Question: Can you please solve #4-#6 please using excel. Please show all work. Thanks Suppose company A stock is last time traded at 145.28 , and

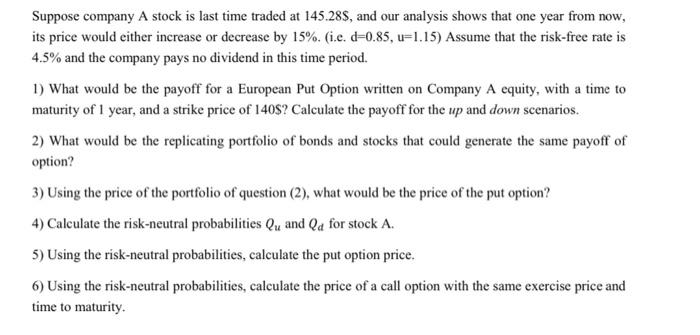

Suppose company A stock is last time traded at 145.28 , and our analysis shows that one year from now, its price would either increase or decrease by 15%. (i.e. d=0.85, u=1.15 ) Assume that the risk-free rate is 4.5% and the company pays no dividend in this time period. 1) What would be the payoff for a European Put Option written on Company A equity, with a time to maturity of 1 year, and a strike price of 140$ ? Calculate the payoff for the up and down scenarios. 2) What would be the replicating portfolio of bonds and stocks that could generate the same payoff of option? 3) Using the price of the portfolio of question (2), what would be the price of the put option? 4) Calculate the risk-neutral probabilities Qu and Qd for stock A. 5) Using the risk-neutral probabilities, calculate the put option price. 6) Using the risk-neutral probabilities, calculate the price of a call option with the same exercise price and time to maturity

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts