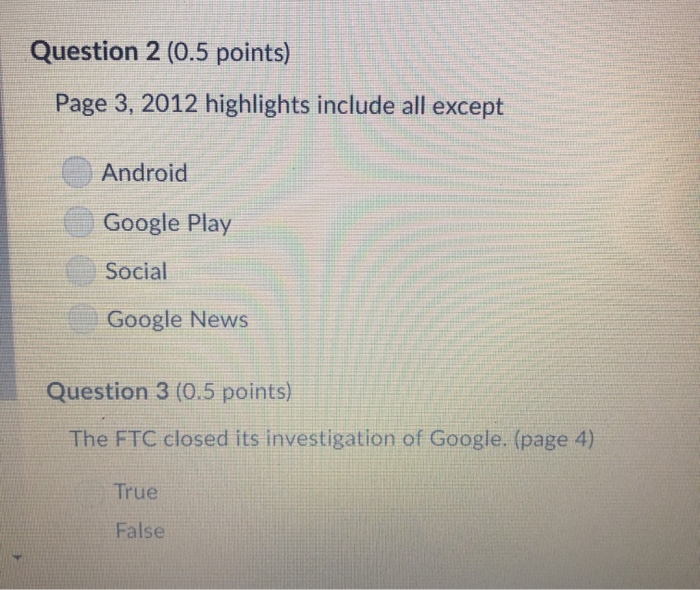

Question: Question 2 (0.5 points) Page 3, 2012 highlights include all except Android Google Play Social Google News Question 3 (0.5 points) The FTC closed its

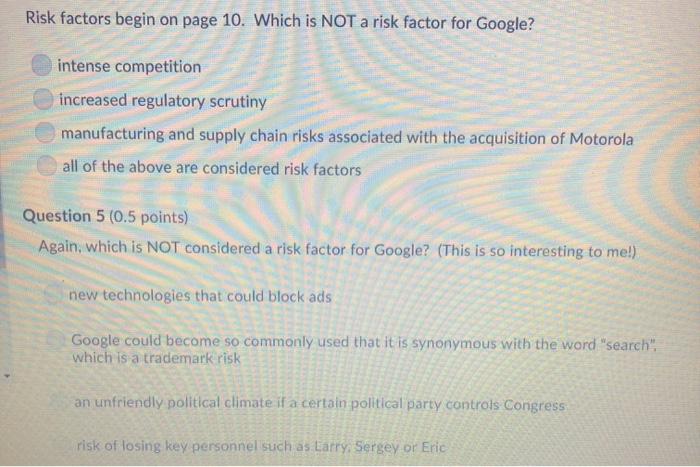

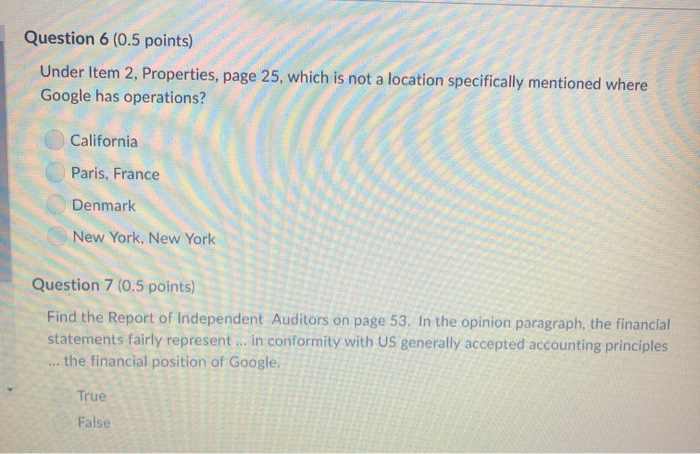

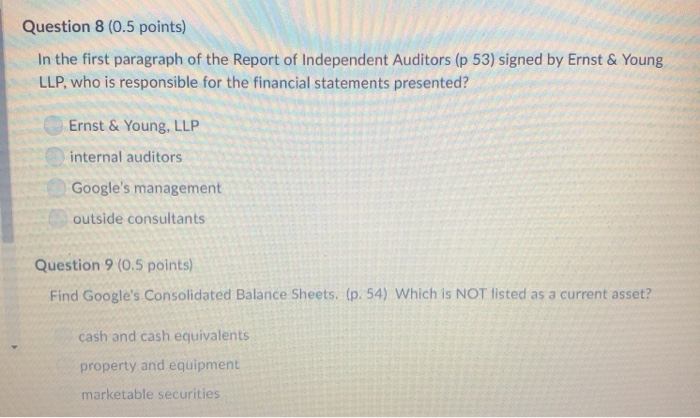

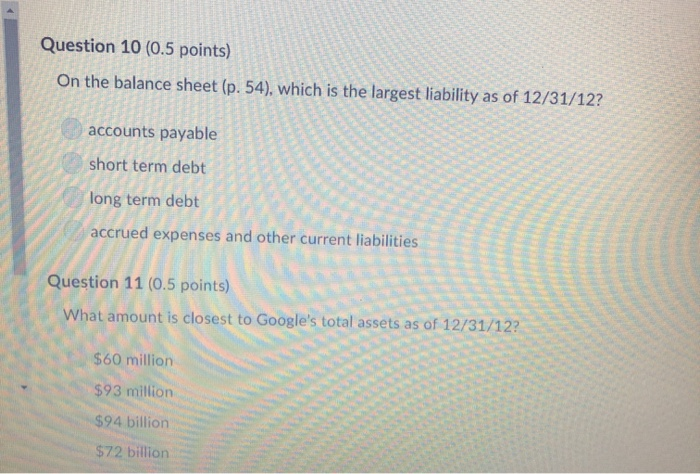

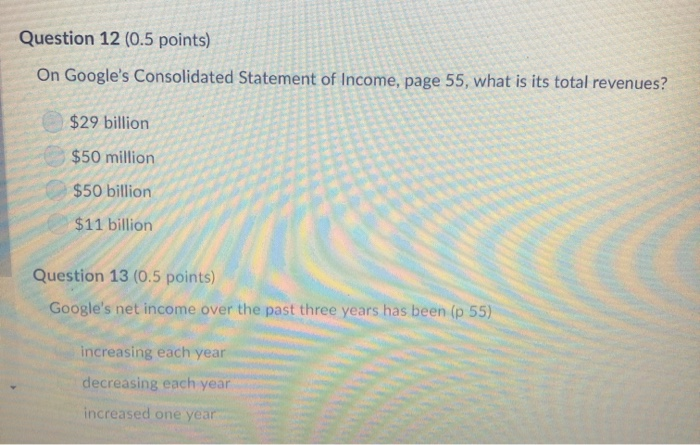

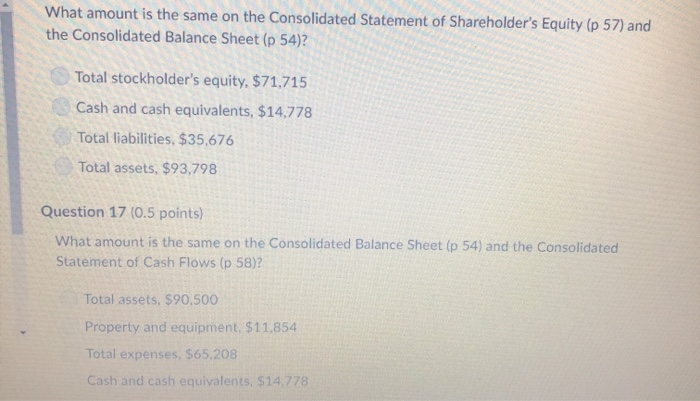

Question 2 (0.5 points) Page 3, 2012 highlights include all except Android Google Play Social Google News Question 3 (0.5 points) The FTC closed its investigation of Google. (page 4) True False Risk factors begin on page 10. Which is NOT a risk factor for Google? intense competition increased regulatory scrutiny manufacturing and supply chain risks associated with the acquisition of Motorola all of the above are considered risk factors Question 5 (0.5 points) Again, which is NOT considered a risk factor for Google? (This is so interesting to me!) new technologies that could block ads Google could become so commonly used that it is synonymous with the word "search" which is a trademark risk an unfriendly political climate if a certain political party controls Congress risk of losing key personnel such as Larry, Sergey or Eric Question 6 (0.5 points) Under Item 2, Properties, page 25, which is not a location specifically mentioned where Google has operations? California Paris, France Denmark New York, New York Question 7 (0.5 points) Find the Report of Independent Auditors on page 53. In the opinion paragraph, the financial statements fairly represent... in conformity with US generally accepted accounting principles the financial position of Google, ... True False Question 8 (0.5 points) In the first paragraph of the Report of Independent Auditors (p 53) signed by Ernst & Young LLP, who is responsible for the financial statements presented? Ernst & Young, LLP internal auditors Google's management outside consultants Question 9 (0.5 points) Find Google's Consolidated Balance Sheets. (p. 54) Which is NOT listed as a current asset? cash and cash equivalents property and equipment marketable securities Question 10 (0.5 points) On the balance sheet (p. 54), which is the largest liability as of 12/31/12? accounts payable short term debt long term debt accrued expenses and other current liabilities Question 11 (0.5 points) What amount is closest to Google's total assets as of 12/31/12? $60 million $93 million $94 billion $72 billion Question 12 (0.5 points) On Google's Consolidated Statement of Income, page 55, what is its total revenues? $29 billion $50 million $50 billion $11 billion Question 13 (0.5 points) Google's net income over the past three years has been (p 55) increasing each year decreasing each year increased one year What amount is the same on the Consolidated Statement of Shareholder's Equity (p 57) and the Consolidated Balance Sheet (p 54)? Total stockholder's equity, $71.715 Cash and cash equivalents, $14,778 Total liabilities, $35,676 Total assets, $93,798 Question 17 (0.5 points) What amount is the same on the Consolidated Balance Sheet (p 54) and the Consolidated Statement of Cash Flows (p 58)? Total assets, $90,500 Property and equipment, $11.854 Total expenses, $65,208 Cash and cash equivalents, $14,778 UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, DC. 20549 FORM 10-K (Mark One) C ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended December 31, 2012 OR TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 Commission file number 000-50726 Google Inc. (Exact name of registat as speofed in ts cha Delaware (State or ether jundon of incorperation or onganiaion) 77-0493581 URS Employer ldenfcation No) 1600 Amphitheatre Parkway Mountain View, CA 94043 (Address of prineipal eute ofices)p Code) (650) 253-0000 (Registrants teephone umb induding area oode Securities registered pursuant to Section 12(b) of the Act Name of each exchange on which egisteed Nasdag Stock Market LLC (Nasdaq Global Select Market) Tee ofeash dlass Class A Common Stock, $0 001 par value Securities registered pursuant to Section 12(g) of the Act T of ach ss Class B Common Stock, $0.001 par value Options to purchase Class A Common Stock Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act Indicate by check mark whether the registrant (1) has filed all reports required to be fled by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports) and (2) has been subject to such filng requirements for the past 90 days Indicate by check mark whether the registrant has submitted electronicalv.and posted on its corporate Webaite if an, every Interactive Data File required to be aubmited and posted pursuar No D Yes Yes No Yes No NOTE ABOUTFORWARDTOOKING STATEMENTS This Annual Report on Form 10-K contains forward-looking statements within the meaning of the Private Seaurities Litigation Reform Act of 1995 These statements include, among other things, statements regarding the growth of our business and revenues and our expectations about the factors that influence our success and trends in our business seasonal fluctuations in intenet usage and traditional retail seasonality, which are likely to cause Suctuations in our quarlerly results, our plans to continue to invest in systems, faciities, and infrastructure, to increase in our hiring and provide compettive compensation programs, as well as to continue our current pace of acquisitions the potenial for declines in our revenue growth rate our expectation that growth in advertising revenues from our websites will continue to exceed that from our Google Network Members' websites, which will have a positive impact on our operating margins our expectation that we will continue to pay most of the fees we recelve from advertisers to our Google Network Members our expectations about the impact of our acquisition of Motorala Mobility Holdings, Inc (Motorola) on our resuts and business and our ability to realze the expected benefits from the acquisition and successfully implement our plans and expectations for Motorola's business our expectation that we willl continue to take steps to improve the relevance of the ads we deliver and to reduce the number of accidental cicks fluctuations in aggregate pald clicks and average cost-per-click our belief that our foreign exchange risk management program will not fully offeet the exposure to uctuations in foreign currency exchange rates the increase of costs related to hedging activities under our foreign exchange risk management program our expectation that our cost of revenues, research and development expenses, sales and marketing expenses, and general and administrative expenses will increase in dollars and may increase as a percentage of revenues our potential exposure in connection with pending investigations and proceedings our expectations about our board of directors intention to declare a dividend of shares of the new Class C capital stock, as well as the timing of that dividend, declared and paid our expectation that our traffic acquisition costs will fuctuate in the future our continued investments in international markets estimates of our future compensation expenses fluctuations in our effectiive tax rate the sufficiency of our sources of funding our payment terms to certain advertisers, which may increase our working capital requirements fuctuations in our capital expenditures our expectations about the timing of disposition of the Home business as well as other statements regarding our future operasions, financial condition and prospects and business strategles Forward-looking statements may appear throughout this report, including without Table of Contents following sections: tem 1 "Business Item 1A "Risk Factors. and tom 7 "Managements Dcnsion and Analysis of Financial Condtion and Resuts of Operations Forward locking statements generally can be identified by words such as "anticipates, beleves, "estimates,"expects, "intends"plans,"predicts "projects,will be "will continu, wll kely result and sims These forward-looking statements are based on curent expectations and assumptions that are subject to risks and uncertainties, which could cause our actual results to difer materialy ions reflected in the forward-looking statements. Factors that could cause or contribute to such differences include, but are not limited to, those discussed in this Annual Report on Form 10 K, and particular, the risks discussed under the caption "Risk Factors in Item 1A and those discussed in other documents we ile with the Securities and Exchange Commission (SEC) We undertake no obligation to revise or publicly release the results of any revision to these forward looking statements, except as required by law Given these risks and uncertainties, readers are cautioned not to place undue reliance on such forward-looking statements As used herein, "Google, we, "our and similar terms include Google Inc and its subsidiaries, unless the context indicates otherwise "Google" and other trademarks of ours appearing in this report are our property. This report contains additional trade names and trademarks of other companies. We do not intend our use or display of other companies' trade names or trademarks to imply an endorsement or sponsorship of us by such companies, or any relationship with any of these companies 2

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts