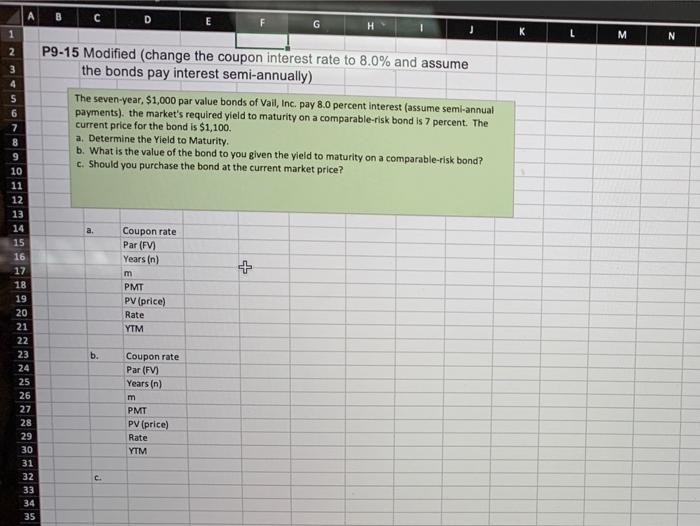

Question: can you please break this problem down and show me how to do it :) thanks A B C D E G 1 M N

A B C D E G 1 M N 3 von N P9-15 Modified (change the coupon interest rate to 8.0% and assume the bonds pay interest semi-annually) The seven-year. $1,000 par value bonds of Vall, Inc. pay 8.0 percent interest (assume semi-annual payments), the market's required yield to maturity on a comparable-risk bond is 7 percent. The current price for the bond is $1,100. a. Determine the Yield to Maturity. b. What is the value of the bond to you given the yield to maturity on a comparable-risk bond? c. Should you purchase the bond at the current market price? + 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 Coupon rate Par (FV) Years (n) m PMT PV (price) Rate YTM b. Coupon rate Par (FV) Years (n) m PMT PV (price) Rate YTM

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts