Question: can you please answer first 3 thank you each payment thereafter. e. Both C and D are correct. 22 increase by cause of the Kyle's

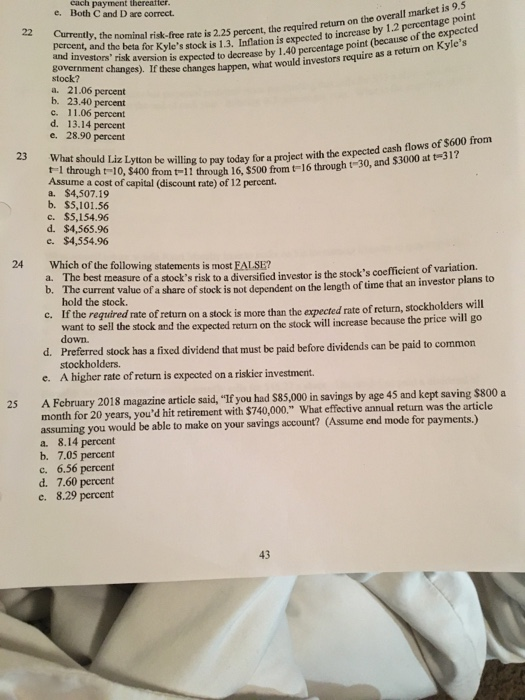

each payment thereafter. e. Both C and D are correct. 22 increase by cause of the Kyle's Currently, the nominal risk-free rate is 2.2 percent, and the beta for Kyle's stock is 1.3. Int and investors' risk aversion is expected to risk-free rate is 2.25 percent the required return on the overall market is 9.5 for Kyle's stock is 1.3. Inflation is expected to increase by 1.2 percentage porn ension is expected to decrease by 1.40 percentage point (because of the expecte ment changes). If these changes happen, what would investors require as a uld investors require as a return on Kyle's stock? a. 21.06 percent b. 23.40 percent c. 11.06 percent d. 13.14 percent e. 28.90 percent on be willing to pay today for a project with the expected cash flows of $600 from gh 16, S500 from t-16 through t30, and $3000 at t-31? What should Liz Lytton be willing to pay today for a project Fl through t-10, $400 from t-11 through 16, $500 from t-16 through t 30, and Assume a cost of capital (discount rate) of 12 percent. a. $4,507.19 b. $5,101.56 c. $5,154.96 d. $4,565.96 e. $4,554.96 24 Which of the following statements is most FALSE? a. The best measure of a stock's risk to a diversified investor is the stock's coefficient of variation. b. The current value of a share of stock is not dependent on the length of time that an investor plans to hold the stock. c. If the required rate of return on a stock is more than the expected rate of return, stockholders will want to sell the stock and the expected return on the stock will increase because the price will go down. d. Preferred stock has a fixed dividend that must be paid before dividends can be paid to common stockholders. e. A higher rate of return is expected on a riskier investment. 25 A February 2018 magazine article said, "If you had $85.000 in savings by age 45 and kept saving $800 a month for 20 years, you'd hit retirement with $740,000." What effective annual return was the article assuming you would be able to make on your savings account? (Assume end mode for payments.) a. 8.14 percent b. 7.05 percent c. 6.56 percent d. 7.60 percent e. 8.29 percent

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts