Question: Can you please make me a recommendation for this case study motion in money? no solving please just straight to the point to the recommendation

Can you please make me a recommendation for this case study motion in money? no solving please just straight to the point to the recommendation and if your going to relate it into a articles put the link :> thankyou

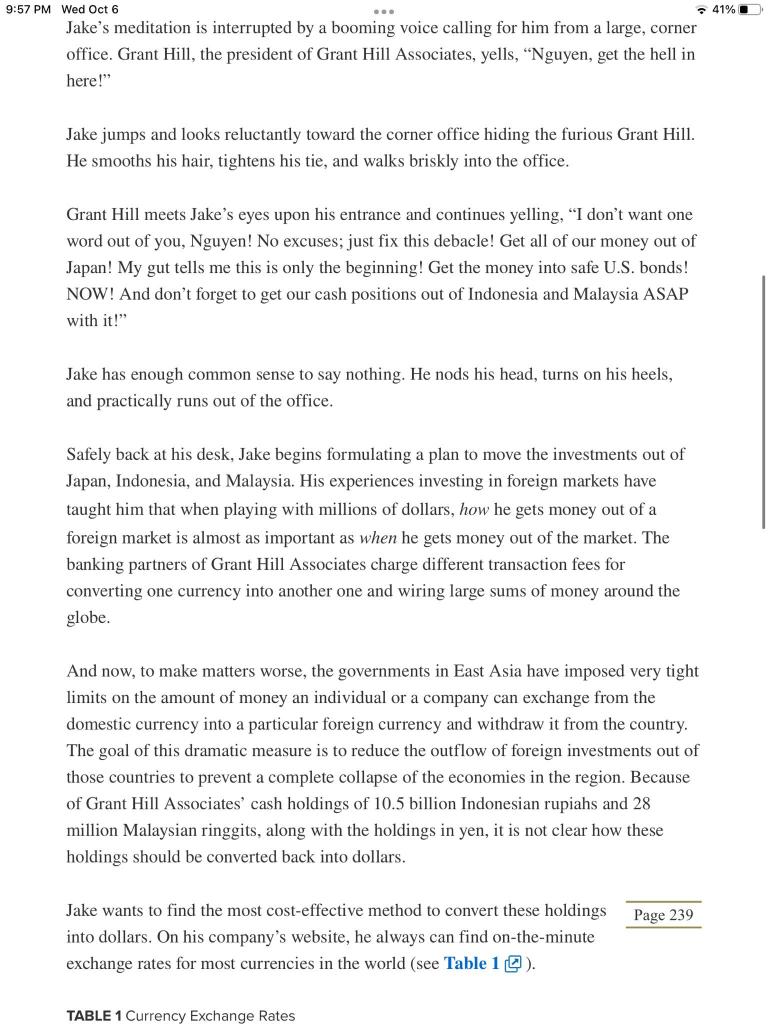

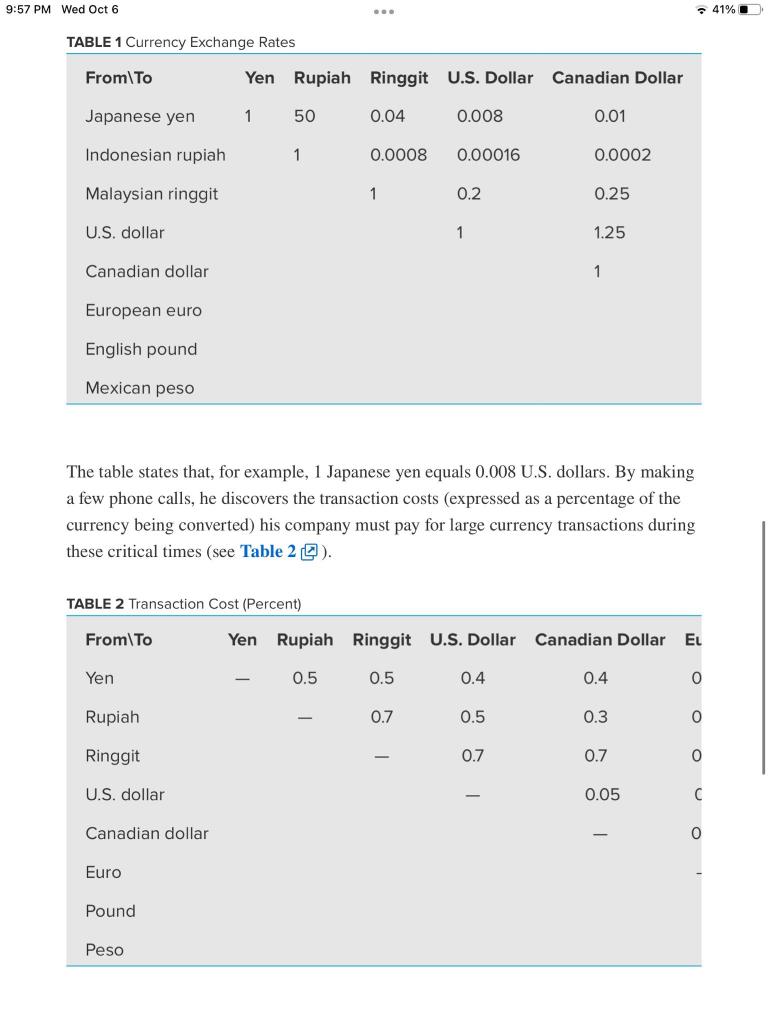

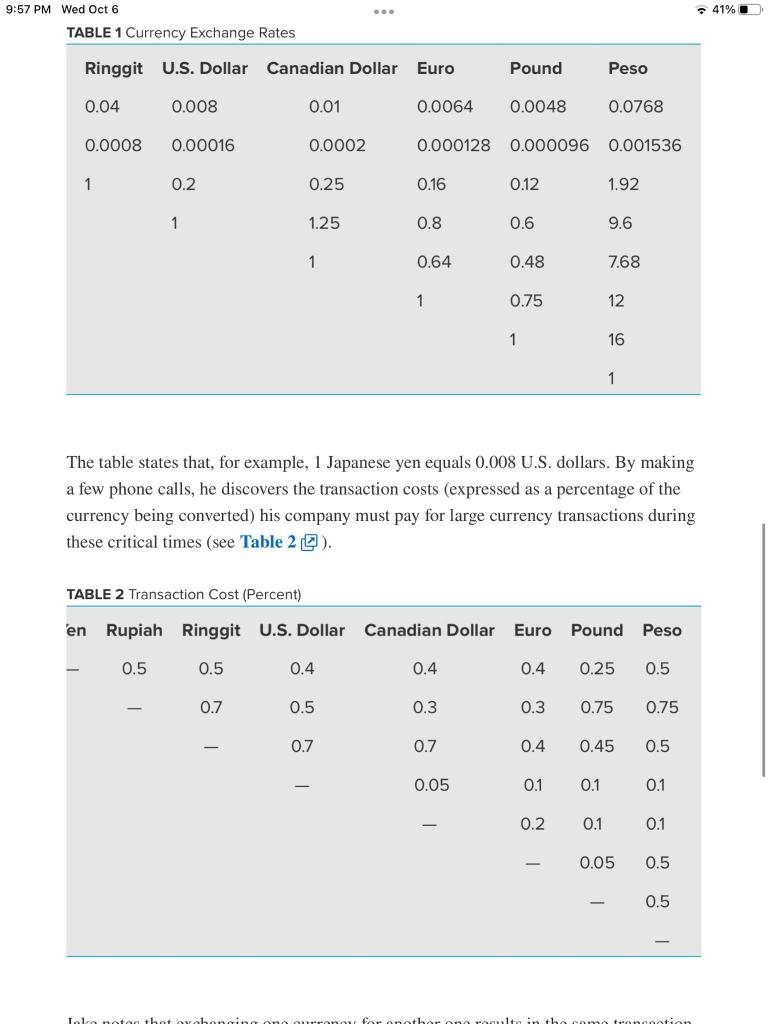

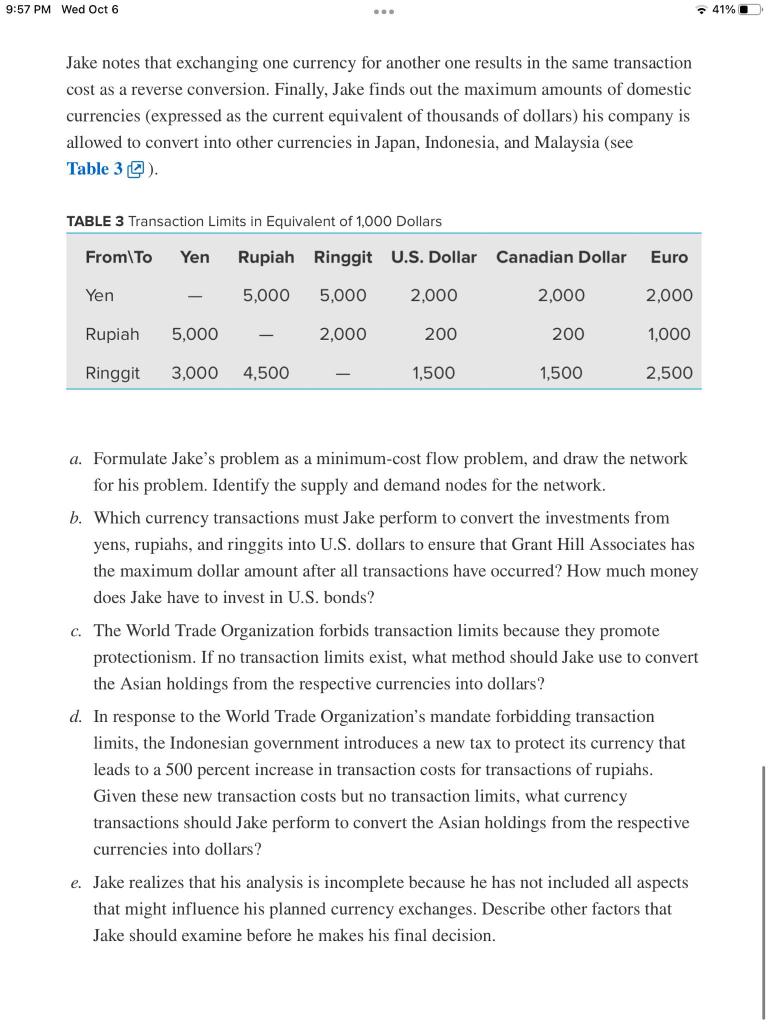

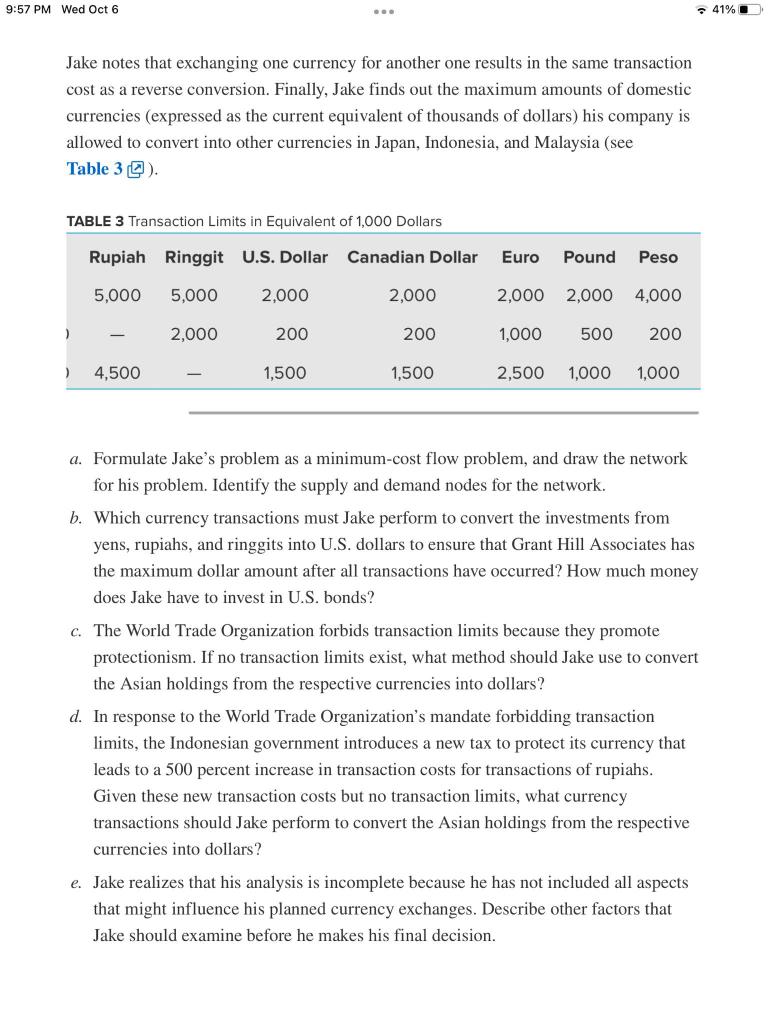

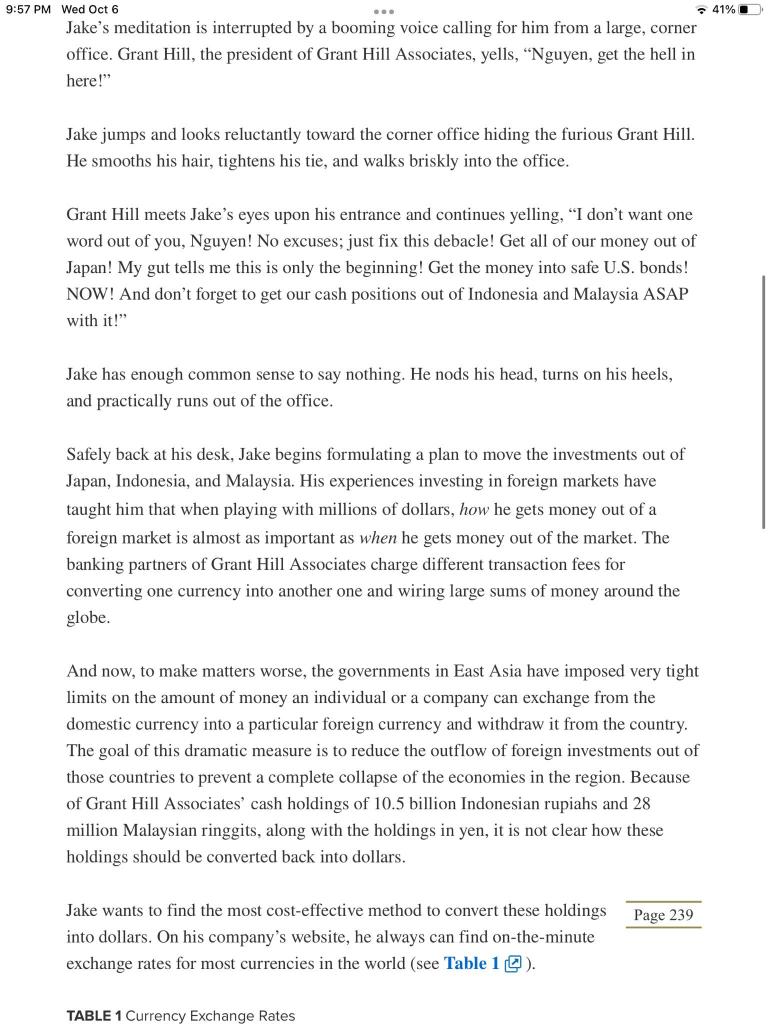

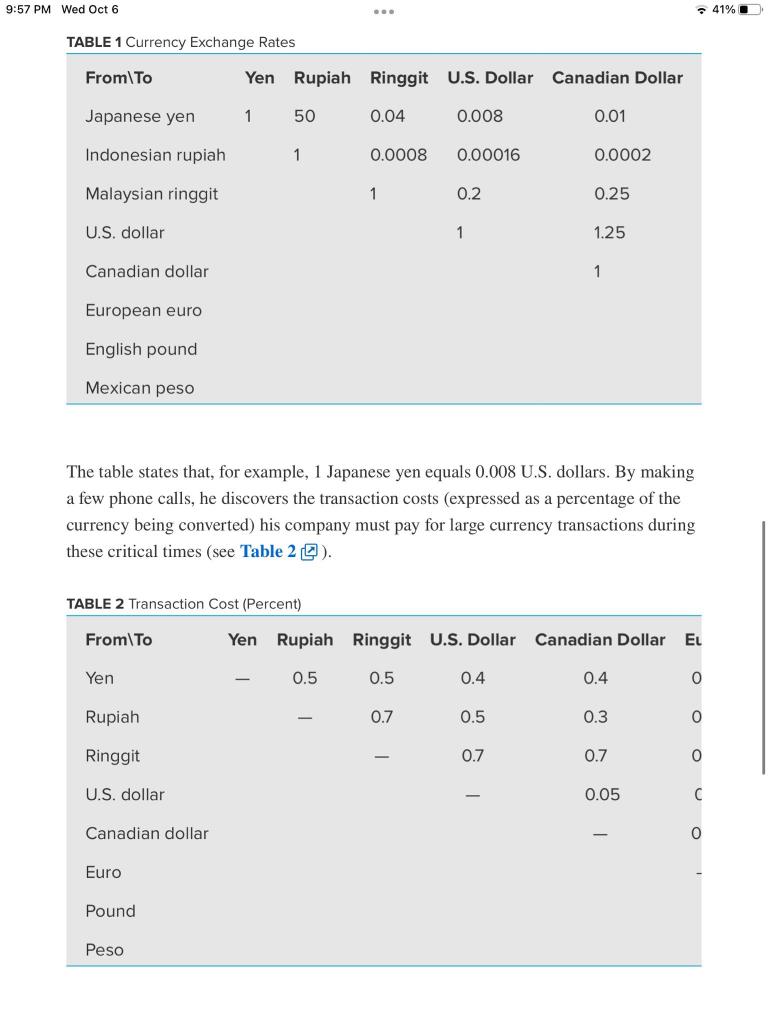

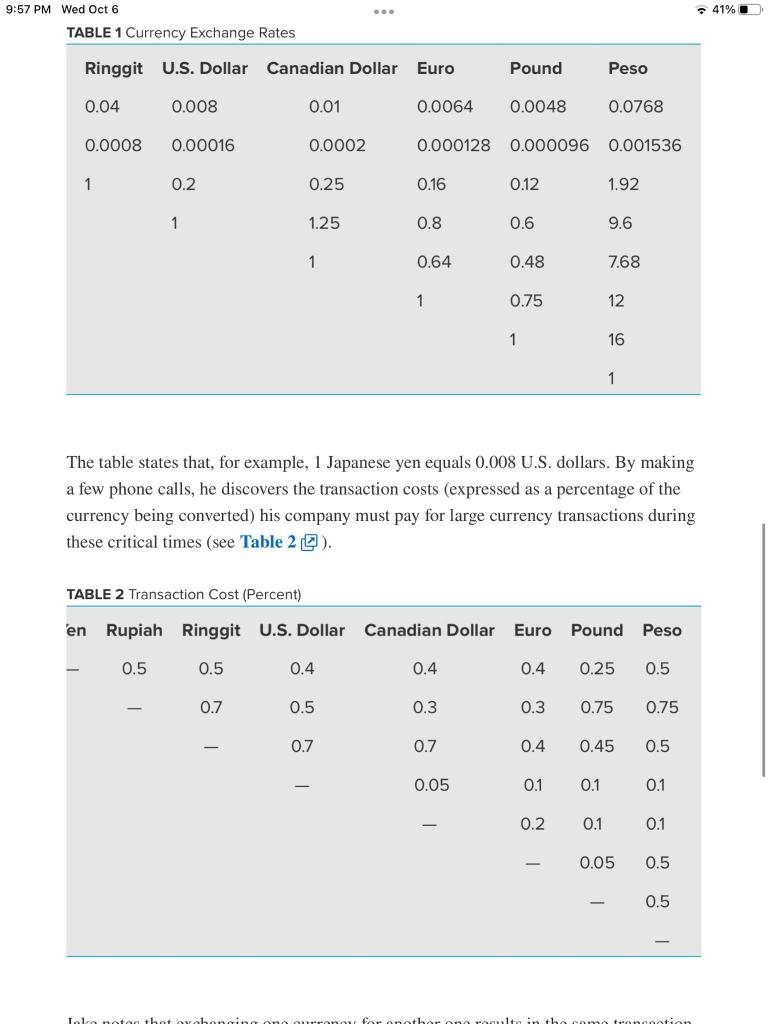

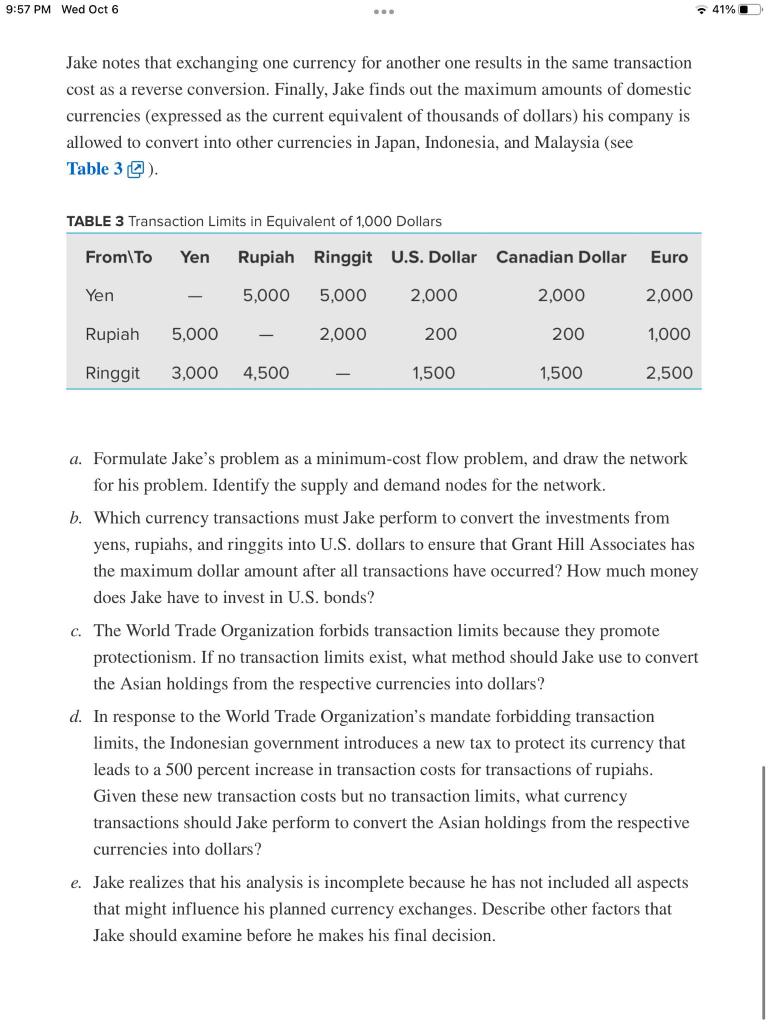

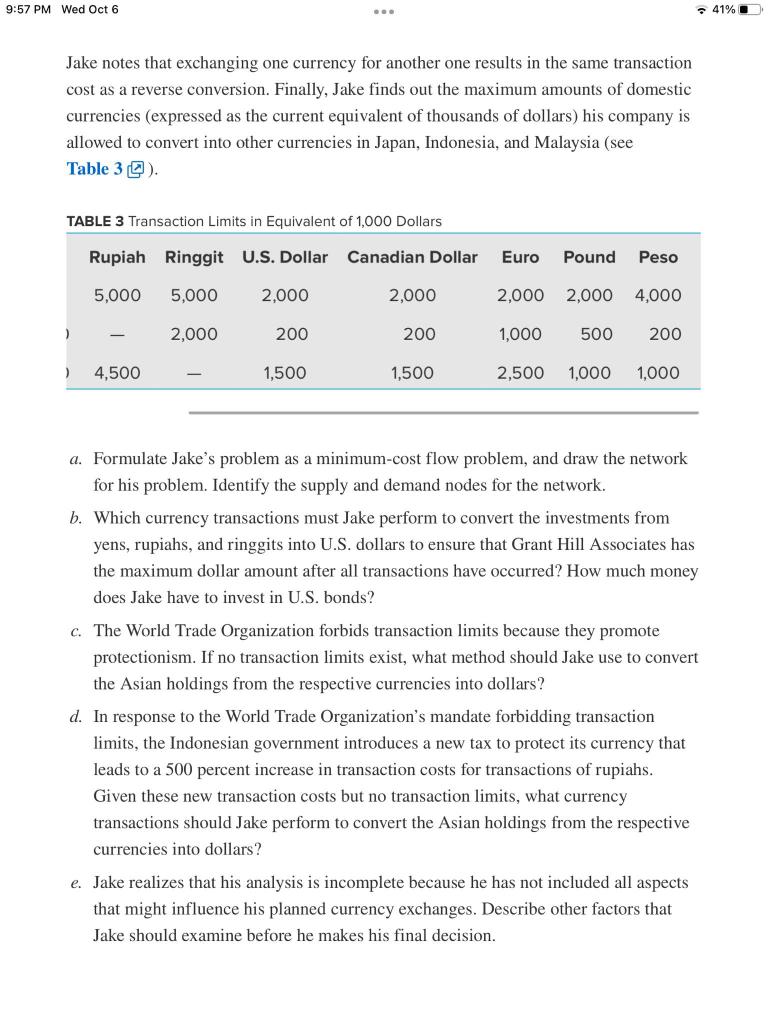

wa 41% 9:57 PM Wed Oct 6 Jake's meditation is interrupted by a booming voice calling for him from a large, corner office. Grant Hill, the president of Grant Hill Associates, yells, Nguyen, get the hell in here!" Jake jumps and looks reluctantly toward the corner office hiding the furious Grant Hill. He smooths his hair, tightens his tie, and walks briskly into the office. Grant Hill meets Jake's eyes upon his entrance and continues yelling, I don't want one word out of you, Nguyen! No excuses; just fix this debacle! Get all of our money out of Japan! My gut tells me this is only the beginning! Get the money into safe U.S. bonds! NOW! And don't forget to get our cash positions out of Indonesia and Malaysia ASAP with it!" Jake has enough common sense to say nothing. He nods his head, turns on his heels, and practically runs out of the office. Safely back at his desk, Jake begins formulating a plan to move the investments out of Japan, Indonesia, and Malaysia. His experiences investing in foreign markets have taught him that when playing with millions of dollars, how he gets money out of a foreign market is almost as important as when he gets money out of the market. The banking partners of Grant Hill Associates charge different transaction fees for converting one currency into another one and wiring large sums of money around the globe. And now, to make matters worse, the governments in East Asia have imposed very tight limits on the amount of money an individual or a company can exchange from the domestic currency into a particular foreign currency and withdraw it from the country. The goal of this dramatic measure is to reduce the outflow of foreign investments out of those countries to prevent a complete collapse of the economies in the region. Because of Grant Hill Associates' cash holdings of 10.5 billion Indonesian rupiahs and 28 million Malaysian ringgits, along with the holdings in yen, it is not clear how these holdings should be converted back into dollars. Page 239 Jake wants to find the most cost-effective method to convert these holdings into dollars. On his company's website, he always can find on-the-minute exchange rates for most currencies in the world (see Table 1). TABLE 1 Currency Exchange Rates 9:57 PM Wed Oct 6 41% 41% TABLE 1 Currency Exchange Rates From\To Yen Rupiah Ringgit U.S. Dollar Canadian Dollar Japanese yen 1 50 0.04 0.008 0.01 Indonesian rupiah 1 0.0008 0.00016 0.0002 Malaysian ringgit 1 0.2 0.25 U.S. dollar 1 1.25 Canadian dollar 1 European euro English pound Mexican peso The table states that, for example, 1 Japanese yen equals 0.008 U.S. dollars. By making a few phone calls, he discovers the transaction costs (expressed as a percentage of the currency being converted) his company must pay for large currency transactions during these critical times (see Table 2). TABLE 2 Transaction Cost (Percent) From\To Yen Rupiah Ringgit U.S. Dollar Canadian Dollar EL Yen 0.5 0.5 0.4 0.4 0 Rupiah 0.7 0.5 0.3 0 Ringgit 0.7 0.7 0 U.S. dollar 0.05 C Canadian dollar 0 Euro Pound Peso 9:57 PM Wed Oct 6 TABLE 1 Currency Exchange Rates ... = 41% 41% Ringgit U.S. Dollar Canadian Dollar Euro Pound Peso 0.04 0.008 0.01 0.0064 0.0048 0.0768 0.0008 0.00016 0.0002 0.000128 0.000096 0.001536 1 0.2 0.25 0.16 0.12 1.92 1 1.25 0.8 0.6 9.6 1 0.64 0.48 7.68 1 0.75 12 1 16 1 The table states that, for example, 1 Japanese yen equals 0.008 U.S. dollars. By making a few phone calls, he discovers the transaction costs (expressed as a percentage of the currency being converted) his company must pay for large currency transactions during these critical times (see Table 2 ). TABLE 2 Transaction Cost (Percent) en Rupiah Ringgit U.S. Dollar Canadian Dollar Euro Pound Peso - 0.5 0.5 0.4 0.4 0.4 0.25 0.5 0.7 0.5 0.3 0.3 0.75 0.75 - 0.7 0.7 0.4 0.45 0.5 0.05 0.1 0.1 0.1 - 0.2 0.1 0.1 0.05 0.5 0.5 Lola ta thot Alte tatia 9:57 PM Wed Oct 6 = 41% 41% Jake notes that exchanging one currency for another one results in the same transaction cost as a reverse conversion. Finally, Jake finds out the maximum amounts of domestic currencies (expressed as the current equivalent of thousands of dollars) his company is allowed to convert into other currencies in Japan, Indonesia, and Malaysia (see Table 3). TABLE 3 Transaction Limits in Equivalent of 1,000 Dollars From\To Yen Rupiah Ringgit U.S. Dollar Canadian Dollar Euro Yen 5,000 5,000 2,000 2,000 2,000 Rupiah 5,000 2,000 200 200 1,000 Ringgit 3,000 4,500 1,500 1,500 2,500 a. Formulate Jake's problem as a minimum-cost flow problem, and draw the network for his problem. Identify the supply and demand nodes for the network. b. Which currency transactions must Jake perform to convert the investments from yens, rupiahs, and ringgits into U.S. dollars to ensure that Grant Hill Associates has the maximum dollar amount after all transactions have occurred? How much money does Jake have to invest in U.S. bonds? c. The World Trade Organization forbids transaction limits because they promote protectionism. If no transaction limits exist, what method should Jake use to convert the Asian holdings from the respective currencies into dollars? d. In response to the World Trade Organization's mandate forbidding transaction limits, the Indonesian government introduces a new tax to protect its currency that leads to a 500 percent increase in transaction costs for transactions of rupiahs. Given these new transaction costs but no transaction limits, what currency transactions should Jake perform to convert the Asian holdings from the respective currencies into dollars? e. Jake realizes that his analysis is incomplete because he has not included all aspects that might influence his planned currency exchanges. Describe other factors that Jake should examine before he makes his final decision. 9:57 PM Wed Oct 6 = 41% 41% Jake notes that exchanging one currency for another one results in the same transaction cost as a reverse conversion. Finally, Jake finds out the maximum amounts of domestic currencies (expressed as the current equivalent of thousands of dollars) his company is allowed to convert into other currencies in Japan, Indonesia, and Malaysia (see Table 3). TABLE 3 Transaction Limits in Equivalent of 1,000 Dollars Rupiah Ringgit U.S. Dollar Canadian Dollar Euro Pound Peso 5,000 5,000 2,000 2,000 2,000 2,000 4,000 ) - 2,000 200 200 1,000 500 200 ) 4,500 1,500 1,500 2,500 1,000 1,000 a. Formulate Jake's problem as a minimum-cost flow problem, and draw the network for his problem. Identify the supply and demand nodes for the network. b. Which currency transactions must Jake perform to convert the investments from yens, rupiahs, and ringgits into U.S. dollars to ensure that Grant Hill Associates has the maximum dollar amount after all transactions have occurred? How much money does Jake have to invest in U.S. bonds? c. The World Trade Organization forbids transaction limits because they promote protectionism. If no transaction limits exist, what method should Jake use to convert the Asian holdings from the respective currencies into dollars? d. In response to the World Trade Organization's mandate forbidding transaction limits, the Indonesian government introduces a new tax to protect its currency that leads to a 500 percent increase in transaction costs for transactions of rupiahs. Given these new transaction costs but no transaction limits, what currency transactions should Jake perform to convert the Asian holdings from the respective currencies into dollars? e. Jake realizes that his analysis is incomplete because he has not included all aspects that might influence his planned currency exchanges. Describe other factors that Jake should examine before he makes his final decision. wa 41% 9:57 PM Wed Oct 6 Jake's meditation is interrupted by a booming voice calling for him from a large, corner office. Grant Hill, the president of Grant Hill Associates, yells, Nguyen, get the hell in here!" Jake jumps and looks reluctantly toward the corner office hiding the furious Grant Hill. He smooths his hair, tightens his tie, and walks briskly into the office. Grant Hill meets Jake's eyes upon his entrance and continues yelling, I don't want one word out of you, Nguyen! No excuses; just fix this debacle! Get all of our money out of Japan! My gut tells me this is only the beginning! Get the money into safe U.S. bonds! NOW! And don't forget to get our cash positions out of Indonesia and Malaysia ASAP with it!" Jake has enough common sense to say nothing. He nods his head, turns on his heels, and practically runs out of the office. Safely back at his desk, Jake begins formulating a plan to move the investments out of Japan, Indonesia, and Malaysia. His experiences investing in foreign markets have taught him that when playing with millions of dollars, how he gets money out of a foreign market is almost as important as when he gets money out of the market. The banking partners of Grant Hill Associates charge different transaction fees for converting one currency into another one and wiring large sums of money around the globe. And now, to make matters worse, the governments in East Asia have imposed very tight limits on the amount of money an individual or a company can exchange from the domestic currency into a particular foreign currency and withdraw it from the country. The goal of this dramatic measure is to reduce the outflow of foreign investments out of those countries to prevent a complete collapse of the economies in the region. Because of Grant Hill Associates' cash holdings of 10.5 billion Indonesian rupiahs and 28 million Malaysian ringgits, along with the holdings in yen, it is not clear how these holdings should be converted back into dollars. Page 239 Jake wants to find the most cost-effective method to convert these holdings into dollars. On his company's website, he always can find on-the-minute exchange rates for most currencies in the world (see Table 1). TABLE 1 Currency Exchange Rates 9:57 PM Wed Oct 6 41% 41% TABLE 1 Currency Exchange Rates From\To Yen Rupiah Ringgit U.S. Dollar Canadian Dollar Japanese yen 1 50 0.04 0.008 0.01 Indonesian rupiah 1 0.0008 0.00016 0.0002 Malaysian ringgit 1 0.2 0.25 U.S. dollar 1 1.25 Canadian dollar 1 European euro English pound Mexican peso The table states that, for example, 1 Japanese yen equals 0.008 U.S. dollars. By making a few phone calls, he discovers the transaction costs (expressed as a percentage of the currency being converted) his company must pay for large currency transactions during these critical times (see Table 2). TABLE 2 Transaction Cost (Percent) From\To Yen Rupiah Ringgit U.S. Dollar Canadian Dollar EL Yen 0.5 0.5 0.4 0.4 0 Rupiah 0.7 0.5 0.3 0 Ringgit 0.7 0.7 0 U.S. dollar 0.05 C Canadian dollar 0 Euro Pound Peso 9:57 PM Wed Oct 6 TABLE 1 Currency Exchange Rates ... = 41% 41% Ringgit U.S. Dollar Canadian Dollar Euro Pound Peso 0.04 0.008 0.01 0.0064 0.0048 0.0768 0.0008 0.00016 0.0002 0.000128 0.000096 0.001536 1 0.2 0.25 0.16 0.12 1.92 1 1.25 0.8 0.6 9.6 1 0.64 0.48 7.68 1 0.75 12 1 16 1 The table states that, for example, 1 Japanese yen equals 0.008 U.S. dollars. By making a few phone calls, he discovers the transaction costs (expressed as a percentage of the currency being converted) his company must pay for large currency transactions during these critical times (see Table 2 ). TABLE 2 Transaction Cost (Percent) en Rupiah Ringgit U.S. Dollar Canadian Dollar Euro Pound Peso - 0.5 0.5 0.4 0.4 0.4 0.25 0.5 0.7 0.5 0.3 0.3 0.75 0.75 - 0.7 0.7 0.4 0.45 0.5 0.05 0.1 0.1 0.1 - 0.2 0.1 0.1 0.05 0.5 0.5 Lola ta thot Alte tatia 9:57 PM Wed Oct 6 = 41% 41% Jake notes that exchanging one currency for another one results in the same transaction cost as a reverse conversion. Finally, Jake finds out the maximum amounts of domestic currencies (expressed as the current equivalent of thousands of dollars) his company is allowed to convert into other currencies in Japan, Indonesia, and Malaysia (see Table 3). TABLE 3 Transaction Limits in Equivalent of 1,000 Dollars From\To Yen Rupiah Ringgit U.S. Dollar Canadian Dollar Euro Yen 5,000 5,000 2,000 2,000 2,000 Rupiah 5,000 2,000 200 200 1,000 Ringgit 3,000 4,500 1,500 1,500 2,500 a. Formulate Jake's problem as a minimum-cost flow problem, and draw the network for his problem. Identify the supply and demand nodes for the network. b. Which currency transactions must Jake perform to convert the investments from yens, rupiahs, and ringgits into U.S. dollars to ensure that Grant Hill Associates has the maximum dollar amount after all transactions have occurred? How much money does Jake have to invest in U.S. bonds? c. The World Trade Organization forbids transaction limits because they promote protectionism. If no transaction limits exist, what method should Jake use to convert the Asian holdings from the respective currencies into dollars? d. In response to the World Trade Organization's mandate forbidding transaction limits, the Indonesian government introduces a new tax to protect its currency that leads to a 500 percent increase in transaction costs for transactions of rupiahs. Given these new transaction costs but no transaction limits, what currency transactions should Jake perform to convert the Asian holdings from the respective currencies into dollars? e. Jake realizes that his analysis is incomplete because he has not included all aspects that might influence his planned currency exchanges. Describe other factors that Jake should examine before he makes his final decision. 9:57 PM Wed Oct 6 = 41% 41% Jake notes that exchanging one currency for another one results in the same transaction cost as a reverse conversion. Finally, Jake finds out the maximum amounts of domestic currencies (expressed as the current equivalent of thousands of dollars) his company is allowed to convert into other currencies in Japan, Indonesia, and Malaysia (see Table 3). TABLE 3 Transaction Limits in Equivalent of 1,000 Dollars Rupiah Ringgit U.S. Dollar Canadian Dollar Euro Pound Peso 5,000 5,000 2,000 2,000 2,000 2,000 4,000 ) - 2,000 200 200 1,000 500 200 ) 4,500 1,500 1,500 2,500 1,000 1,000 a. Formulate Jake's problem as a minimum-cost flow problem, and draw the network for his problem. Identify the supply and demand nodes for the network. b. Which currency transactions must Jake perform to convert the investments from yens, rupiahs, and ringgits into U.S. dollars to ensure that Grant Hill Associates has the maximum dollar amount after all transactions have occurred? How much money does Jake have to invest in U.S. bonds? c. The World Trade Organization forbids transaction limits because they promote protectionism. If no transaction limits exist, what method should Jake use to convert the Asian holdings from the respective currencies into dollars? d. In response to the World Trade Organization's mandate forbidding transaction limits, the Indonesian government introduces a new tax to protect its currency that leads to a 500 percent increase in transaction costs for transactions of rupiahs. Given these new transaction costs but no transaction limits, what currency transactions should Jake perform to convert the Asian holdings from the respective currencies into dollars? e. Jake realizes that his analysis is incomplete because he has not included all aspects that might influence his planned currency exchanges. Describe other factors that Jake should examine before he makes his final decision