Question: can you explain how we managed to solve this question (answer attached )? and what is the equation used? and what for? like explain it

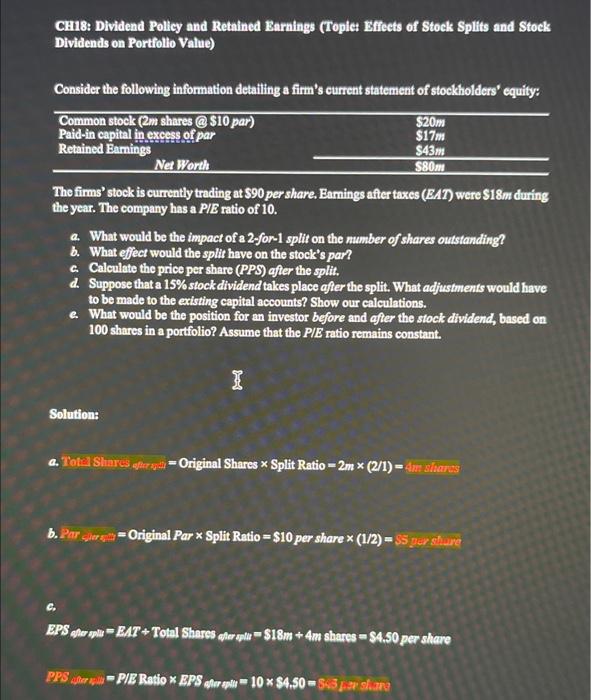

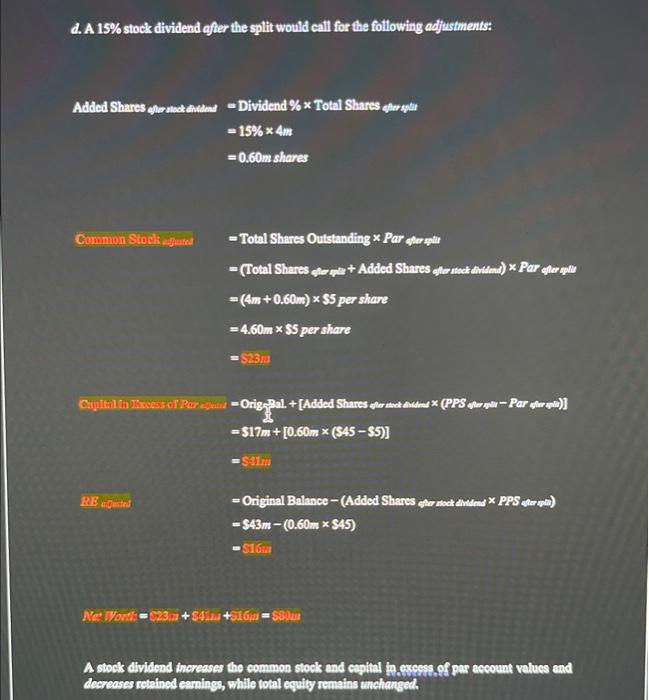

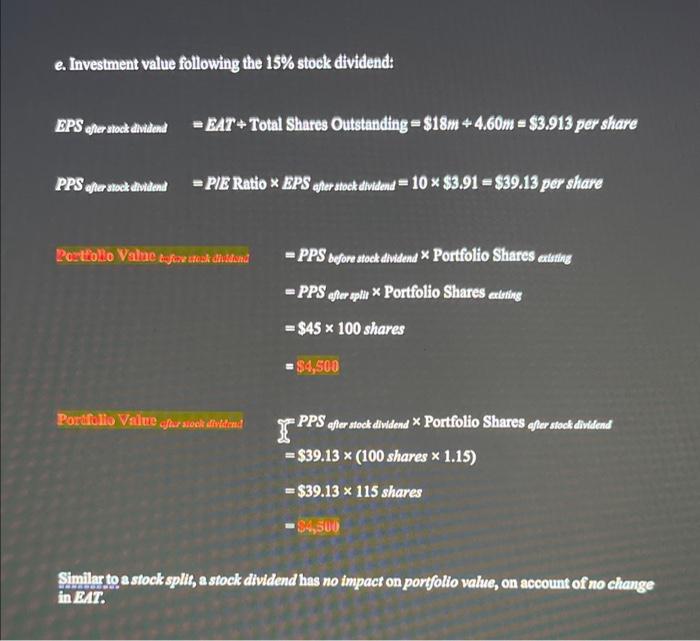

CH18: Dividend Policy and Retained Rarnings (Topiet Effects of Stock Splits and Stock Dividends on Portfollo Value) Consider the following information detailing a firm's current statement of stoekholders' equity: The firms' stock is currently trading at $90 per share. Eamings after taxes (BAT) were S18m during the year. The company has a P/E ratio of 10. a. What would be the impact of a 2-for-1 split on the number of shares outstanding? b. What effect would the split have on the stock's par? c. Calculate the price per share (PPS) after the split, d. Suppose that a 15% stock dividend takes place offer the split. What adjustments would have to be made to the existing capital accounts? Show our calculations. c. What would be the position for an investor before and after the stock dividend, based on 100 shares in a portfolio? Assume that the PIE ratio remains constant. Solution: b. Par siars = Original Par Split Ratio =$10 per share (1/2)=$5 par shune c. d. A 15% stock dividend afler the sptit would call for the fotlowing adjustments: AddedSharesstranct=Dividend%TotalSharessturwhit=15%4m=0.60mshares =(4m+0.60m)55pershare=4.60m$5pershare=523m =517m+[0.60m(54555)]=541m=OriginalBalance-(AddedShares=$43m(0.60m545)-sraNeWWonle=523a+545a+916a=5304 e. Investment value following the 15% stock dividendf BPS ofer stock dimateat = RAT + Total Shares Outstanding =$18m+4.60m=$3.913 per share - PPS efer oflit Portfolio Shares abthis =$45100 shares =$4,500 If PPSfferstockdildend Portfolio Shares afar stock divelend =$39.13(100 shares 1.15) =$39.13115 shares =$4,500 Similar to a stock splif, a stock dividend has no impact on portfolio value, on account of no change in BM

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts