Question: Can someone please explain how to answer this question? I'd really appreciate any help! 4. Kollmorgea Corporation, a diversified technology company, reported sales of $194.9

Can someone please explain how to answer this question? I'd really appreciate any help!

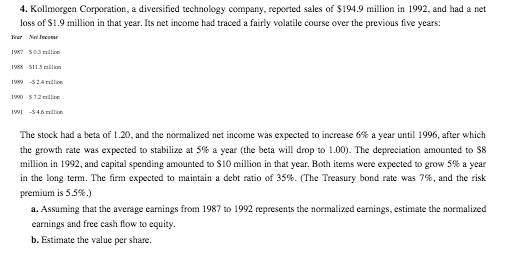

4. Kollmorgea Corporation, a diversified technology company, reported sales of $194.9 million in 1992 , and had a net loss of $1.9 million in that year. Its net income had traced a fairly volatile course over the previous five years: Trer Nrifeceses IWex \$115 metion 129$2.4 ration 190 \$12 nation 1901546 ration The stock had a beta of 1.20, and the normalized net income was expected to increase 6\% a year until 1996 , after which the growth rate was expected to stabilize at 5% a year (the beta will drop to 1.00 ). The depreciation amounted to $8 million in 1992, and capital speading amounted to $10 million in that year. Both items were expected to grow 5% a year in the long term. The firm expected to maintain a debt ratio of 35%. (The Treasury bond rate was 75 , and the risk premium is 5.5%.) a. Assuming that the average earnings from 1987 to 1992 represents the normalized earnings, estimate the normalized earaings and free cash flow to couity. b. Estimate the value per share

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts