Question: can u pls help me w/ this? The beginning trial balance has been entered in the general ledger for you. The amounts in this exercise

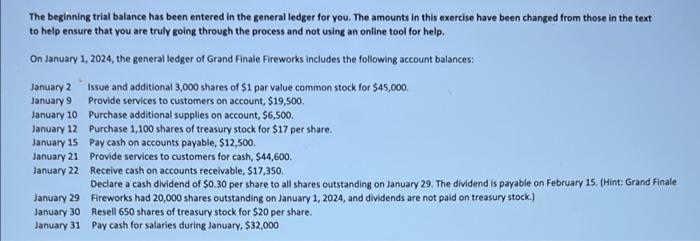

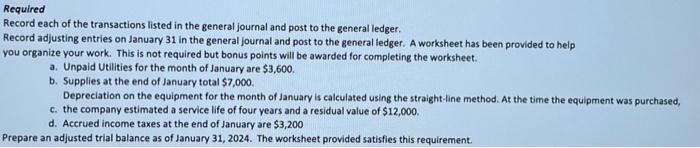

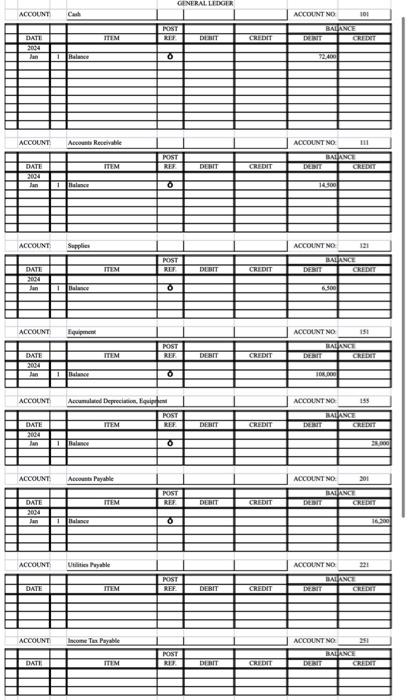

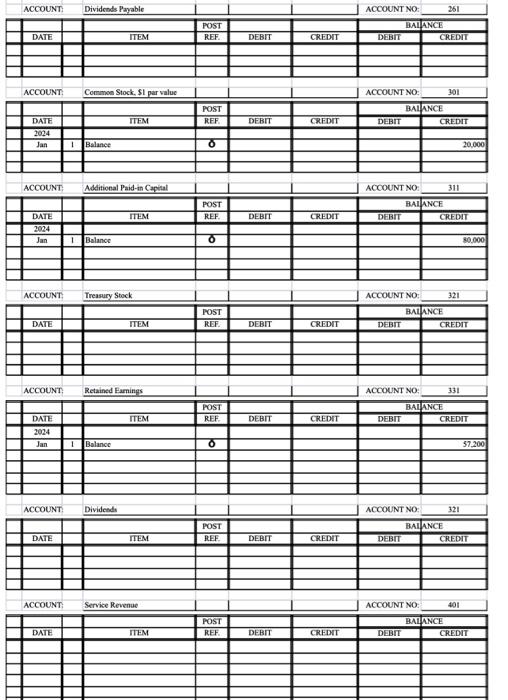

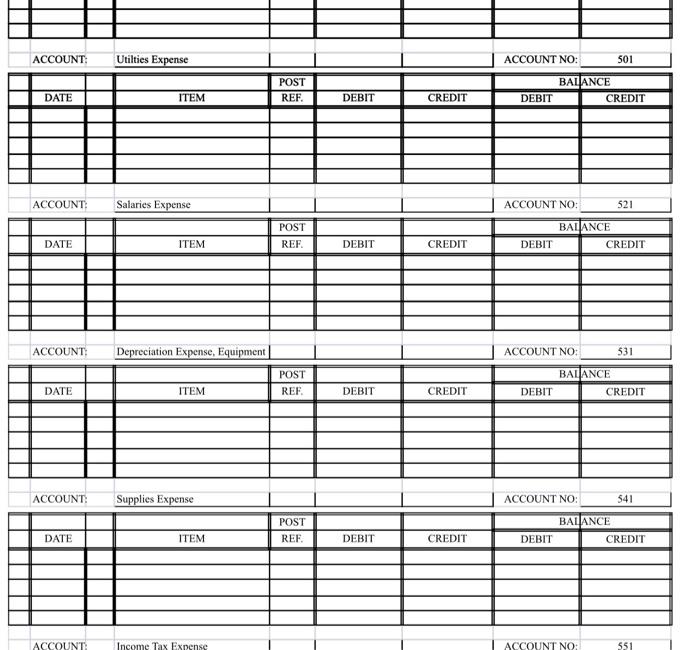

The beginning trial balance has been entered in the general ledger for you. The amounts in this exercise have been changed from those in the text to help ensure that you are truly going through the process and not using an online tool for help. On January 1, 2024, the general ledger of Grand Finale Fireworks includes the following account balances: January 2 Issue and additional 3,000 shares of $1 par value common stock for $45,000. January 9 Provide services to customers on account, $19,500. January 10 Purchase additional supplles on account, 56,500 . January 12 Purchase 1,100 shares of treasury stock for $17 per share. January 15 Pay cash on accounts payable, $12,500. January 21 Provide services to customers for cash, $44,600. January 22 Recelve cash on accounts receivable, $17,350. Declare a cash dividend of 50.30 per share to all shares outstanding on January 29 . The dividend is payable on February 15 . (Hint: Grand Finale January 29 Fireworks had 20,000 shares outstanding on January 1,2024 , and dividends are not paid on treasury stock.) January 30 Resell 650 shares of treasury stock for $20 per share. January 31 Pay cash for salaries during January, $32,000 Record each of the transactions listed in the general journal and post to the general ledger. Record adjusting entries on January 31 in the general journal and post to the general ledger. A worksheet has been provided to help you organize your work. This is not required but bonus points will be awarded for completing the worksheet. a. Unpaid Utilities for the month of January are $3,600. b. Supplies at the end of January total $7,000. Depreciation on the equipment for the month of January is calculated using the straight-line method. At the time the equipment was purchased, c. the company estimated a service life of four years and a residual value of $12,000. d. Accrued income taxes at the end of January are $3,200 Prepare an adjusted trial balance as of January 31,2024 . The worksheet provided satisfies this requirement. \begin{tabular}{|l|l|l|l|l|l|l|l|} \hline & & & & & & & \\ \hline & & & & & & & \\ \hline \end{tabular} The beginning trial balance has been entered in the general ledger for you. The amounts in this exercise have been changed from those in the text to help ensure that you are truly going through the process and not using an online tool for help. On January 1, 2024, the general ledger of Grand Finale Fireworks includes the following account balances: January 2 Issue and additional 3,000 shares of $1 par value common stock for $45,000. January 9 Provide services to customers on account, $19,500. January 10 Purchase additional supplles on account, 56,500 . January 12 Purchase 1,100 shares of treasury stock for $17 per share. January 15 Pay cash on accounts payable, $12,500. January 21 Provide services to customers for cash, $44,600. January 22 Recelve cash on accounts receivable, $17,350. Declare a cash dividend of 50.30 per share to all shares outstanding on January 29 . The dividend is payable on February 15 . (Hint: Grand Finale January 29 Fireworks had 20,000 shares outstanding on January 1,2024 , and dividends are not paid on treasury stock.) January 30 Resell 650 shares of treasury stock for $20 per share. January 31 Pay cash for salaries during January, $32,000 Record each of the transactions listed in the general journal and post to the general ledger. Record adjusting entries on January 31 in the general journal and post to the general ledger. A worksheet has been provided to help you organize your work. This is not required but bonus points will be awarded for completing the worksheet. a. Unpaid Utilities for the month of January are $3,600. b. Supplies at the end of January total $7,000. Depreciation on the equipment for the month of January is calculated using the straight-line method. At the time the equipment was purchased, c. the company estimated a service life of four years and a residual value of $12,000. d. Accrued income taxes at the end of January are $3,200 Prepare an adjusted trial balance as of January 31,2024 . The worksheet provided satisfies this requirement. \begin{tabular}{|l|l|l|l|l|l|l|l|} \hline & & & & & & & \\ \hline & & & & & & & \\ \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts