Question: Can someone please do a step by step solution for this problem! Thank you! :D Suppose that you invest 50% of your money in asset

Can someone please do a step by step solution for this problem! Thank you! :D

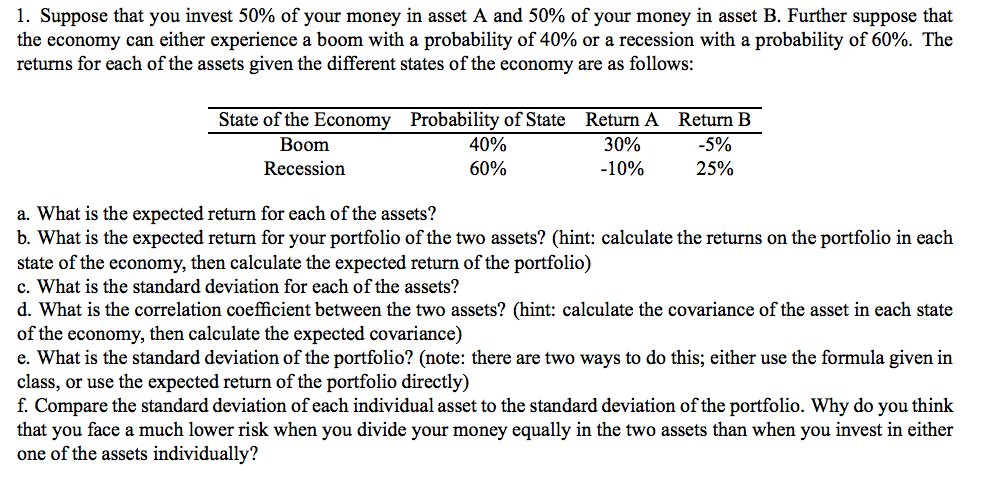

Suppose that you invest 50% of your money in asset A and 50% of your money in asset B. Further suppose that the economy can either experience a boom with a probability of 40% or a recession with a probability of 60%. The returns for each of the assets given the different states of the economy are as follows: What is the expected return for each of the assets? What is the expected return for your portfolio of the two assets? What is the standard deviation for each of the assets? What is the correlation coefficient between the two assets? What is the standard deviation of the portfolio? Compare the standard deviation of each individual asset to the standard deviation of the portfolio. Why do you think that you face a much lower risk when you divide your money equally in the two assets than when you invest in either one of the assets individually

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts