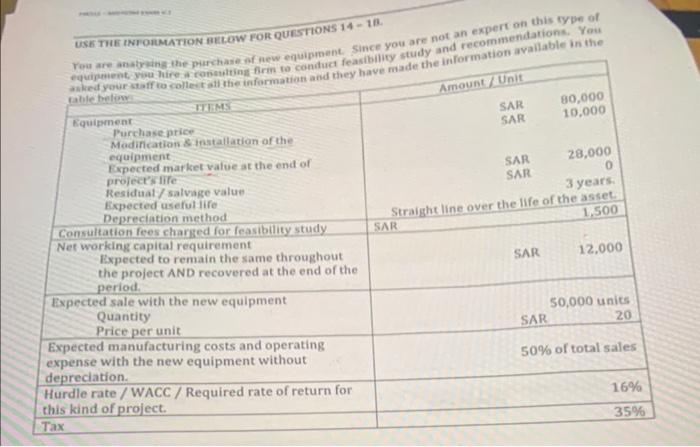

Question: Can you please solve Question 15 , 17 , 18 USE THE TNIOHMATION BELOW FOR QUESTONS 14 - 12 . Kou are ahatwaina ithe purchase

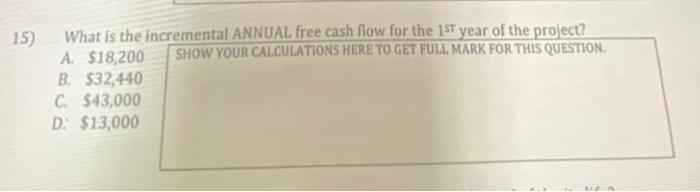

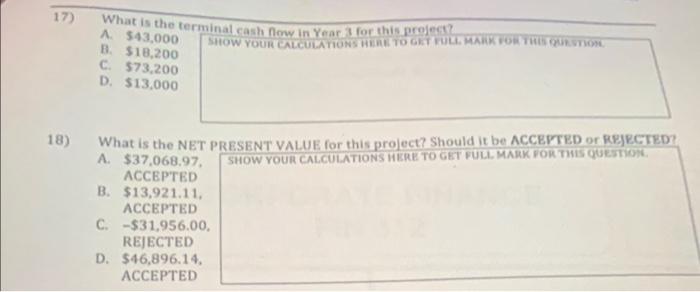

USE THE TNIOHMATION BELOW FOR QUESTONS 14 - 12 . Kou are ahatwaina ithe purchase of new equipment. since you are not an expert on this type of feasibilicy study and recommendations. Yeu - Aw the information avallable in the 15) What is the incremental ANNUAL free cash flow for the 15T year of the project? A. $18,200 SHOW YOUR CALCULATIONS HERE TO GET FULL MARK FOR THIS QUESTION. B. $32,440 C. 543,000 D. $13,000 17) What is the terminal cash fory in Yesar t for this progect? (1. 518,200 C. 573,200 D. 513,000 18) What is the NET PRESENT VALUE for this project? Should it be ACCEPTED or RRJECTED? ACCEPTED B. $13,921,11, ACCEPTED C. $31,956.00. RE]ECTED D. $46,896.14. ACCEPTED USE THE TNIOHMATION BELOW FOR QUESTONS 14 - 12 . Kou are ahatwaina ithe purchase of new equipment. since you are not an expert on this type of feasibilicy study and recommendations. Yeu - Aw the information avallable in the 15) What is the incremental ANNUAL free cash flow for the 15T year of the project? A. $18,200 SHOW YOUR CALCULATIONS HERE TO GET FULL MARK FOR THIS QUESTION. B. $32,440 C. 543,000 D. $13,000 17) What is the terminal cash fory in Yesar t for this progect? (1. 518,200 C. 573,200 D. 513,000 18) What is the NET PRESENT VALUE for this project? Should it be ACCEPTED or RRJECTED? ACCEPTED B. $13,921,11, ACCEPTED C. $31,956.00. RE]ECTED D. $46,896.14. ACCEPTED

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts