Question: can you explain how we managed to solve this question (answer attached )? and what is the equation used? and what for? like explain it

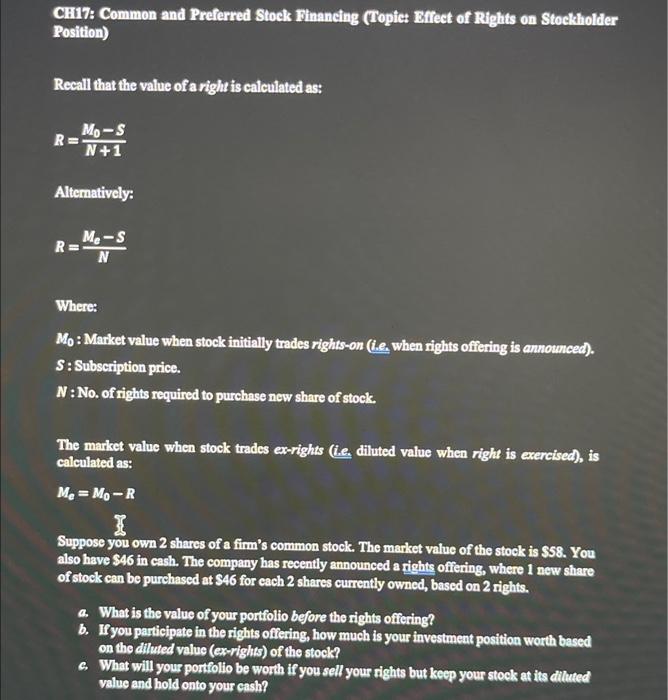

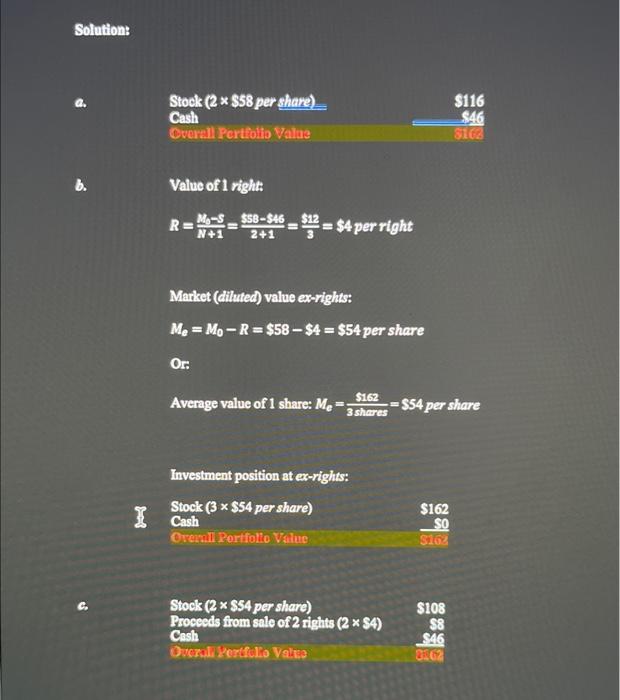

CH17: Common and Preferred Stock Financing (Topiet Bffect of Rights on Stockholder Rosition) Recall that the value of a right is calculated as: R=N+1M0S Alternatively: R=NMeS Where: M0 : Market value when stock initially trades rights-on (i.e, when rights offering is announced). S : Subscription price. N : No. of rights required to purchase new share of stock. The market value when stock trades ex-rights (i.e. diluted value when right is exercised), is calculated as: Mc=M0R Suppose you own 2 shares of a firm's common stock. The market value of the stock is $58. You also have $46 in cash. The company has recently announced a rights offering, where 1 new share of stock can be purchased at $46 for each 2 shares currently owned, based on 2 rights. a. What is the value of your portfolio before the rights offering? b. If you participate in the rights offering, how much is your investment position worth based on the diluted value (ex-rights) of the stock? c. What will your portfolio be worth if you sell your rights but keep your stock at its diluted value and hold onto your cash? Stock(2$58pershare)CashCverallPcrtiolioValus$116$46 Value of 1 right R=N+1M5=2+1$58$46=3$12=$4perright Market (diluted) value ex-rights: Me=M0R=$58$4=$54pershare Or: Average value of 1 share: Me=3shares$162=$54 per share Investment position at exrights

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts