Question: can someone please help and explain the first one please. the second question not getting at all. thank you Metlock Company is evaluating its performance

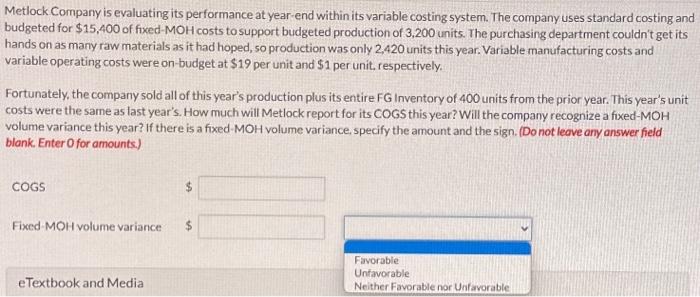

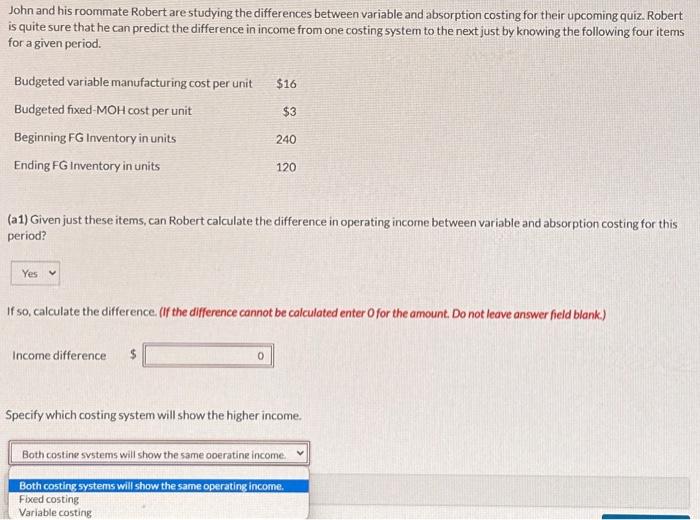

Metlock Company is evaluating its performance at year-end within its variable costing system. The company uses standard costing and budgeted for $15,400 of fixed- MOH costs to support budgeted production of 3,200 units. The purchasing department couldn't get its hands on as many raw materials as it had hoped, so production was only 2,420 units this year. Variable manufacturing costs and variable operating costs were on-budget at $19 per unit and $1 per unit, respectively. Fortunately, the company sold all of this year's production plus its entire FG Inventory of 400 units from the prior year. This year's unit costs were the same as last year's. How much will Metlock report for its COGS this year? Will the company recognize a fixed-MOH volume variance this year? If there is a fixed- MOH volume variance, specify the amount and the sign. (Do not leove any answer field blank. Enter 0 for amounts.) coGS John and his roommate Robert are studying the differences between variable and absorption costing for their upcoming quiz. Robert is quite sure that he can predict the difference in income from one costing system to the next just by knowing the following four items for a given period. (a1) Given just these items, can Robert calculate the difference in operating income between variable and absorption costing for this period? If so, calculate the difference. (If the difference cannot be calculated enter 0 for the amount. Do not leave answer field blank.) Income difference Specify which costing system will show the higher income. Metlock Company is evaluating its performance at year-end within its variable costing system. The company uses standard costing and budgeted for $15,400 of fixed- MOH costs to support budgeted production of 3,200 units. The purchasing department couldn't get its hands on as many raw materials as it had hoped, so production was only 2,420 units this year. Variable manufacturing costs and variable operating costs were on-budget at $19 per unit and $1 per unit, respectively. Fortunately, the company sold all of this year's production plus its entire FG Inventory of 400 units from the prior year. This year's unit costs were the same as last year's. How much will Metlock report for its COGS this year? Will the company recognize a fixed-MOH volume variance this year? If there is a fixed- MOH volume variance, specify the amount and the sign. (Do not leove any answer field blank. Enter 0 for amounts.) coGS John and his roommate Robert are studying the differences between variable and absorption costing for their upcoming quiz. Robert is quite sure that he can predict the difference in income from one costing system to the next just by knowing the following four items for a given period. (a1) Given just these items, can Robert calculate the difference in operating income between variable and absorption costing for this period? If so, calculate the difference. (If the difference cannot be calculated enter 0 for the amount. Do not leave answer field blank.) Income difference Specify which costing system will show the higher income

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts