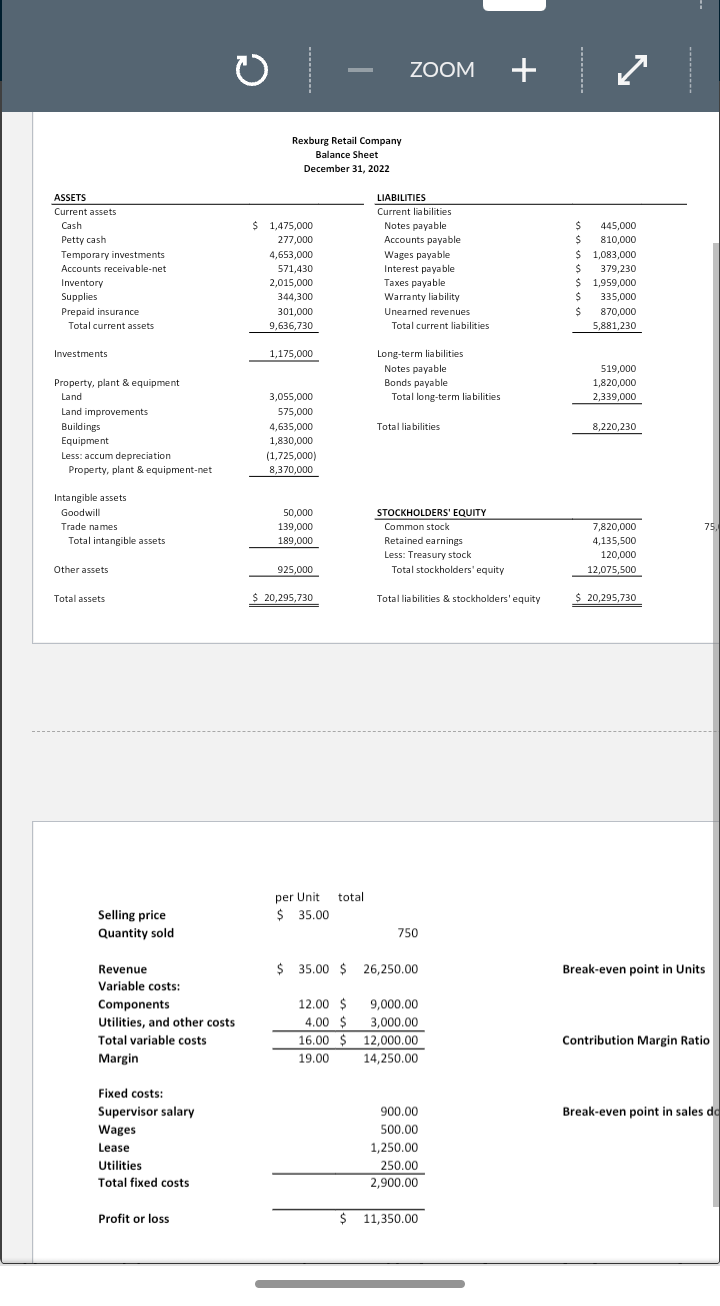

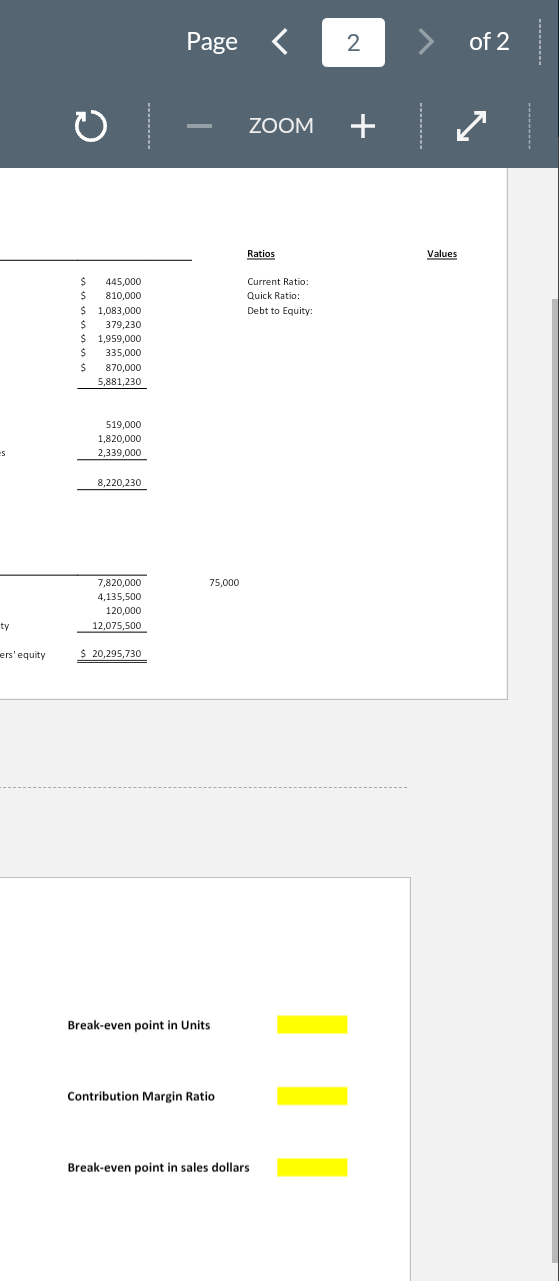

Question: Can you please find 1. current ratio 2. quick ratio 3. Debt to equity 4. Break even point in units 5. contribution margin ratio 6.

Can you please find 1. current ratio 2. quick ratio 3. Debt to equity 4. Break even point in units 5. contribution margin ratio 6. Break even point in sales dollars

ASSETS Current assets Cash Petty cash Temporary investments Accounts receivable-net Inventory Supplies Prepaid insurance Total current assets Investments Property, plant & equipment Land Land improvements Buildings Equipment Less: accum depreciation Property, plant & equipment-net Intangible assets Goodwill Trade names Total intangible assets Other assets Total assets O Selling price Quantity sold Revenue Variable costs: Components Utilities, and other costs Total variable costs Margin Fixed costs: Supervisor salary Wages Lease Utilities Total fixed costs Profit or loss Rexburg Retail Company Balance Sheet December 31, 2022 $ 1,475,000 277,000 4,653,000 571,430 2.015,000 344,300 301,000 9,636,730 1,175,000 3,055,000 575,000 4,635,000 1,830,000 (1,725,000) 8,370,000 50,000 139,000 189,000 925,000 $ 20,295,730 ZOOM LIABILITIES Current liabilities Notes payable Accounts payable Wages payable Interest payable Taxes payable Warranty liability Unearned revenues Total current liabilities Long-term liabilities Notes payable Bonds payable Total long-term liabilities + Total liabilities STOCKHOLDERS' EQUITY Common stock Retained earnings Less: Treasury stock Total stockholders' equity Total liabilities & stockholders' equity total per Unit $35.00 750 $ 35.00 $ 26,250.00 12.00 $ 9,000.00 4.00 $ 3,000.00 16.00 $ 12,000.00 19.00 14,250.00 900.00 500.00 1,250.00 250.00 2,900.00 $ 11,350.00 $ 445,000 $ 810,000 $ 1,083,000 $ 379,230 $ 1,959,000 $ 335,000 $ 870,000 5,881,230 519,000 1,820,000 2,339,000 8,220,230 7,820,000 4,135,500 120,000 12,075,500 $ 20,295,730 Break-even point in Units Contribution Margin Ratio Break-even point in sales do 75, +5 ty ers' equity C Page

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts