Question: can someone please explain all steps and mechanism behind this to someone that doesnt understand WITHOUT COPY PASTING old answers which will be reported for

can someone please explain all steps and mechanism behind this to someone that doesnt understand WITHOUT COPY PASTING old answers which will be reported for plagiarism.

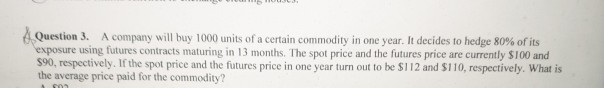

Question 3. A company will buy 1000 units of a certain commodity in one year. It decides to hedge 80% of its exposure using futures contracts maturing in 13 months. The spot price and the futures price are currently $100 and 90, respectively. If the spot price and the futures price in one year turn out to be $112 and $110, respectively. What is the average price paid for the commodity

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock