Question: 6. U-Haul is evaluating a potential lease agreement on a truck that costs $500 and falls into the MACRS 7-year class. U-Haul can borrow

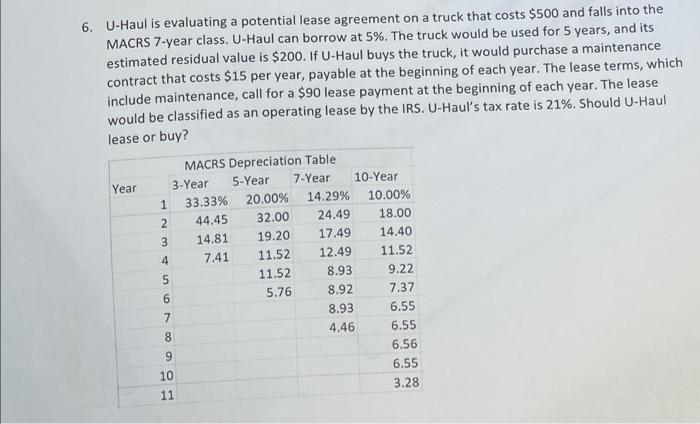

6. U-Haul is evaluating a potential lease agreement on a truck that costs $500 and falls into the MACRS 7-year class. U-Haul can borrow at 5%. The truck would be used for 5 years, and its estimated residual value is $200. If U-Haul buys the truck, it would purchase a maintenance contract that costs $15 per year, payable at the beginning of each year. The lease terms, which include maintenance, call for a $90 lease payment at the beginning of each year. The lease would be classified as an operating lease by the IRS. U-Haul's tax rate is 21%. Should U-Haul lease or buy? Year MACRS Depreciation Table 3-Year 5-Year 1 33.33% 2 44.45 3 14.81 4 7.41 5 6 7 8 9 10 11 20.00% 32.00 19.20 11.52 11.52 5.76 7-Year 10-Year 14.29% 10.00% 24.49 18.00 17.49 14.40 12.49 11.52 8.93 9.22 8.92 7.37 8.93 6.55 4.46 6.55 6.56 6.55 3.28

Step by Step Solution

3.45 Rating (161 Votes )

There are 3 Steps involved in it

Decision NPV of lease option is ... View full answer

Get step-by-step solutions from verified subject matter experts