increased from $956 million in 2011 to $1.0bn in 2012. The computer penetration was forecasted to rise by 20% in 2016.3 Software Sector The software industry in Egypt remains in its early stage of development, consisting of four market segments, The rst was software tools which were computer programs used to create, maintain or support other programs and applications. The second market segment was packaged applications which were a bundle of two or more computer programs that were used together to address a specific business need. The third segment was the customization of existing applications to align with customers' needs. Finally was arabization software that allowed existing applications to be used for inputting Arabic text. ITWorx was currently active in two segments; packed applications and customization of existing applications. According to the BMI Egypt report 2010, the overall spending on software remains low: "being projected at U.S.$187M in 2010. The estimated 14% share of the total Egyptian IT spending accounted for by software reflects the relative immaturity of Egypt's IT market". However, the domestic software market was expected to grow at a CAGR of around 11% over the forecast period until end-2014. Software piracy was the main obstacle that was hindering the development of software industry. According to Business Software Association, illegal software usage was 59 percent.4 ITWorx5 IT Worx was one of the leading software professional services company in Egypt. With its head- quarter in Cairo, the company offered different IT services to more than 2000 companies in North America, Europe, and the Middle East. ITWorx had a list of clients among leading Fortune 500 repeat customers such as United Technologies, Microsoft, Vodafone, and Mellon Bank. Moreover, ITWorx partnered with top players in the IT market such as Magic Quadrant technology vendors- Microsoft, Vignette, IBM, Oracle, MicroStrategy, Informatica, Ounce Labs, and Intel. IT Worx developed a successful project methodology through expertise and using best practices to ensure the delivery of products on time, on budget, and to customers' needs. The company's mis- sion was "improving people's lives through technology." Its vision however was to work, live, and learn better. ITWorx encourages different values such as passion, integrity, accountability, quality, and innovation and productivity. ITWorx developed products to four different industries; government, education, Teleco, and enterprise. For the government, ITWorx developed innovative software products that would facili- tate their business processes. These products enhanced citizen's experience by managing e-permits, e-license issuing and e-services. For the education sector, ITWorx was considered a market leader in educational software solutions. The company developed unique e-learning platforms that employ the latest technologies and cutting-edge education techniques, tools, and applications. The company was able to customize software solutions for more than 1,400 schools. IT Worx also developed telecom application that transforms businesses process and organiza- tion to an online core. Finally, in the enterprise sector, ITWorx delivered enterprise solutions to consolidate data, visually represent data, analyze data, and build analytical models to enrich decision making. In 2003, ITWorx started to reposition itself from being a generic custom software services pro- vider to highlight its expertise in specific industries such as software for telecommunication opera- tors. ITWorx had been rapidly growing thus opening new markets and learning new technologieswas essential to keep this position and to achieve customer satisfaction. The company's revenues had been growing at phenomenal rates above 40% with revenues from the Middle East growing at almost 100% in 2008. The yearly turnover reached 10% a year and ITWorx was considering further expansion in new markets Reverse Growth 25 20 15 10 Revenue (Million $) 0 I I I I I 2003 2004 2005 2006 2007 2008 Years Source: Company records Through gaining experience and delivering high quality products, ITWorx was able to build a strong brand name in the Egyptian and international market. The company had three centers of distribution in Egypt and a fourth one in China, these centers were the basis of outsourcing to all of their regional and global olces.5 In 2014, the company had around 700 employees. COMPETITION ITWorx had different local and international competitors In the local market the main competie tors were two small companies, Link development and OMSI These companies also competed with ITWorx in the Middle East market as they share the same language and cultural advantage. Link development was a subsidiary of OTVentures that was founded in 1996 and employed 300 employ- ees. The company operated through ofces in Egypt (Headquarter), UAE, KSA, Qatar, Italy, and Canada. The second local competitor was OMS, an information and communication technology services provider that was founded in 2000. The company has three branches in the Middle East; UAE, Saudi Arabia, and Lebanon, and has 19 partners in the Middle East. In the international market however, the main competitors were Wipro and Infosys. These two large companies were Indian and they competed with ITWorx in the US. and the Canadian markets. Wipro was a global information technology, consulting and outsourcing company. It employed around 156,866 employees and operated in 175 cities across 6 continents. Infosys, another competie tor, was also a global leader in consulting, technology, and outsourcing solutions. The company had clients in 50 countries and employed 165,000 employees. Cultural and Language Barriers Being an Egyptian company impacted ITWorx in different ways. International clients were usually suspicious about Egypt's ability to develop quality IT solutions. Accordingly ITWorx had to open ofces in each market it decided to go to. \"Although it was a huge burden on us, we had to open of- fices and hire sales people to convince the clients to try our products," indicated Badr, In the US, for example, ITWorx used to approach its clients as a U.S. company that offeshores development center in Egypt. This approach was also followed by other IT companies such as large Indian companies. The language however was not a barrier for ITWorx in international markets. As indicated by Badr, Egypt had a large population of well educated engineers who spoke different languages mainly English. Moreover, ITWorx provided training to its engineers to improve their language skills and allowed them to travel to their clients to better understand their needs, Unlike Indian and Chinese competitors, ITWorx could communicate easily with its clients and deliver the software services required However, language represented a barrier in non-English speaking countries \"That why we never considered working in Germany or France,D added Badr \"as it would be very diicult to communicate," The culture however could sometimes represent a barrier to ITWorx when dealing with inter- national clients. Communicating with customers in Canada and Us would not be possible unless they were open to oif shoring. According to Badr, international clients should have \"appetite for off shoring\" in order for the communication to succeed, Otherwise it would be very hard to understand customers' needs and deliver software that satisfy these needs. In the Middle East market however, ITWorx had an advantage for being an Egyptian company Sharing common language, religion, and culture, allowed ITWorx to communicate easily with its clients, understand their needs, and deliver software solutions that suit these needs. ITWorx had an edge over its Indian competitors, not only because of the language barrier, but also due to the time zones. ITWorx could respond immediately to its customers and get their feedback often as they share the same time zone. Unlike Indian companies who had large time gap that hindered the com- munication and fast response for customers in the Middle East. Moreover, customers in the Middle East preferred ITWorx because it was a certied company that delivered products with international standards. ITWorx Competitive Advantage ITWorx was able to establish itself in the Egyptian and international market, The company had different competitive advantages that allowed it to attract customers and compete with large inter, national companies. The rst edge of the company was offshoring its operations. Most international companies found it very difcult and expensive to build their own software systems and accordingly used companies such as ITWorx to develop these systems for them. However the cost of engineers in the US, Canada, and even the Middle East was very high. Accordingly, ITWorx used o'shoring in Egypt to develop software solutions for its clients. The company hired highly skilled Egyptian engineers who were less costly, compared to other countries, and developed high quality software solutions at low costs. Another competitive edge that ITWorx possessed was its large expertise in intranet, enterprise portals, and business intelligence. ITWorx's experience was developed through its strategic partner, ships with global technology leaders such as Microsoft, IBM, Vignette, etc. Through engaging in different projects, whether in the private or public sector, ITWorx's team became very skilled and experienced. Moreover, ITWorx provided continuous training for its team to improve their efciency and skills. ITWorx was also able to differentiate itself from competitors, mainly Indians, through the high quality of its products. The company was certied and developed products with international stan- dards. In addition, ITWorx had received different awards such as the Microsoft Worldwide Customer Experience Award in 2004. Later in 2007, ITWorx received the Adobe's \"Site of the Day\" award, for Vodafone Egypt 3G website, that recognized websites based on their strong visual designs, superior functionalities, and innovative use of adobe products. In 2014, the Ooredoo group intranet that was developed in partnership with ITWorx was among the world's 10 best intranets in 2014K Opportunities in Egypt's IT Market The IT market in Egypt had different opportunities especially ITWorx's goal to make Egypt a regional center for outsourcing, especially with the strong government support for the industry in general, and exporting the production to other countries. Another important opportunity was that the IT industry had been expanding to be essential part of other industries. It used to be only related to educational and governmental institutes but now IT investments in the oil and gas, telecom and banking sectors had been growing signicantly. Thus ITWorx should begin to deal with oil and gas sectori This was besides the growing potential in domestic market with computer penetration above 2% for a population of80million. CHALLENGES IN THE EXTERNAL ENVIRDEMNT Between 2011 and 2013, ITWorx went through a very dilcult period. Due to the political instability in Egypt, many international clients started to refrain from doing business with ITWorx. When the revolution started in 25 Jan 2011, the political authority decided to cut the internet throughout Egypt on 28 Ian, in an effort to minimize communication and control the situation. Although the govern- ment failed to control the demonstrations, the internet cut off remained for a week. \"The internet cut had huge impact on the company,\" indicated Badr, "we were unable to communicate with our customers nor deliver our products on time,\" Although the internet came back a Week later, many customers were worried that the Egyptian authority could do it again and accordingly refrained from demanding ITWorx's products, To overcome this problem, ITWorx developed a recovery system through satellites to act as a back-up in case the internet went off again. Another problem that ITWorx faced during this period was the closure of Cairo airport during the revolution. This hindered ITWorx's team to travel to its clients. Although the airport was open few days later, customers were still worried that it would happen again and that their businesses get affected, As a result of the political instability that Egypt was going through, demand decreased tre- mendously and revenues accordingly decreased. Most clients were continuing the existing projects with ITWorx but none wanted to start any new products. The situation in Egypt was very unclear and customers wanted to monitor how would this aect ITWorx before deciding to continue with new projects All this had huge impact on the expected growth of ITWorx. The Middle East market however was not affected severely like the international market In 2015 the situation got better and international customers started to gain condence in Egypt and ITWorx. PLANNING COMPANY STRATEGY After passing the tough situation between 2011 and 2014, Egypt's political environment started to stabilize and the economy started moving slowly At this stage, ITWorx started to reconsider its expansion plans that had been put on hold for a few years. Ahmed Badr focused on entering a new market where they could gain rst mover advantage. Africa as one of the least developed markets with the least competition was his choice. The company would be market seeking not resource seeking as there was no technological resources or labor with advanced technological education in these markets that could be an opportunity for the company. However, the opportunity was in the market itself with huge population and potential growth The company could enter the market through exporting with opening sales representative's of- ces thus eliminating the threat normally associated with exporting which included losing control over distribution and lack of knowledge of the market. Trained representatives would go to govern ment institutions, educational institutions and multinational companies to present the products. The products would be customized based on the customer's needi Opening small ofces in Nigeria and South Africa might be the rst step. The industry attractive- ness in both countries was strong. There is a threat of new entrants but still the current competition status wasn't strong which made the buyer bargaining power relatively low. Since software could be considered a service, and then there was no supplier needed as production would remain in the same placesr Outsourcing wouldn't be considered for now for unstable political factors and lack of needed resources such as skilled labor. The target market would be the same globally including: educational institutions, governmen- tal institutions and multinational or big companies, Segmentation strategy would be used as the company also offered customized products The strategy would be of a service company focusing on personal visit to the target market and making easy to try the services provided by the company. An important step was to be able to develop general awareness about the industry in the developing countries through awareness campaigns. Maintenance of after sales services and continuous relations with the customers was essential Nigeria Nigeria was one of the highest importers of software products in Sub-Saharan African continent as all its operating systems, system software, network software, development tools were hundred percent imported. There was an over dependency on foreign software due to the nonexistence of software quality assurance, poor investment in software development, poor product standards and absence of proper documentation. The nancial sector was the principal consumer of foreign software, as it relied hundred percent on foreign software to drive its operations The fact that the majority of Nigerian software companies did not offer customized software as they only provided existing offrtheeshelf software signied the presence of a market gap in the specialized application development markets. This represented a golden opportunity for software developers especially to ITWorx as it was one of their core activities, However, Nigerian businesses usually did not invest their money in buying customized software due to either their ignorance of the benets of the software or their preference in buying the foreign software as it was regarded as better quality as opposed to the local specialized software which was known for its dreadful quality and poor function The Nigerian government had established the Nigerian Software Development Initiative (NSDI) jointly with Nigerian software practitioners in recognition of the importance of software. According to the Oracle of the Nigerian IT industry, ISPON had initiated strategies to establish a National Policy and tactics for Software Development, \"ISPON indicated that the Nigerian software market potential was currently worth about $5,2billion U.S. dollars and could grow to more than $15 billion annually, provided that an exclusive, independent and professionally constituted framework was established to harness its immense potential.\" South Africa The ICT industry in South Africa was booming, it currently contributed to about 7% of the country's Gross Domestic Product. South Africa had about 3000 IT companies, mainly in Gauteng, Western Cape, and Kwazulu provinces\". In 2009, the spending on software was estimated at ZAR 11,732 Million of which 50% came from imported packaged software, and its growth was estimated at 7.2% a year until the end of 20139. The growth was supported by the low and stable exchange rate that makes the local products price competitive and a capable labor market. Local companies usually were usually associated with foreign companies; South African developers had a good reputation especially concerning the nancial services sectorr The country's economy was continuously developing and the ICT industry was currently boom- ing as it contributed to about 7% of South Africa's gross domestic product. The country also ranked 72nd freest in the 2010 Economic freedom index; which was higher than the world averages Since ITWorx was trying to expand their client base, the fact that South Africa had more than 3000 IT companies and ranks 22nd worldwide in IT spend in 2001 reafrms it as a good choice As a service provider, Human resources were especially signicant for ITWorx. South Africa's widespread pov- erty and weak educational system might very well deny the company access to qualied labor and thus hinder business success. Moreover, South Africa still had considerable political risk due to high corruption perception, Non-transparent regulations, rigid labor laws, and crime. And what most of all, as a software company they could stand to lose a lot in terms of potential sales because end-use piracy is not criminalized in South Africa yeti ITWorx also needed to consider the international and local competitors in South Africa before making its nal decision. After the full analysis of the situation, Ahmed Badr was sure that the expansion to the African market especially Nigeria and South Africa was the right decisions However, still unresolved issues and questions were still in his mind. How to know much more about the customs and habits of the population there and how to eectively reach them? What was the possibility of failure and how would it be handled? How could the company benet and crate spillover effect to the other near African countries? What and when potential competitors would enter the market and how this would affect the position of the company, its revenues and the market in general? DISCUSSION QUESTIONS 1. What rm-specic and country-specic advantages does ITWorx have in the Middle East? Do they transfer also to Nigeria and South Africa? 2. Are there rst-mover advantages in these markets? Can they work in Nigeria? In South Africa? 3. What should be the entry strategy of ITWorx in Nigeria? In South Africa? Does the com pany need a local partner? 4. What segment should be targeted in these countries? Which segments are most likely to have high entry barriers, and which ones would have strong competition? 5. What should ITWorx doienter one (which one), enter both, or none at all, focus on the Middle East

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts