Question: can you explain how we managed to solve this question (answer attached )? and what is the equation used? and what for? like explain it

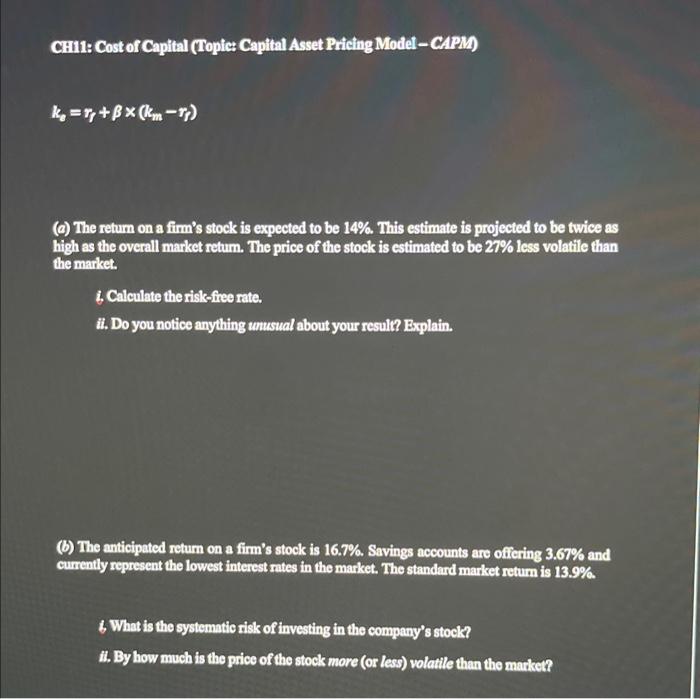

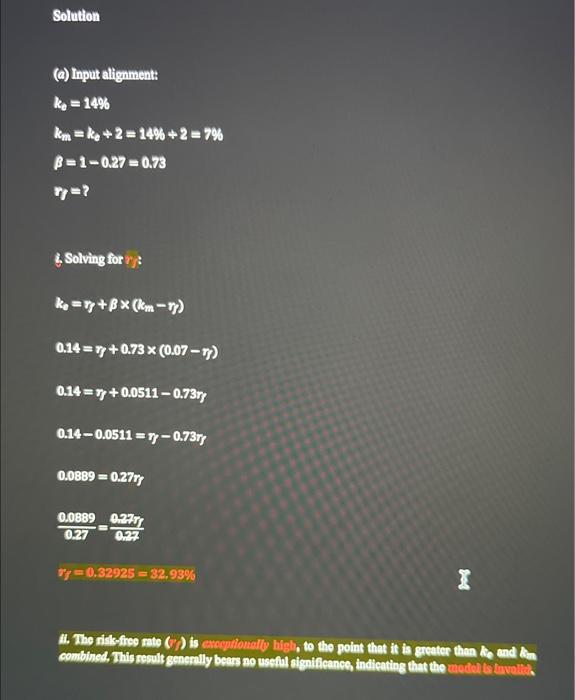

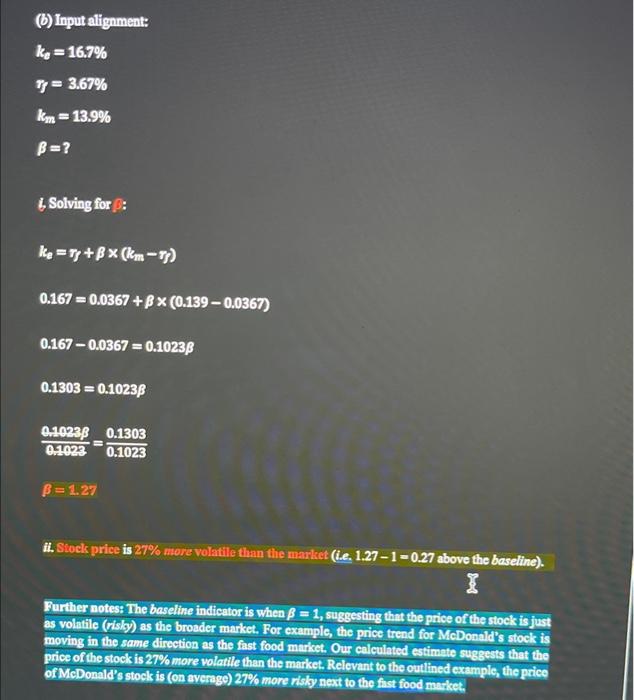

ke=r+(kmr) (a) The retum on a firm's stock is expected to be 14%. This estimate is projected to be twice as high as the overall market retum. The price of the stock is estimated to be 27% less volatile than the market. i. Calculate the risk-free rate. ii. Do you notice anything unusual about your result? Explain. (b) The anticipated retum on a firm's stock is 16.7%. Savings accounts are offering 3.67% and currently represent the lowest interest rutes in the market. The standard market retum is 13.9%. 6. What is the systematic risk of investing in the company's stock? 11. By how much is the price of the stock more (or less) volatile than the market? Solution (a) Input alignments ke=14%km=kb+2=14%+2=7%=10.27=0.73f=? 6. Solving for : ke=+(km)0.14=+0.73(0.07)0.14=+0.05110.730.140.0511=0.730.0889=0.27r0.270.0889=0.270.27 1. The rilkefise mate (I) is exoyuthonally high, to the point that it is greater then ite and An (b) Input alignment: ka=16.7%g=3.67%km=13.9%=? b. Solving for 0 : ke=f+(kmf)0.167=0.0367+(0.1390.0367)0.1670.0367=0.10230.1303=0.10230.10230.1023=0.10230.1303=1.27 ii. Stoek price is 27% more volatile than the market (i.e. 1.271=0.27 above the baseline). Further notes: The baseline indicator is when =1, suggesting that the price of the stock is just as volatile (risky) as the broader market. For example, the price trend for McDonald's stock is moving in the same direction as the fast food market. Our calculated estimate suggests that the price of the stock is 27% more volatile than the market. Relevant to the outlined example, the price of McDonald's stock is (on average) 27% more risky next to the fist food market

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts