Question: can you help me with these practices? Question 2 (0.5 points) If a firm must pay for goods it has ordered with foreign currency, it

can you help me with these practices?

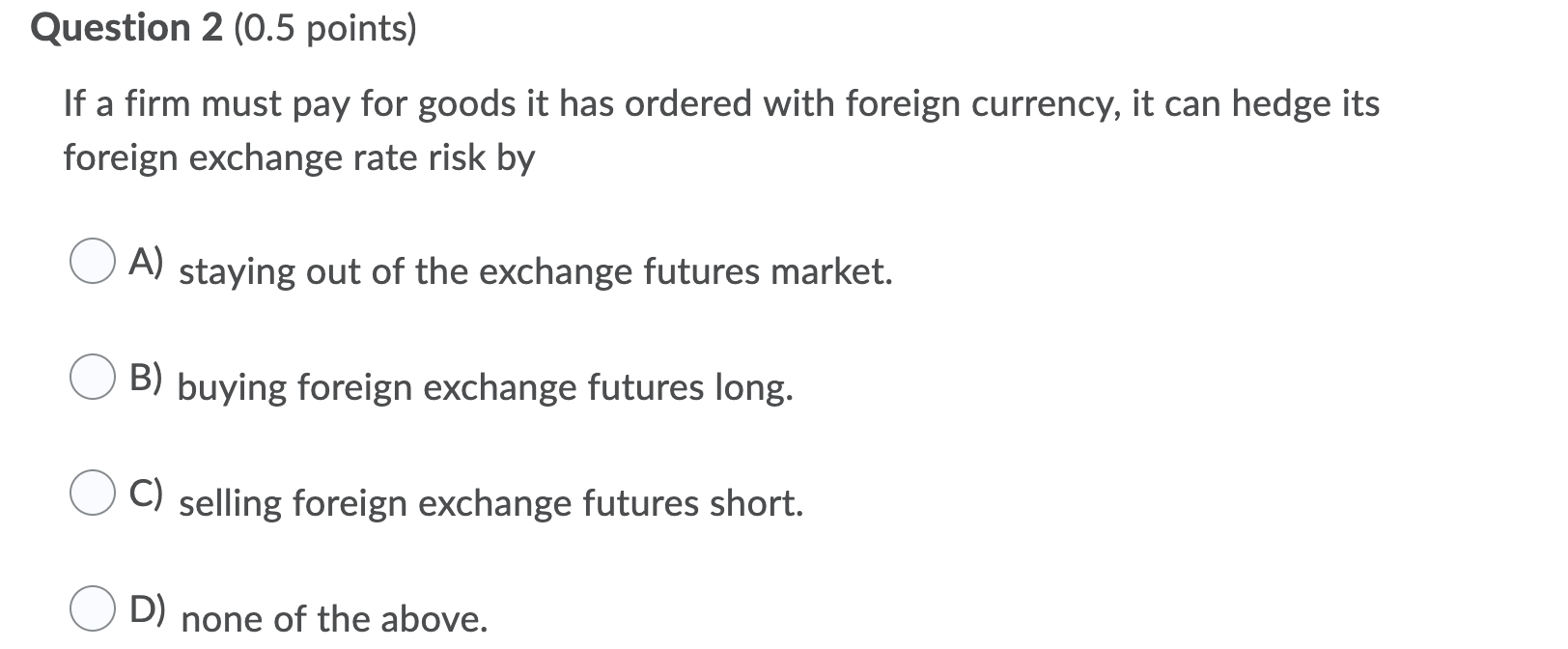

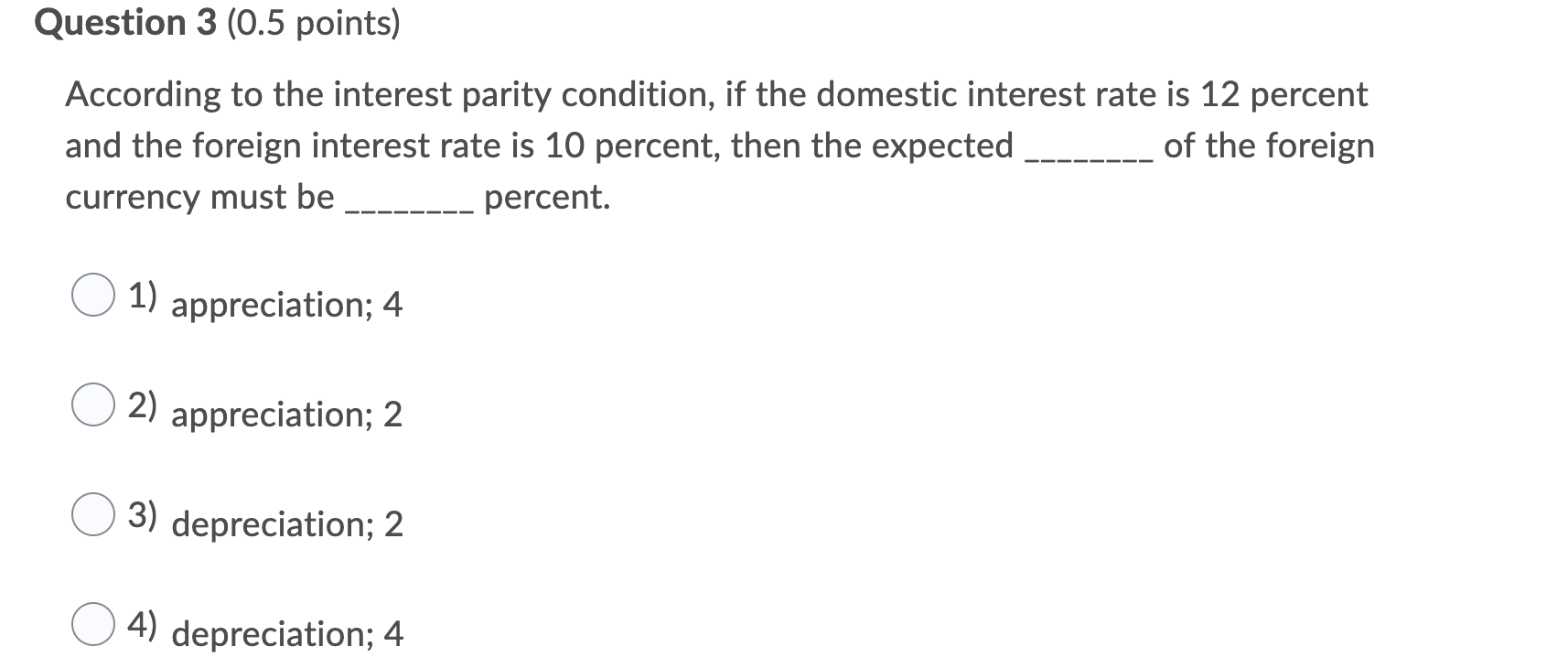

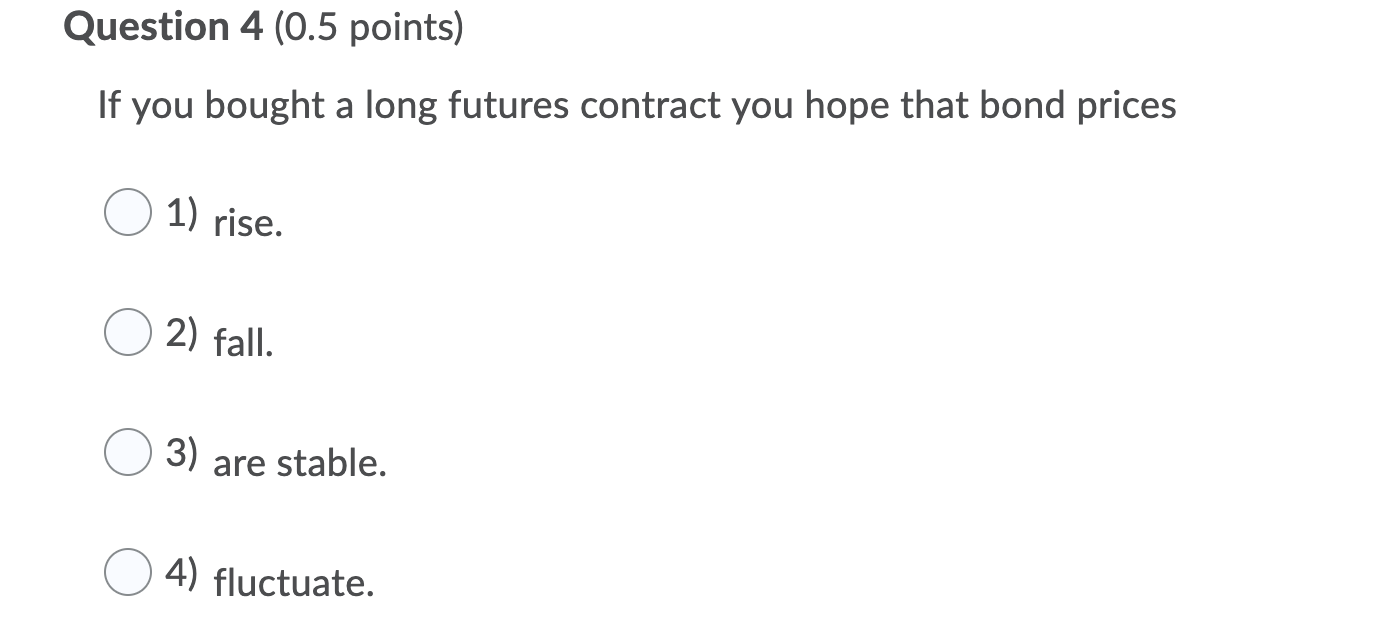

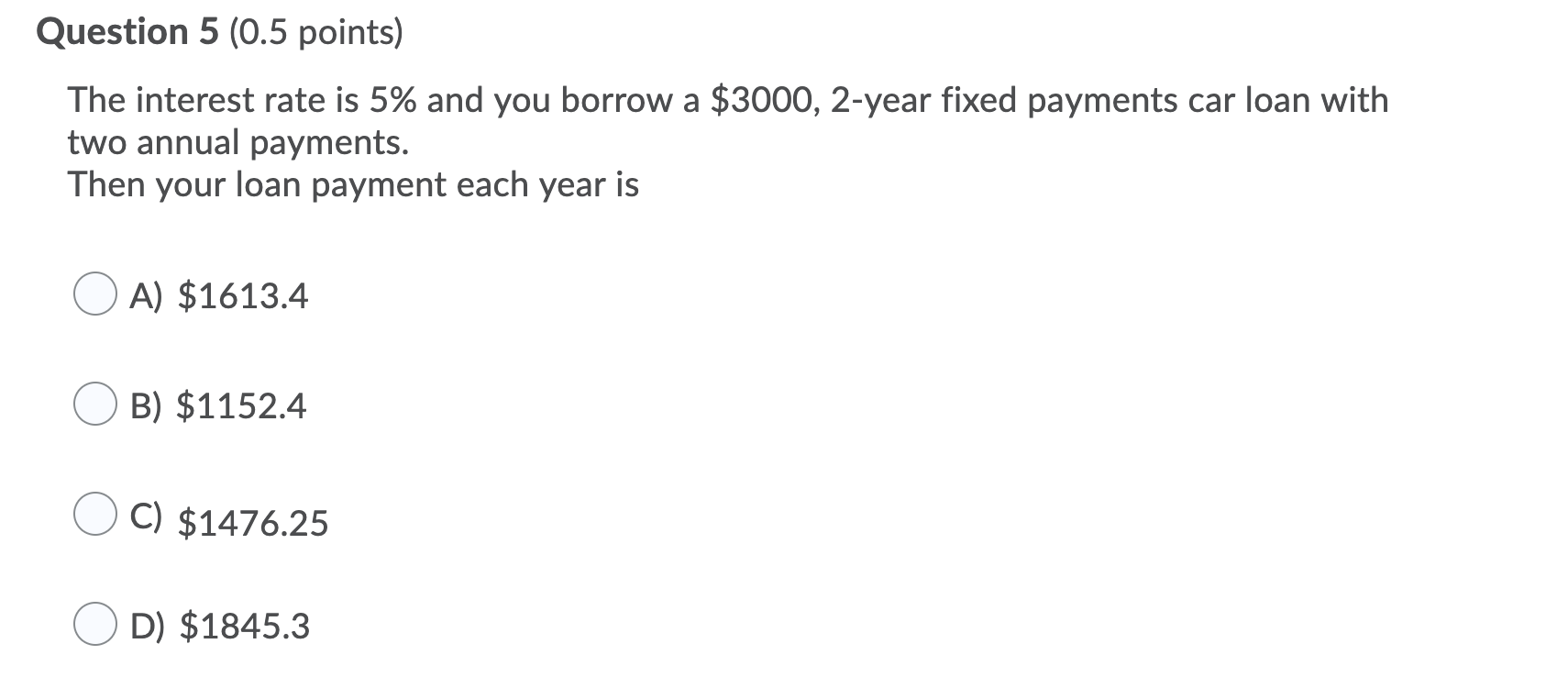

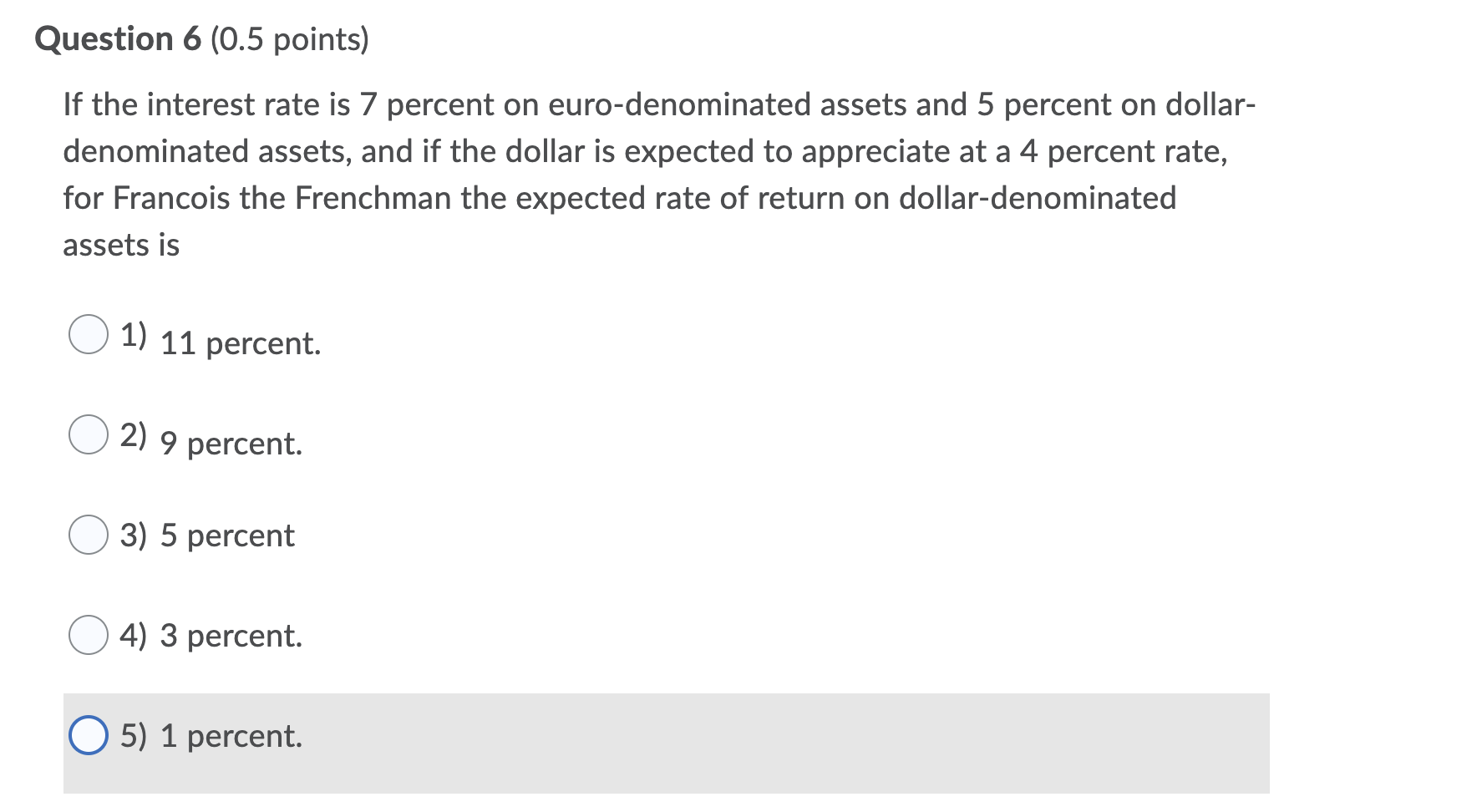

Question 2 (0.5 points) If a firm must pay for goods it has ordered with foreign currency, it can hedge its foreign exchange rate risk by O A) staying out of the exchange futures market. 0 '3) buying foreign exchange futures long. 0 Cl selling foreign exchange futures short. 0 Dl none of the above. Question 3 (0.5 points) According to the interest parity condition, if the domestic interest rate is 12 percent and the foreign interest rate is 10 percent, then the expected ________ of the foreign currency must be ________ percent. O 1) appreciation; 4 O 2) appreciation; 2 O 3) depreciation; 2 O 4) depreciation; 4 Question 4 (0.5 points) If you bought a long futures contract you hope that bond prices 0 1) rise. 0 2) fall. 0 3) are stable. 0 4) fluctuate. Question 5 (0.5 points) The interest rate is 5% and you borrow a $3000, 2-year fixed payments car loan with two annual payments. Then your loan payment each year is O A) $16134 O B) $11524 O C) $1476.25 O D) $18453 Question 6 (0.5 points) If the interest rate is 7 percent on eurodenominated assets and 5 percent on dollar denominated assets, and if the dollar is expected to appreciate at a 4 percent rate, for Francois the Frenchman the expected rate of return on dollar-denominated assets is O 1) 11 percent. 0 2) 9 percent. 0 3) 5 percent 0 4) 3 percent. 0 5) 1 percent

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts