Question: can someone please help me on these 2 questions please? my salution does not match any correct answer on first one. the second one is

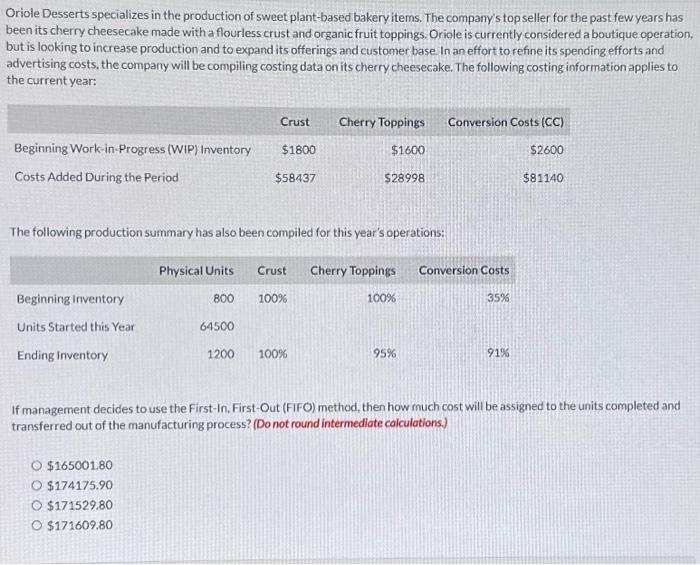

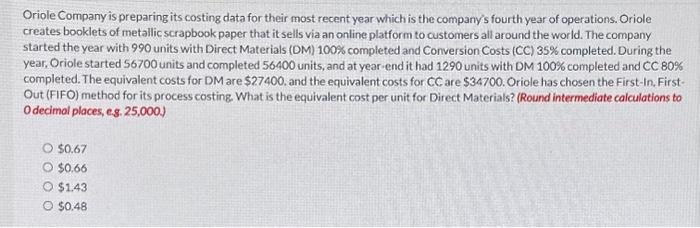

Oriole Desserts specializes in the production of sweet plant-based bakery items. The company's top seller for the past few years has been its cherry cheesecake made with a flourless crust and organic fruit toppings. Oriole is currently considered a boutique operation, but is looking to increase production and to expand its offerings and customer base In an effort to refine its spending efforts and advertising costs, the company will be compiling costing data on its cherry cheesecake. The following costing information applies to the current year: The following production summary has also been compiled for this year's operations: If management decides to use the First-In, First-Out (FIFO) method, then how much cost will be assigned to the units completed and transferred out of the manufacturing process? (Do not round intermediote calculations) $165001.80$174175.90$171529.80$171609.80 Oriole Company is preparing its costing data for their most recent year which is the company's fourth year of operations. Oriole creates booklets of metallic scrapbookpaper that itsells via an online platform to customers all around the world. The company started the year with 990 units with Direct Materials (DM) 100% completed and Conversion Costs (CC) 35% completed. During the year, Oriole started 56700 units and completed 56400 units, and at year-end it had 1290 units with DM 100% completed and CC 80% completed. The equivalent costs for DM are $27400. and the equivalent costs for CC are $34700. Oriole has chosen the First-In. FirstOut (FIFO) method for its process costing. What is the equivalent cost per unit for Direct Materials? (Round intermediate calculations to Odecimal places, e.s. 25,000. $0.67$0.66$1.43$0.48

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts