Question: can u please answer q7? Preview File 1) 87% 0 Fri 03:52 = Edit View Go Tools Window Help Final exam 2022.pdf (page 5 of

can u please answer q7?

can u please answer q7?

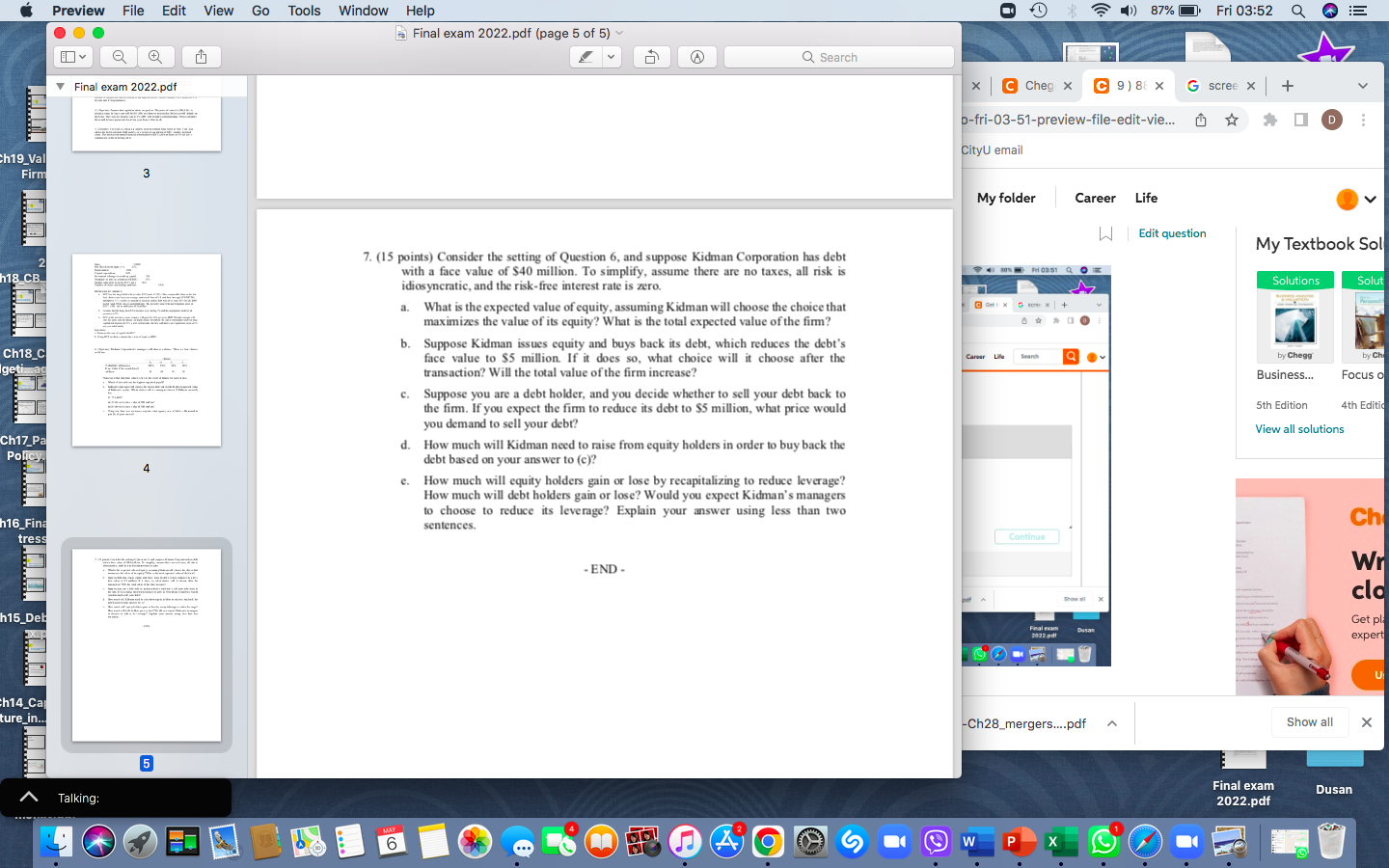

Preview File 1) 87% 0 Fri 03:52 = Edit View Go Tools Window Help Final exam 2022.pdf (page 5 of 5) Q Search Final exam 2022.pdf UN x Cheg x C 9) 8 x G scree x | + D-fri-03-51-preview-file-edit-vie... -- O D : CityU email Ch19 Val Firm 3 My folder Career Life Edit question My Textbook Sol 2 h18 CB 03:51 Solutions Solut SER a O + Career by Chegg by Ch Ch18_C Igeti...a Business... Focus o . 7. (15 points) Consider the setting of Question 6, and suppose Kidman Corporation has debt with a face value of $40 million. To simplify, assume there are no taxes, all risk is idiosyncratic, and the risk-free interest rate is zero. What is the expected value of equity, assuming Kidman will choose the choice that maximizes the value of its equity? What is the total expected value of the firm? b. Suppose Kidman issues equity and buys back its debt, which reduces the debt's face value to $5 million. If it does so, what choice will it choose after the transaction? Will the total value of the firm increase? c. Suppose you are a debt holder, and you decide whether to sell your debt back to the firm. If you expect the firm to reduce its debt to $5 million, what price would you demand to sell your debt? d. How much will Kidman need to raise from equity holders in order to buy back the debt based on your answer to (c)? e. How much will equity holders gain or lose by recapitalizing to reduce leverage? How much will debt holders gain or lose? Would you expect Kidman's managers to choose to reduce its leverage? Explain your answer using less than two sentences. 5th Edition 4th Editio View all solutions Ch17_Pa Policy. 4 Ch h16_Fina tress Continue -END- Wr clo Show h15 Del Fialam 2022.pdf Dusan Get pl expert U U Ch14 Ca ture in.. JDI.SI -Ch28_mergers....pdf Show all 5 Final exam 2022.pdf Dusan Talking: MAY ME o 6 A w X Preview File 1) 87% 0 Fri 03:52 = Edit View Go Tools Window Help Final exam 2022.pdf (page 5 of 5) Q Search Final exam 2022.pdf UN x Cheg x C 9) 8 x G scree x | + D-fri-03-51-preview-file-edit-vie... -- O D : CityU email Ch19 Val Firm 3 My folder Career Life Edit question My Textbook Sol 2 h18 CB 03:51 Solutions Solut SER a O + Career by Chegg by Ch Ch18_C Igeti...a Business... Focus o . 7. (15 points) Consider the setting of Question 6, and suppose Kidman Corporation has debt with a face value of $40 million. To simplify, assume there are no taxes, all risk is idiosyncratic, and the risk-free interest rate is zero. What is the expected value of equity, assuming Kidman will choose the choice that maximizes the value of its equity? What is the total expected value of the firm? b. Suppose Kidman issues equity and buys back its debt, which reduces the debt's face value to $5 million. If it does so, what choice will it choose after the transaction? Will the total value of the firm increase? c. Suppose you are a debt holder, and you decide whether to sell your debt back to the firm. If you expect the firm to reduce its debt to $5 million, what price would you demand to sell your debt? d. How much will Kidman need to raise from equity holders in order to buy back the debt based on your answer to (c)? e. How much will equity holders gain or lose by recapitalizing to reduce leverage? How much will debt holders gain or lose? Would you expect Kidman's managers to choose to reduce its leverage? Explain your answer using less than two sentences. 5th Edition 4th Editio View all solutions Ch17_Pa Policy. 4 Ch h16_Fina tress Continue -END- Wr clo Show h15 Del Fialam 2022.pdf Dusan Get pl expert U U Ch14 Ca ture in.. JDI.SI -Ch28_mergers....pdf Show all 5 Final exam 2022.pdf Dusan Talking: MAY ME o 6 A w X

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts