Question: Can you please help how to do the FV allocation only for this problem On January 1, 2014, King Company acquired an 80% interest in

Can you please help how to do the FV allocation only for this problem

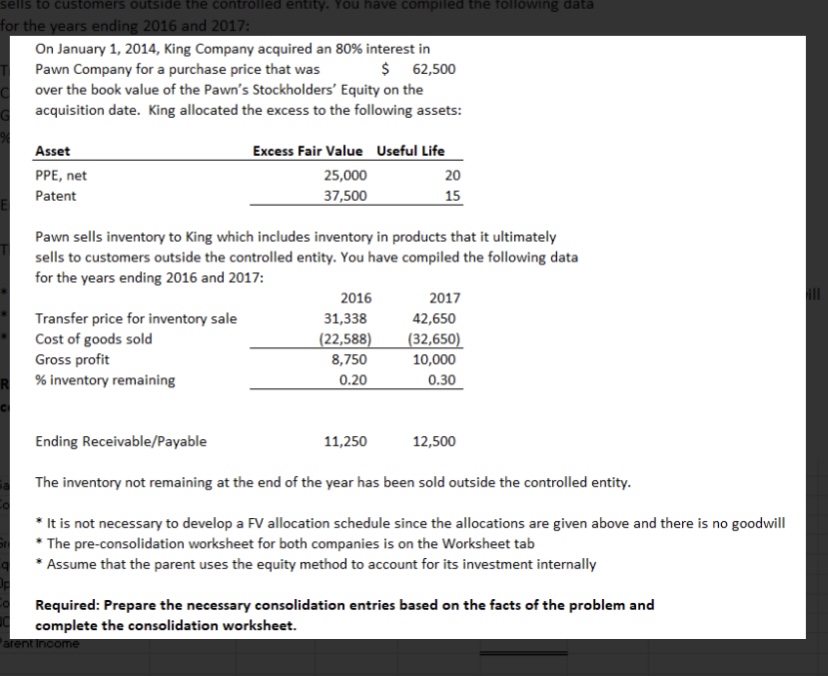

On January 1, 2014, King Company acquired an 80% interest in Pawn Company for a purchase price that was 5 62,500 over the book value of the Pawn's Stockholders' Equity on the acquisition date. King allocated the excess to the following assets: Asset Excess Fair Value Useful Life PPE, net 25,000 20 Patent 37,500 15 Pawn sells inventory to King which includes inventory in products that it ultimately sells to customers outside the controlled entity. You have compiled the following data for the years ending 2016 and 2017: 2016 2017 Transfer price for inventory sale 31,338 42,650 Cost of goods sold (22,588) (32,650) Gross profit 8,750 10,000 % inventory remaining 0.20 0.30 Ending Receivable/Payable 11,250 12,500 The inventory not remaining at the end of the year has been sold outside the controlled entity. * It is not necessary to develop a FV allocation schedule since the allocations are given above and there is no goodwill * The pre-consolidation worksheet for both companies is on the Worksheet tab * Assume that the parent uses the equity method to account for its investment internally Required: Prepare the necessary consolidation entries based on the facts of the problem and complete the consolidation worksheet

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts