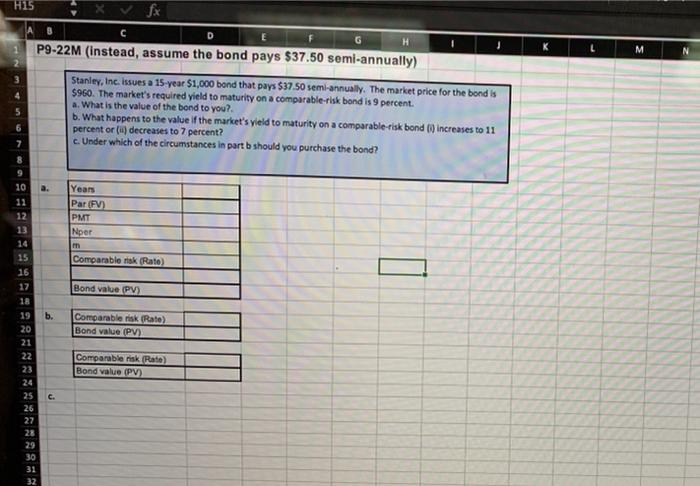

Question: can you please break this problem down and show me how to do it :) thanks H15 8 C D G H P9-22M (Instead, assume

H15 8 C D G H P9-22M (Instead, assume the bond pays $37.50 semi-annually) M N Stanley, Inc. issues a 15-year $1,000 bond that pays $37.50 semi-annually. The market price for the bond is $960. The market's required yield to maturity on a comparable-risk bond is 9 percent a. What is the value of the bond to you? b. What happens to the value of the market's yield to maturity on a comparable-risk bond(increases to 11 percent or() decreases to 7 percent? c. Under which of the circumstances in part b should you purchase the bond? 10 Years Par (FV) PMT Nper 12 13 15 16 Comparable risk (Rato) Bond value (PV) b. Comparable risk (Rate) Bond value (PV) Comparable risk. (Rate) Bond value (PV) 19 20 21 22 23 24 25 26 27 28 29 30 31 32 C

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts