Question: Can someone please explain how to do these on a financial calculator? I have my final tomorrow. Question 8 1 pts Federated Holdings recently issued

Can someone please explain how to do these on a financial calculator? I have my final tomorrow.

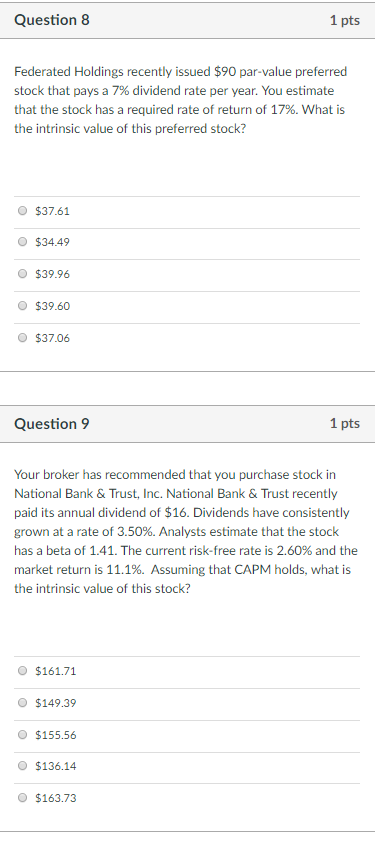

Question 8 1 pts Federated Holdings recently issued $90 par-value preferred stock that pays a 7% dividend rate per year. You estimate that the stock has a required rate of return of 17%. what is the intrinsic value of this preferred stock? $37.61 $34.49 $39.96 $39.60 $37.06 Question 9 1 pts Your broker has recommended that you purchase stock in National Bank & Trust, Inc. National Bank & Trust recently paid its annual dividend of $16. Dividends have consistently grown at a rate of 3.50%. Analysts estimate that the stock has a beta of 1.41. The current risk-free rate is 2.60% and the market return is 11.1%. Assuming that CAPM holds, what is the intrinsic value of this stock? $161.71 $149.39 $155.56 $136.14 $163.73

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts