Question: can you please break this problem down and show me how to do it :) thanks 2 P9-13 Modified (Change the bond interest rate to

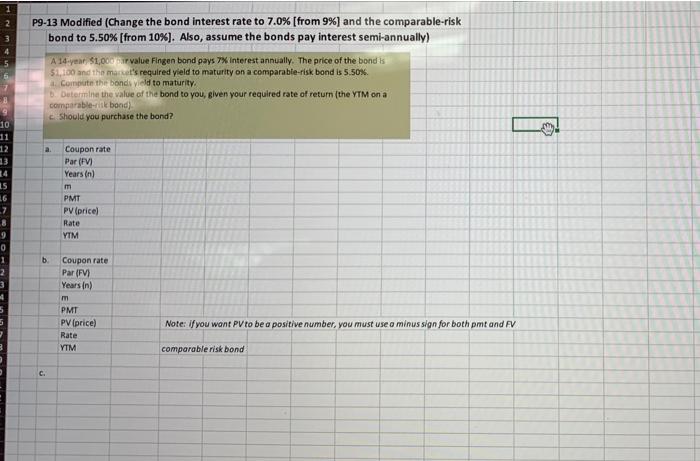

2 P9-13 Modified (Change the bond interest rate to 7.0% [from 9%) and the comparable-risk bond to 5.50% [from 10%). Also, assume the bonds pay interest semi-annually) A 14-year $1,000 ar value Fingen bond pays 7% interest annually. The price of the bond is S100 and the market's required yield to maturity on a comparable-risk bond is 5.50% Compute the bonds Vield to maturity. D. Dutermine the value of the bond to you, given your required rate of return (the YTM on a comparable-riik bond) Should you purchase the bond? 10 11 12 a 15 16 7 8 9 0 1 2 3 Coupon rate Par (PV) Years (n) m PMT PV (price) Rate YTM b Coupon rate Par (FV) Years in) PMT PV (price) Rate YTM Note: if you want PV to be a positive number, you must use a minus sign for both pit and FV comparable risk bond C

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts