Question: can u answer those three please even though just the answer. if it's true I'm gonna give u with good comment. Thanks Current Attempt in

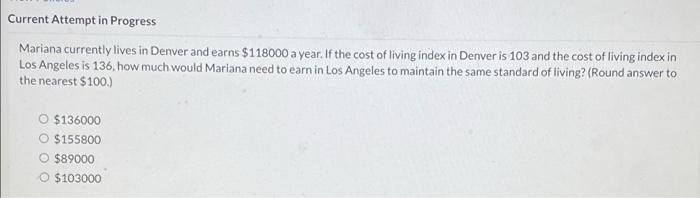

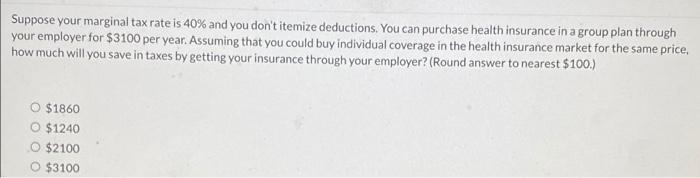

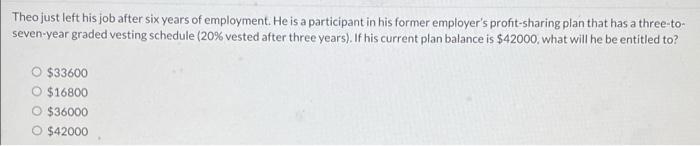

Current Attempt in Progress Mariana currently lives in Denver and earns $118000 a year. If the cost of living index in Denver is 103 and the cost of living index in Los Angeles is 136, how much would Mariana need to earn in Los Angeles to maintain the same standard of living? (Round answer to the nearest $100.) $136000 $155800 O $89000 O $103000 Suppose your marginal tax rate is 40% and you don't itemize deductions. You can purchase health insurance in a group plan through your employer for $3100 per year. Assuming that you could buy individual coverage in the health insurance market for the same price, how much will you save in taxes by getting your insurance through your employer? (Round answer to nearest $100.) O $1860 O $1240 $2100 $3100 Theo just left his job after six years of employment. He is a participant in his former employer's profit-sharing plan that has a three-to- seven-year graded vesting schedule (20% vested after three years). If his current plan balance is $42000, what will he be entitled to? O $33600 O $16800 O $36000 $42000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts